Oscillators in Trading: Best Binary Options Strategies (2026)

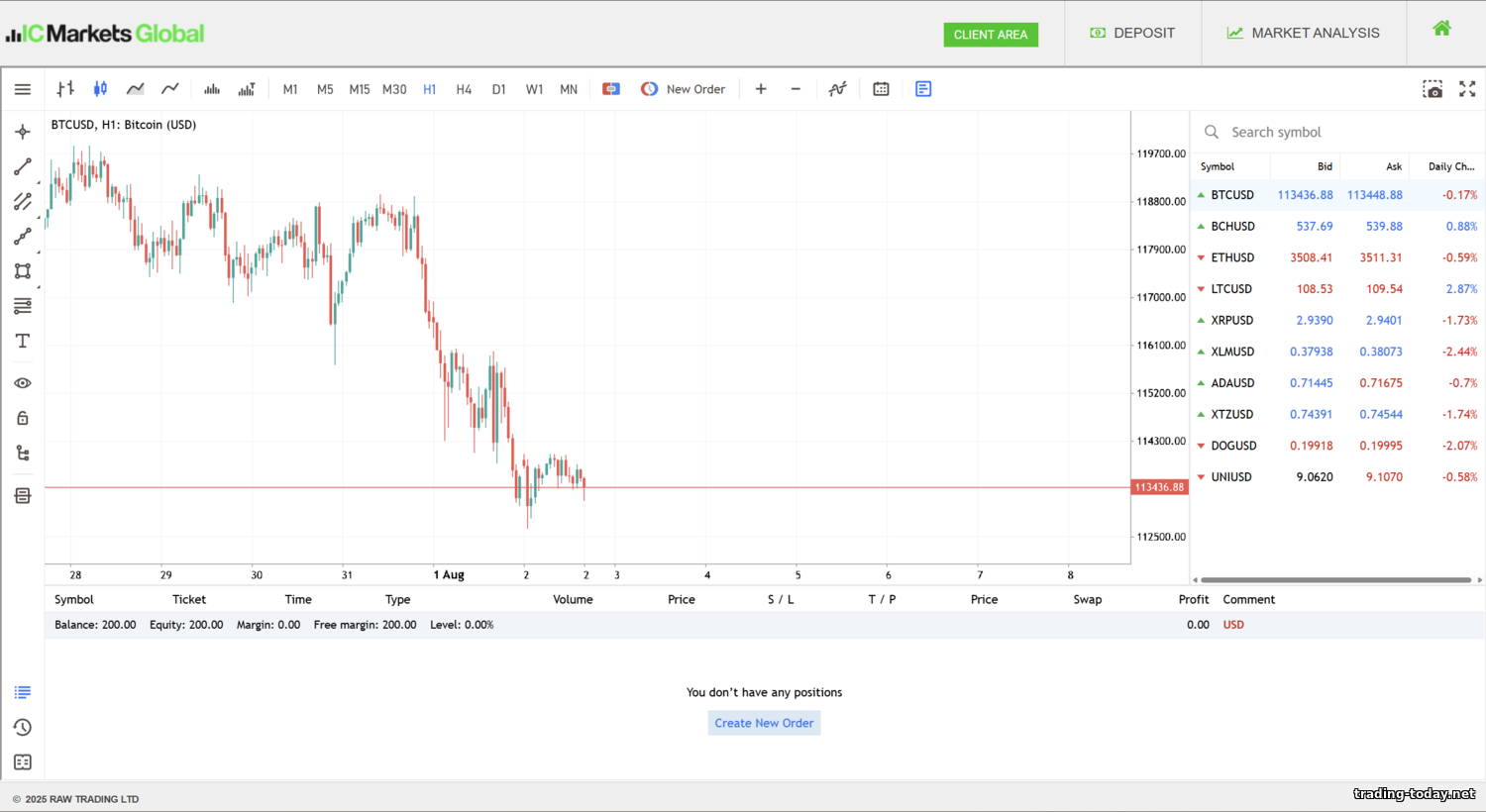

Updated: 25.01.2026

Oscillators in trading: using oscillators in binary options trading (2026)

Oscillators are a type of technical analysis indicator that can inform the trader in advance about a price reversal. As a rule, these indicators have their own limited numerical or percentage range within which their readings fluctuate. Most often, oscillators are used in sideways price movements - in flats, indicators are most effective.

Oscillators are also called leading indicators - they indicate possible reversal points in price movements. To do this, many indicators of this type have oversold and overbought zones - possible local price highs and lows.

Oscillators are divided into two types:

The most common leading indicators are:

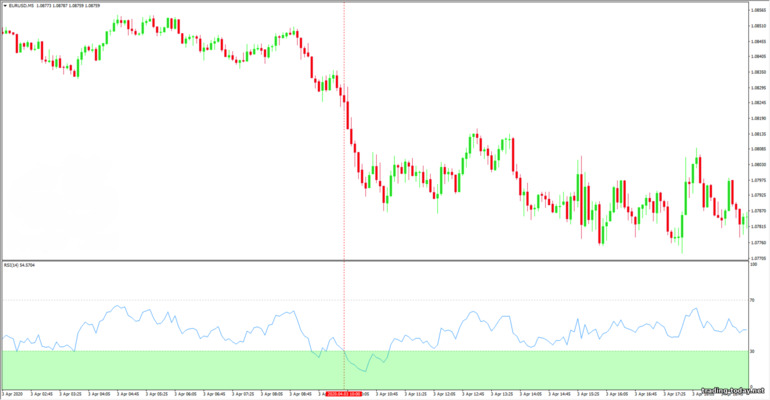

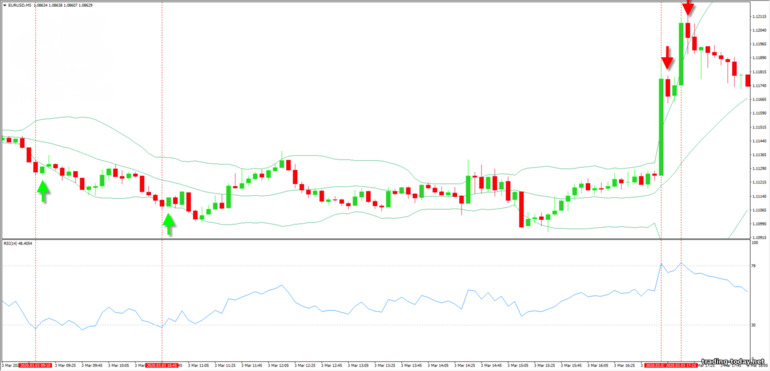

In trending price movements, oscillators (including RSI) may give false signals - they will still indicate overbought and oversold zones, but a price reversal may follow much later than the trader expects:

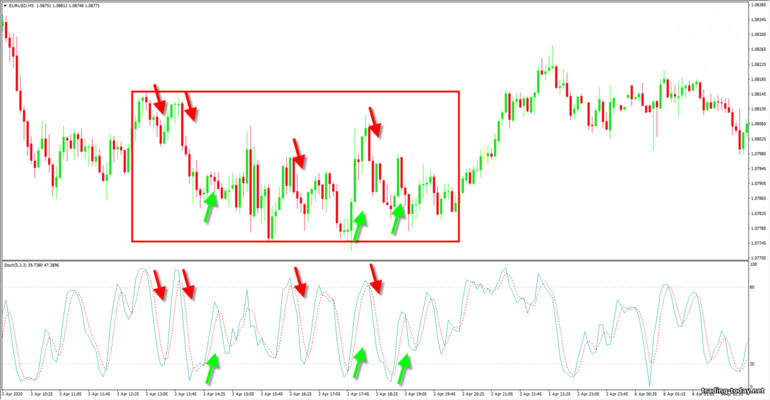

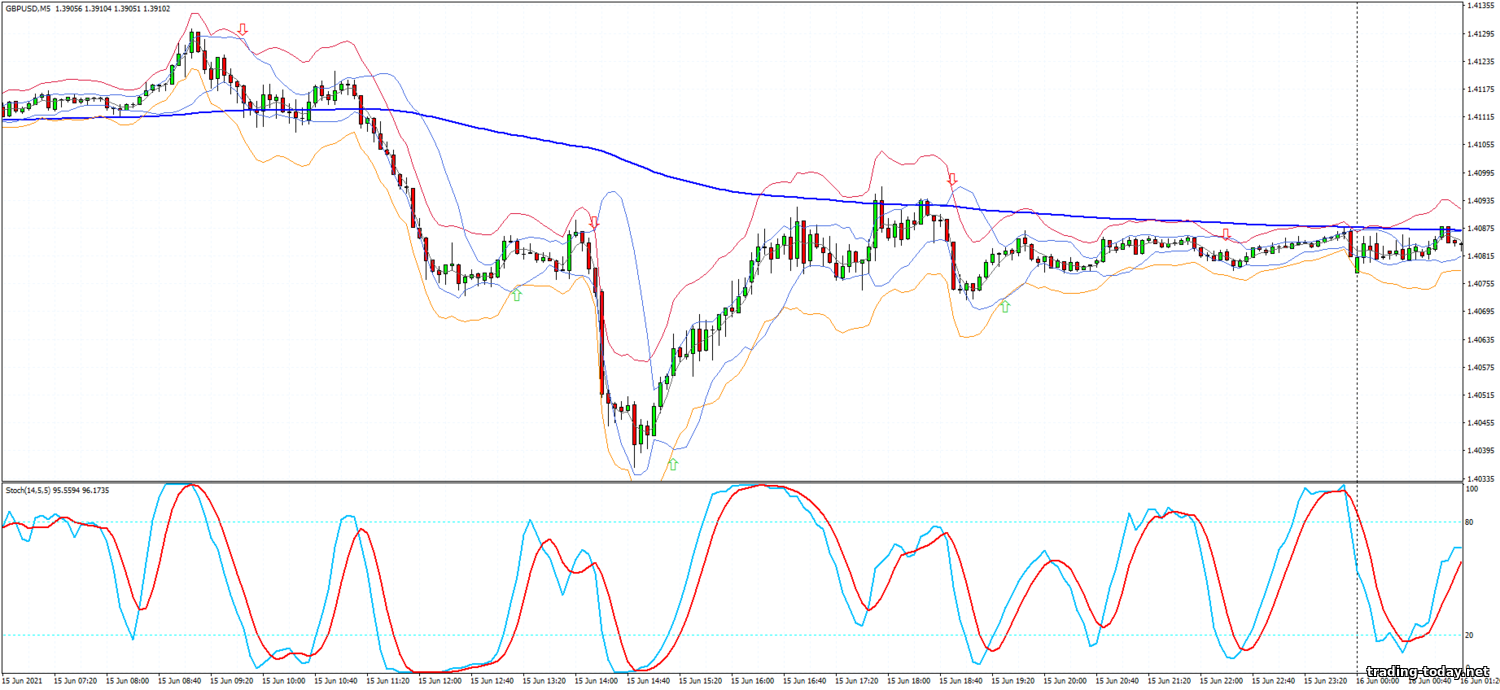

The indicator has a scale with levels “20” and “80” - these are overbought and oversold zones. Unlike the RSI indicator, the stochastic has two lines - fast and slow. The intersection of these lines allows you to quickly determine price turning points. The most valuable are considered to be intersections beyond the levels “20” and “80”. The Stochastic oscillator performs well in sideways movements and very poorly in a trend: Personally, this indicator does not inspire confidence in me. The problem, most likely, is a personal dislike for this oscillator - I don’t like its signals because they are “blurred” and inaccurate. On the other hand, many traders understand this indicator perfectly and make serious money from its signals. So, it's a matter of taste.

The Commodity Channel Index has a scale with levels of “100” and “-100” - if the oscillator line goes beyond these levels, then there is a strong trend impulse in the market. The CCI indicator does not indicate price turning points, unlike the RSI. If the price, having been beyond the “100” and “-100” levels, returns to the “usual range”, then these signals can also be considered for opening buy or sell transactions: The CCI oscillator is beneficial to use in trending price movements, and in sideways movements, the indicator will give many false signals, since trend impulses will quickly fade. In a trend, it is best to look for entry points in the direction of the main movement - the commodity channel index copes with this task perfectly.

Delayed oscillators include:

In sideways movement everything is quite simple and you need to pay attention to the boundaries of the price channel:

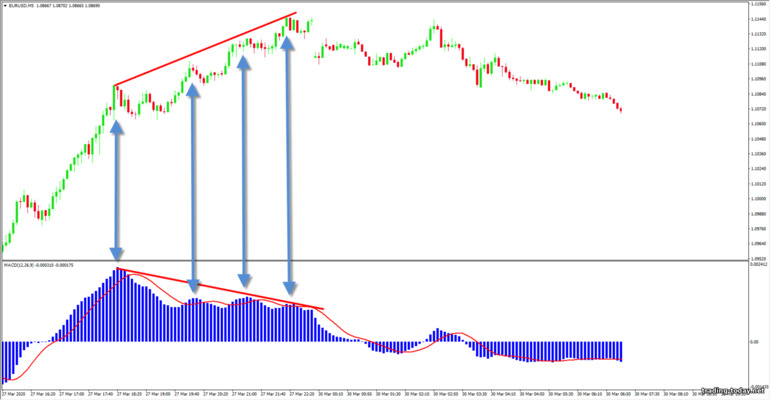

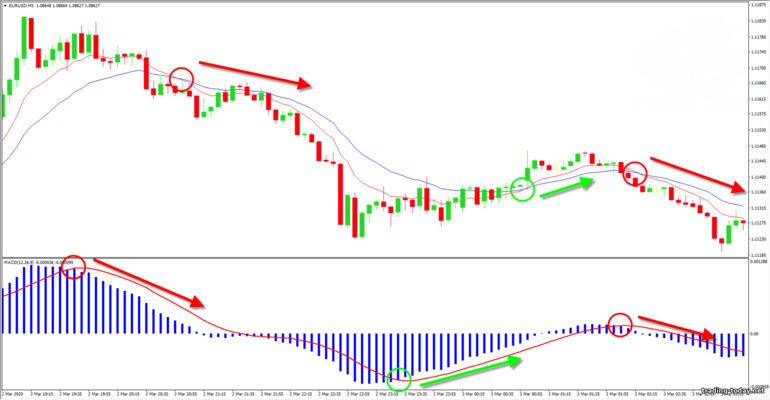

If we consider MACD as a tool for searching for divergence, then everything is simple: The graph goes up, and the indicator histogram gradually decreases - this is a sign of an imminent price reversal. The only problem is that we don’t know exactly when this reversal will happen and how long the divergence will last. Therefore, MACD is classified as a lagging oscillator.

With MACD trends and reversals, everything is also simple:

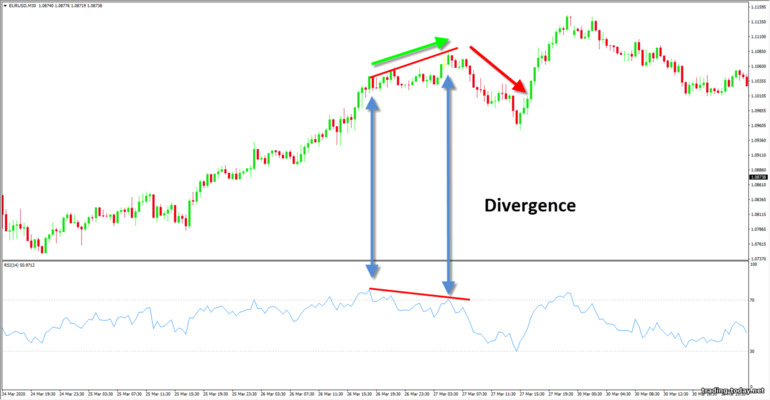

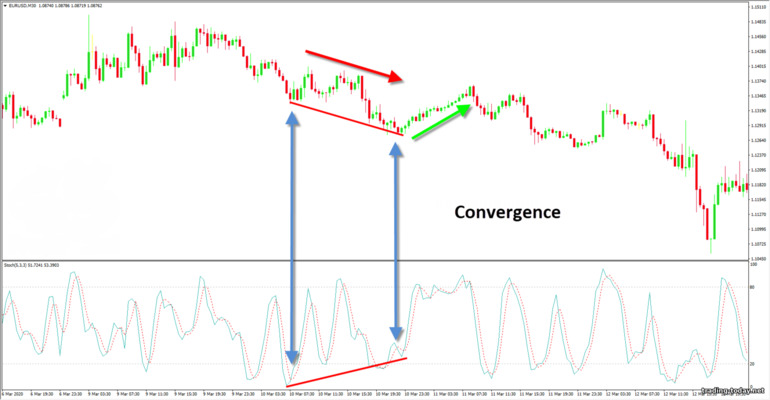

It is worth understanding that after divergence or convergence, a price reversal is expected. For example, this is what divergence looks like based on the RSI indicator: And this is the convergence of the Stochastic oscillator: Divergence and convergence mean that the price movement is weakening (which is what the oscillators indicate), but this is not yet noticeable on the chart. Of course, convergence and divergence naturally lead to a price reversal or rollback, because the strength of the trend will end sooner or later.

This can very often be observed during the release of important economic news, and at this time not a single technical indicator is working correctly. It follows that finding the indicator line in overbought or oversold zones is not at all a clear signal calling for action. On the contrary, this is a warning signal that you should pay attention to the asset, and only then find a more compelling rationale for opening a transaction.

For example, the intersection of the lines of the Stochastic indicator means a change in the current trend, but since the indicator reacts very quickly to price changes, the intersection can even indicate a rollback of one candle.

The intersection of the MACD signal line and the histogram indicates a continuation of the current trend. If the signal line leaves the histogram, then a rollback or trend change has begun - in any case, you should wait for the price to move against the current trend. But MACD reacts to changes later than stochastic, which means its signals will be stronger, although delayed.

It is also worth paying attention to where exactly the intersection occurred (for oscillators with overbought or oversold zones) - if the intersection occurred in an imbalance zone, then it will be stronger than the intersection in the “usual” state of the market. Please note that the stochastic actually detects the beginning of a rollback faster, but this is not much use. The MACD later sees a pullback, but its signals are more accurate.

It is best to use oscillators in conjunction with other indicators or support and resistance levels. This will help get rid of a number of problems associated with false signals. Also, combinations of Japanese candlestick models with oscillators show themselves very well - some find an imbalance in the market, while others indicate exact entry point.

Another disadvantage of oscillators is the lack of ideal settings. Yes, there are standard (recommended) settings, but for the indicator to work better, it very often needs to be reconfigured to suit the current situation. This process allows you to weed out some of the false signals in some cases, but also increase their number in other situations. Also, changing the oscillator settings can lead to its “sensitivity” - some profitable signals may pass by.

Many aspiring traders, in an effort to improve their trading skills and improve their results, take thousands of screenshots of their trading for further analysis. Many people record videos that show how and in what situations the oscillator works. Everyone learns from their mistakes.

Yes, it is difficult and long, but the result is worth it! By combining various oscillators, changing their settings, combining them with support and resistance levels or candlestick patterns, the trader gains experience, and he will not go anywhere. On the contrary, the knowledge gained will greatly affect trading results - where many will lose money, experienced traders will make money.

It would seem that the market is the same for everyone, but traders see it from the top of their experience. Those who chose to neglect a long and persistent study of trading will have a “hole” instead of the top, into which more experienced traders will spit from high, taking the money of lazy people.

Oscillators are also called leading indicators - they indicate possible reversal points in price movements. To do this, many indicators of this type have oversold and overbought zones - possible local price highs and lows.

Oscillators are divided into two types:

- Leading indicators

- Lagging indicators

Contents

Leading oscillators in binary options trading

Leading oscillators indicate a price reversal or the beginning of a new trend even before the signal itself appears on the market - i.e. they are ahead of the price, and this can be used very profitably in trading.The most common leading indicators are:

- RSI – relative strength index

- Stochastic

- CCI – commodity channel index

RSI oscillator – relative strength index

The RSI oscillator or relative strength index indicates the state of the market - 95% of the time the market is at rest, the remaining 5% is imbalanced. To identify this imbalance, the indicator, on the reading scale, has levels “30” and “70”. If the RSI indicator line goes beyond the “30” level, then the asset price is considered to be oversold. If the line goes beyond the “70” level, then the asset is said to be overbought. In both cases, we should expect a possible price reversal: The Relative Strength Index Oscillator can work both during sideways movements and during trend movements. During a flat, the RSI indicator shows significantly better results, since the price moves within a certain price range, and all movements are reduced to simple “up” and “down” from the channel boundaries.In trending price movements, oscillators (including RSI) may give false signals - they will still indicate overbought and oversold zones, but a price reversal may follow much later than the trader expects:

Stochastic Oscillator - Stochastic

The Stochastic Oscillator is another leading indicator that indicates the rate of change or momentum in price. Like RSI, Stochastic can predict reversal points and trend continuation points.The indicator has a scale with levels “20” and “80” - these are overbought and oversold zones. Unlike the RSI indicator, the stochastic has two lines - fast and slow. The intersection of these lines allows you to quickly determine price turning points. The most valuable are considered to be intersections beyond the levels “20” and “80”. The Stochastic oscillator performs well in sideways movements and very poorly in a trend: Personally, this indicator does not inspire confidence in me. The problem, most likely, is a personal dislike for this oscillator - I don’t like its signals because they are “blurred” and inaccurate. On the other hand, many traders understand this indicator perfectly and make serious money from its signals. So, it's a matter of taste.

CCI oscillator – commodity channel index

The CCI oscillator or commodity channel index is another interesting indicator that looks like RSI, but shows completely different data. CCI indicates strong trend impulses, as well as the end of these impulses.The Commodity Channel Index has a scale with levels of “100” and “-100” - if the oscillator line goes beyond these levels, then there is a strong trend impulse in the market. The CCI indicator does not indicate price turning points, unlike the RSI. If the price, having been beyond the “100” and “-100” levels, returns to the “usual range”, then these signals can also be considered for opening buy or sell transactions: The CCI oscillator is beneficial to use in trending price movements, and in sideways movements, the indicator will give many false signals, since trend impulses will quickly fade. In a trend, it is best to look for entry points in the direction of the main movement - the commodity channel index copes with this task perfectly.

Lagging oscillators in trading

Lagging oscillators are indicators that follow price. Simply put, the price changes first, and only then the indicator indicates the presence of a trend - you will not be able to catch the very beginning of the movement, but these indicators will indicate changes in the market with high accuracy.Delayed oscillators include:

- Moving Average or moving average

- Bollinger Bands

- MACD or Moving Average Convergence/Divergence

Moving Average Oscillator

The Moving Average Oscillator refers to a lagging indicator .Moving Average shows the average price value for a certain period, which is set in the settings, and the longer this period, the longer the indicator line reacts to price changes. All trend movements will be shown with a delay, but, on the other hand, we get a dynamic support and resistance level that can be used to catch the end of pullbacks: In some cases, the moving average line will take a very long time to react to price changes - by that time the trend impulse may completely end. Another obvious disadvantage of the Moving Average is its poor performance in lateral movements - there will be a lot of false signals.Oscillator Bollinger Bands

The Bollinger Bands Oscillator is a channel indicator for all occasions. It is able to work perfectly both during sideways movements and during trend price movements. You just need to correctly understand the operation of this indicator. But the indicator is also a lagging oscillator, which means that you will receive some signals with a delay.In sideways movement everything is quite simple and you need to pay attention to the boundaries of the price channel:

- If the price has broken through the upper border, but the lower border has not begun to expand, then we should expect a rollback. Similarly with breaking the lower border

MACD Oscillator or Moving Average Convergence/Divergence

The MACD oscillator or Moving Average Convergence/Divergence is an indicator that is most often used to find divergence and price convergence (the discrepancy between the indicator readings and what is on the price chart). MACD consists of a histogram, which is used to determine divergences and convergences, as well as a signal line, which is needed to determine trends and entry points into them.If we consider MACD as a tool for searching for divergence, then everything is simple: The graph goes up, and the indicator histogram gradually decreases - this is a sign of an imminent price reversal. The only problem is that we don’t know exactly when this reversal will happen and how long the divergence will last. Therefore, MACD is classified as a lagging oscillator.

With MACD trends and reversals, everything is also simple:

- The signal line enters the histogram – a trend impulse has begun

- The signal line has gone beyond the histogram - a rollback or price reversal

Using oscillators in trading

All oscillators are used in trading, as a rule, for only two purposes - to determine:- Intersections

- Divergence or convergence

Using oscillators to determine divergence or convergence

Many oscillators are capable of determining divergence and convergence of price charts. For example, the same Stochastic or RSI will show divergence no worse than MACD. So it’s a matter of taste and preference of the trader himself.It is worth understanding that after divergence or convergence, a price reversal is expected. For example, this is what divergence looks like based on the RSI indicator: And this is the convergence of the Stochastic oscillator: Divergence and convergence mean that the price movement is weakening (which is what the oscillators indicate), but this is not yet noticeable on the chart. Of course, convergence and divergence naturally lead to a price reversal or rollback, because the strength of the trend will end sooner or later.

Using oscillators to determine overbought and oversold zones

With the intersection of oscillators, everything is quite clear - we are waiting for:- Intersection of levels that define overbought or oversold zones (for example, on the RSI indicator)

- The intersection of the price with the moving average line to determine a change in trend

- Price crossing Bollinger years boundaries

- Crossing CCI Oscillator Levels to Determine Trend Impulses

This can very often be observed during the release of important economic news, and at this time not a single technical indicator is working correctly. It follows that finding the indicator line in overbought or oversold zones is not at all a clear signal calling for action. On the contrary, this is a warning signal that you should pay attention to the asset, and only then find a more compelling rationale for opening a transaction.

Oscillator zero level crossing

The zero level of oscillators is also an important level for many indicators of this type. Crossing the zero level most often means a trend change. For example, the MACD indicator has two indicators of trend changes:- Readings from histogram

- Crossing the zero level by the signal line

- The zero level is crossed from bottom to top – an upward trend has begun

- The zero level is crossed from top to bottom - a downward trend has begun

Intersection of oscillator lines

The MACD, Stochastic and many others oscillators have two lines to determine the market situation. It is also worth considering their mutual intersection (they still exist for a reason). As a rule, the intersection of lines means the same thing as the intersection of a fast and slow moving average - a change in trend or the beginning of a rollback.For example, the intersection of the lines of the Stochastic indicator means a change in the current trend, but since the indicator reacts very quickly to price changes, the intersection can even indicate a rollback of one candle.

The intersection of the MACD signal line and the histogram indicates a continuation of the current trend. If the signal line leaves the histogram, then a rollback or trend change has begun - in any case, you should wait for the price to move against the current trend. But MACD reacts to changes later than stochastic, which means its signals will be stronger, although delayed.

It is also worth paying attention to where exactly the intersection occurred (for oscillators with overbought or oversold zones) - if the intersection occurred in an imbalance zone, then it will be stronger than the intersection in the “usual” state of the market. Please note that the stochastic actually detects the beginning of a rollback faster, but this is not much use. The MACD later sees a pullback, but its signals are more accurate.

Pros and cons of oscillators

Oscillators have their pros and cons that you need to know about:- Oscillators show the situation on the market quite accurately: they determine the beginning of a new trend and reversal points. Some oscillators work great in sideways movements, and some are designed to be profitable during a trend. There are also those who feel great in any market.

- Oscillators are very easy to use - their operation is clear and does not raise serious questions. It is also worth noting the fact that these indicators are leading (or lagging, depending on the nature of their work) and allow you to predict price movements in advance, albeit not always.

- Oscillators are great for determining the strength of a trend, or more precisely, for determining the decrease in this strength. Convergence and divergence perfectly indicate a weakening trend, which means that you can prepare in advance for a price reversal.

- Oscillators are very common - they are available in almost any trading terminal. There are a lot of strategies built on oscillators, as well as thousands of modifications that allow you to use these indicators in various situations.

It is best to use oscillators in conjunction with other indicators or support and resistance levels. This will help get rid of a number of problems associated with false signals. Also, combinations of Japanese candlestick models with oscillators show themselves very well - some find an imbalance in the market, while others indicate exact entry point.

Another disadvantage of oscillators is the lack of ideal settings. Yes, there are standard (recommended) settings, but for the indicator to work better, it very often needs to be reconfigured to suit the current situation. This process allows you to weed out some of the false signals in some cases, but also increase their number in other situations. Also, changing the oscillator settings can lead to its “sensitivity” - some profitable signals may pass by.

Oscillator-based strategies: oscillators in technical analysis

There are many strategies based on oscillators, but to consolidate the material, it is worth considering at least a few of them. Some strategies are quite interesting, so it is worth trying them out in your trading. Of course, we should not forget that there are no 100% trading strategies, so risk management has not been canceled!Strategy based on RSI and Bollinger Bands oscillators

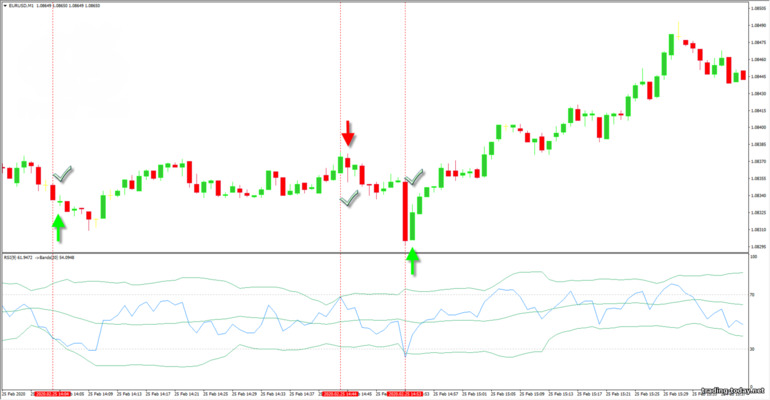

It is noteworthy that in this strategy, Bollinger bands are added to the RSI oscillator window. Now in more detail. We will need:- RSI oscillator with period “9”

- Bollinger Bands with period “20”, deviation “2.5” added to the RSI window

- If the RSI oscillator line breaks through the upper border of the Bollinger Bands, then on the next candle you should open a bearish trade

- If the RSI oscillator line breaks through the lower border of the Bollinger Bands, then on the next candle you should open a bullish trade

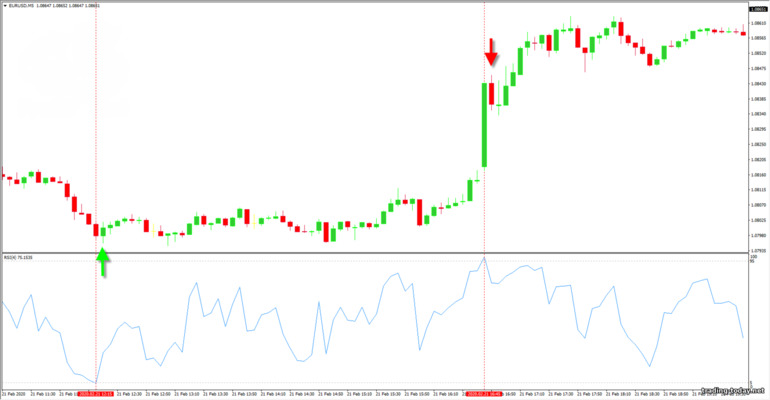

Strategy for binary options based on the RSI oscillator – 95-5

The strategy based on the RSI oscillator “95-5” implies that the levels “5” and “95” will be used instead of the standard ones. The indicator period should be set to “4”. The signals are very simple:- The RSI indicator line has entered the zone below level “5” - open a trade for an increase

- The RSI indicator line has entered the zone above the “95” level - open a bearish trade

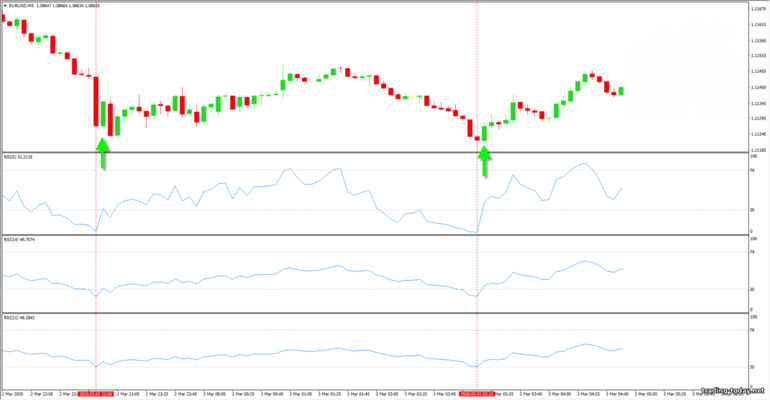

Strategy based on three RSI oscillators

The “Three RSI” strategy is based on three RSI oscillators with different settings. We will need:- RSI with period “5”

- RSI with period “14”

- RSI with period “21”

Strategy “Intersection of moving averages and MACD”

The strategy will require the following indicators:- EMA with period “10”

- EMA with a period of “20”

- MACD

- We wait until the MACD signal line leaves the histogram zone

- We are waiting for the moving averages to cross

- The trade should be opened 3-5 candles in the direction of the trend

Strategy for catching reversals based on the RSI oscillator and Bollinger Bands

The strategy is based on standard RSI and Bollinger Bends - these indicators combine very well and allow you to find good entry points. We will need:- RSI with period “14”

- Bollinger Bands with period “20” and deviation “2”

- We wait until the candle closes beyond the Bollinger Band border

- The RSI indicator line must be above the “70” level or below the “30” level

- Enter a trade at the beginning of the formation of the next candle

- Expiration time is equal to one candle

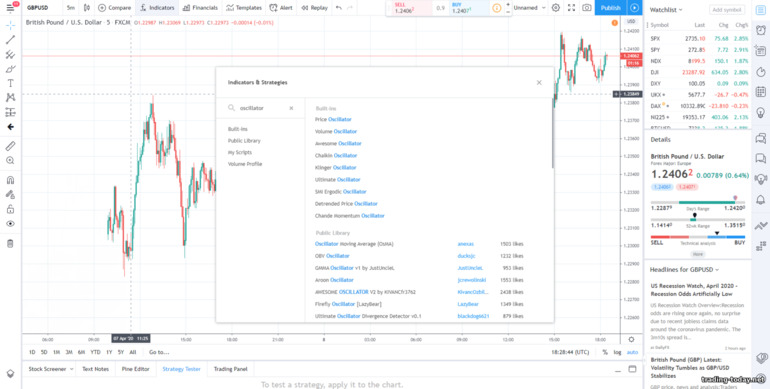

40 live chart oscillators (Trading View)

On the technical analysis platform Trading View you can find a large number of different oscillators that will help you in your trading. Simply enter one of the following names in the search field:- Price oscillator

- Volume oscillator

- Awesome oscillator

- Chaikin oscillator

- Klinger oscillator

- Ultimate oscillator

- SMI Ergodic oscillator

- Detrendet Price oscillator

- Chande Momentum oscillator

- Oscillator Moving Average (OsMA)

- OBV oscillator

- GMMA oscillator

- Aroon oscillator

- Firefly oscillator

- Wave Trend oscillator

- McClellan oscillator

- Super Trend oscillator v3

- Elliot Wave oscillator

- Primer RSI oscillator

- Accelerator oscillator

- TFS: volume oscillator

- Volume zone oscillator

- USC Momentum oscillator

- Cycle Channel oscillator

- OBV oscillator

- Pivot Detector oscillator

- USC Murray's Math oscillator

- CCT Bollinger Bands oscillator

- Ehlers Stochastic oscillator

- Bitcoin Energy Value oscillator

- Derivative oscillator

- Bull Trading oscillator

- Absolute Strange index oscillator

- Rahul Mohindar oscillator

- Rainbow Chart oscillator

- Volume and Price oscillator

- Adaptive Ergodic Candlestric oscillator

- Premier Stochastic

- DescriptionPoint Volume Swenlin Trading oscillator

- DescriptionPoint Breadth Swenlin Trading oscillator

Practice of correct work with oscillators

Oscillators, like any other technical chart analysis tools, will work correctly only in one case - if the trader spends hundreds of hours developing his skills and understands in which situations the indicator works and in which it will be useless.Many aspiring traders, in an effort to improve their trading skills and improve their results, take thousands of screenshots of their trading for further analysis. Many people record videos that show how and in what situations the oscillator works. Everyone learns from their mistakes.

Yes, it is difficult and long, but the result is worth it! By combining various oscillators, changing their settings, combining them with support and resistance levels or candlestick patterns, the trader gains experience, and he will not go anywhere. On the contrary, the knowledge gained will greatly affect trading results - where many will lose money, experienced traders will make money.

It would seem that the market is the same for everyone, but traders see it from the top of their experience. Those who chose to neglect a long and persistent study of trading will have a “hole” instead of the top, into which more experienced traders will spit from high, taking the money of lazy people.

Reviews and comments