Risk Management in Binary Options Trading | Key Rules (2026)

Updated: 25.01.2026

Risk management in Binary options: rules for risk management or Binary options without risk (2026)

Do you think an experienced trader is taking risks when trading Binary Options? You can answer this question right now, and you will find the correct answer by reading this article, in which I will describe in detail the importance of risk management in Binary Options trading.

For money management, there are two components in trading: money management and risk management. If money management is a set of strict rules that are tailored to the management of trading capital. But what then is risk management? Risk management is a set of strict rules that are aimed at reducing unfavorable situations in trading, as well as reducing losses during trading. Simply put, risk management (as the name suggests) is the rules that will NOT allow you to lose your entire trading balance.

Someone will now think: “Rules? Well, why do I need these rules? I feel great without them!” Of course, you can trade without risk management rules, but the result will be disastrous. You don’t need to look far for examples: remember yourself at the very beginning of mastering trading - did you know how to manage your capital? I doubt! This is not taught in school, so unless you are an economist, you most likely have no idea how to use your capital correctly.

Risk management is needed in Binary Options only because there have never been 100% trading strategies or trading systems. There is a risk of loss in every single transaction, so the main task of a trader is to learn not to lose all the money at once! In fact, if you lose your entire deposit in a few days, weeks or months, then this also indicates that you have problems managing your capital and risk management.

Risk management itself complements money management rules - all of this refers to the rules of money management. This is a kind of single whole that will not only help you not lose your money in large quantities, but will also help you make money trading Binary Options or any other financial instrument. Money management rules very quickly adapt to any financial instrument (Forex, Binary Options, stock markets, etc.), so they are practically universal. Depending on the financial instrument, some rules will be added or removed, but in general, the basic rules will help you make money anywhere.

Risk management allows the trader to withstand long drawdowns of the deposit with minimal losses. Any trader has losses (unprofitable periods) - you cannot do without losses in trading, so the sooner you understand this, the easier it will be for you in the future. Having waited out these losses and retained most of his trading balance, an experienced trader can easily return all losses and begin trading for profit:

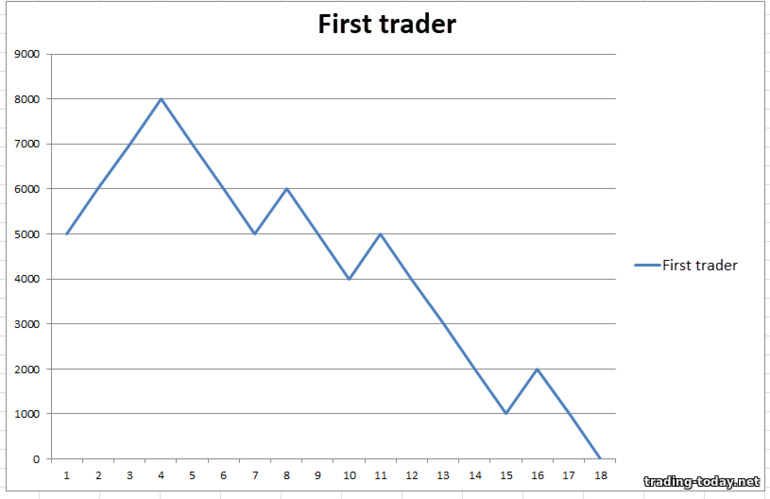

The results of the first trader will look like this: After a short growth of the deposit, a loss-making period begins. Due to too high risks, the trader’s trading balance cannot withstand the drawdown and is lost very quickly.

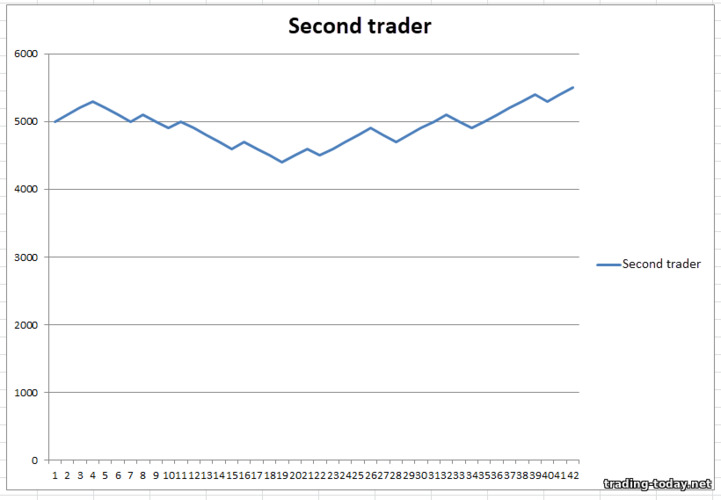

The results of the second trader will look like this: The same short-term growth of the deposit at the very beginning, which replaced the unprofitable period. But, due to adequate risks, the deposit withstood temporary drawdowns, and the trader soon returned all losses and turned into a plus. Yes, the deposit increase is not the greatest - only 10% for 42 transactions, but it is much better than losing everything.

This example clearly shows the advantages of risk management, as well as the need for its use. Without risk management rules, any amount is lost - what is the use of money if a trader does not know how to manage it correctly? So they pass into the hands of a more experienced trader or into the clutches of a broker.

Trading on Binary Options is designed in such a way thatevery experienced trader should always think about how much he will lose in a transaction if it closes at a loss.

When we earn money, we take it as a position - “I traded (worked) - I received my profit (this is my salary for my work)!” But as soon as losses appear, then, emotionally, complete chaos begins - “It shouldn’t be like this! This is my money! I earned them honestly!” We can go from a state of complete peace to a state of fear and anxiety in just a few minutes - when trading begins to take “our” money!

And when does this happen? When a trader begins to be strangled by a toad - “Why does some trader earn hundreds of thousands of dollars a month, and my income does not even reach 200 dollars?! These pennies didn’t give me away in vain - I want serious income!” There is immediately an increase in risks (increasing the amount of investment in a transaction), and attempts to win back after unprofitable transactions (trading on Martingale), and erratic opening of trades. In general, a whole bunch of all sorts of “useful things”, after which it is no longer possible to revive the trade balance - it is completely lost by the trader. What if this is your last money? What if, financially, you're having a hard time making ends meet? What if you have a low salary or no job at all? There are a lot of such traders - they all came to trading for quick money, but what if you lost your entire deposit and you simply don’t have money for a new one?

It will hurt you! It will hurt like hell! The most powerful thing that will be in your mind is to quickly get rid of this feeling of “complete loss”! In this state, you will not care that this was your last money - you will find new ones. There are friends who will give you money for a long time, there are loans...

Completely disregarding the rules of money management, you will begin to trade under the power of emotions: with inflated risks, not according to the rules of the strategy, praying that the deal will close in profit. In trying to win back, you will lose everything you have left, thereby significantly aggravating an already difficult situation.

There are thousands of traders who came into trading as cheerful, positive and confident people, and the market threw them to the sidelines with a lot of debt and doubts about their own existence. And all because of his own stupidity - stupidity that convinced the trader that he could easily do without rules for managing his capital.

Why do you think so many traders trade using Martingale? Yes, they are simply choked by a toad, if they give even a penny to the broker - return everything and take everything from the Binary Options broker. The problem is that instead of “temporarily depositing a small part of their deposit with the broker,” they give everything to the broker, irrevocably!

The only way to avoid a complete loss of your deposit is to stop! Yes - forget about losses, close the tab with the broker's trading platform and do other things! And here, either you are able to force yourself to end trading at a loss - you have all the makings of a profitable trader, or you are a wimp and will enrich Binary Options brokers for a very long time! The choice is always yours!

99.999% of new traders simply don’t know how to do this (I “should” get my money back!). But that’s why they are newbies. Trading professionals know very well that even the most experienced traders experience losses. But when will they start? How long will this last? There is no answer to these questions, and there never will be.

Therefore, experienced traders stop trading at the first sign (3 losing trades in a row) of the beginning of a losing period. Indeed, why continue to lose your money if you can just try to wait out this period? Perhaps something is happening in the market that an experienced trader was not prepared for, and tomorrow everything will return to normal and there will be hundreds of opportunities to make money. And if not, then it’s much easier to “test the strength of the market” - to catch a series of three losing trades every day (you can even do it on demo account) and stop trading until the next day. The period of losses cannot last forever and sooner or later it will be replaced by a period of profit. In the meantime, it’s worth looking for the reasons for your losses - there’s plenty of time.

Psychologically stopping losses eliminates many mistakes. After a series of three losing trades, you need to:

But who am I telling this to? Most of you will read this article, remember these instructions, nod your head in approval and... while trading, put a huge bolt on any rules of psychological and mathematical risk management. But you need to stop! Very necessary! You have no idea how important it is to force yourself to stop when there are already losses.

If you don’t stop now, when the market plainly says that you won’t be able to make money today, and then lose money, then you will lose something more important than finances - faith in yourself. In some cases (as I had at the beginning of trading), a fear of trading may develop - a fear of making transactions, because previously these actions led to the loss of the deposit. Getting out of this hole is much more difficult than finding/earning money for a new deposit. The only thing that can save you here is a very long work on your psychology, and this does not always help.

The rules of psychological and mathematical risk management, coupled with the rules of money management, make it possible to transform a trading deposit into a stable amount, which, with the right approach, cannot be drained. Experienced traders know this, therefore, over a long period of time, although their deposit is subject to minor drawdowns, there is absolutely no risk of losing the entire deposit. Here is the answer to the question I asked you at the very beginning of this article.

The rules of risk and money management simply will not allow you to lose everything! Yes, you definitely need a lot of serious work on yourself to learn how to use these rules, but without it you can’t make money in trading! Typically, traders begin to study these rules only a few months after they start trading, because they are tired of losing their deposits. But many traders never come to risk management and money management - after that, do not be surprised that 95% of traders consistently lose their money in trading. Of course, ignorance of the rules does not exempt you from consequences!

Contents

- Risk management in Binary Options

- Why risk management is very important in binary options trading

- Emotional perception of trading on Binary options

- Risk management tools in Binary Options trading

- Rules of psychological risk management in Binary options

- Why Binary Options Traders Want to Win Back

- Psychological stop tap in binary options trading

Risk management in Binary options

Trading Binary Options, as you already know, involves risks of losing money. Moreover, novice traders very often lose everything - they lose their entire deposit, and experienced traders, during unprofitable trading, lose only part of the deposit. As you already understood from the article “Money management in Binary Options", a lot depends on the ability to manage your capital.For money management, there are two components in trading: money management and risk management. If money management is a set of strict rules that are tailored to the management of trading capital. But what then is risk management? Risk management is a set of strict rules that are aimed at reducing unfavorable situations in trading, as well as reducing losses during trading. Simply put, risk management (as the name suggests) is the rules that will NOT allow you to lose your entire trading balance.

Someone will now think: “Rules? Well, why do I need these rules? I feel great without them!” Of course, you can trade without risk management rules, but the result will be disastrous. You don’t need to look far for examples: remember yourself at the very beginning of mastering trading - did you know how to manage your capital? I doubt! This is not taught in school, so unless you are an economist, you most likely have no idea how to use your capital correctly.

Risk management is needed in Binary Options only because there have never been 100% trading strategies or trading systems. There is a risk of loss in every single transaction, so the main task of a trader is to learn not to lose all the money at once! In fact, if you lose your entire deposit in a few days, weeks or months, then this also indicates that you have problems managing your capital and risk management.

Risk management itself complements money management rules - all of this refers to the rules of money management. This is a kind of single whole that will not only help you not lose your money in large quantities, but will also help you make money trading Binary Options or any other financial instrument. Money management rules very quickly adapt to any financial instrument (Forex, Binary Options, stock markets, etc.), so they are practically universal. Depending on the financial instrument, some rules will be added or removed, but in general, the basic rules will help you make money anywhere.

Risk management allows the trader to withstand long drawdowns of the deposit with minimal losses. Any trader has losses (unprofitable periods) - you cannot do without losses in trading, so the sooner you understand this, the easier it will be for you in the future. Having waited out these losses and retained most of his trading balance, an experienced trader can easily return all losses and begin trading for profit:

- During a profitable period, an experienced trader receives his income and increases his trading balance

- A profitable period is replaced by a period of losses. Risk management rules allow an experienced trader to lose the bare minimum during these periods, only to understand when the end of this period will come.

- As soon as the drawdown period ends, the profitable period begins again, in which an experienced trader first returns the lost money, and only then begins to trade in profit

- Improper management of your capital

- Trade misperceptions

- Improper psychological state

- Lack of discipline

- Ignoring the rules of a trading strategy

- Desire to “Play” on Binary Options

- The desire to win back after a loss

- Lack of knowledge on the part of the trader

- Incorrect forecasting of price movement

- Having an emotional interest in earning money (I have to earn money! This is my last money!)

- Changes in price behavior – a long period of adjustment for the trader

- Third-party psychological factors (fatigue, depression, indifference)

- In a profitable period, even a novice trader earns money (yes, beginners in Binary Options trading have profitable periods too!)

- But the unprofitable period begins very quickly, since a novice trader is not able to quickly understand his mistake and find a solution.

- The deposit of a novice trader simply does not survive until the profitable period - this is the pattern.

Why risk management is very important in binary options trading

Let's look at an example of a familiar trading situation:- The first trader has an initial deposit of $5,000

- The second trader has the same deposit of $5000

- The first trade trades an amount of 20% of the trading balance in each trade - $1000

- The second trader trades an amount of 2% of the trading balance in each trade - $100

The results of the first trader will look like this: After a short growth of the deposit, a loss-making period begins. Due to too high risks, the trader’s trading balance cannot withstand the drawdown and is lost very quickly.

The results of the second trader will look like this: The same short-term growth of the deposit at the very beginning, which replaced the unprofitable period. But, due to adequate risks, the deposit withstood temporary drawdowns, and the trader soon returned all losses and turned into a plus. Yes, the deposit increase is not the greatest - only 10% for 42 transactions, but it is much better than losing everything.

This example clearly shows the advantages of risk management, as well as the need for its use. Without risk management rules, any amount is lost - what is the use of money if a trader does not know how to manage it correctly? So they pass into the hands of a more experienced trader or into the clutches of a broker.

Trading on Binary Options is designed in such a way thatevery experienced trader should always think about how much he will lose in a transaction if it closes at a loss.

Emotional perception of trading on Binary options

We all came to trading for the sake of financial independence or the realization of any financial dreams. There is no need to deny this. Money is one of the strongest motivators for trading Binary Options. Moreover, everyone wants to earn not a measly $10 a month, but thousands of dollars a day - this is possible in trading.When we earn money, we take it as a position - “I traded (worked) - I received my profit (this is my salary for my work)!” But as soon as losses appear, then, emotionally, complete chaos begins - “It shouldn’t be like this! This is my money! I earned them honestly!” We can go from a state of complete peace to a state of fear and anxiety in just a few minutes - when trading begins to take “our” money!

And when does this happen? When a trader begins to be strangled by a toad - “Why does some trader earn hundreds of thousands of dollars a month, and my income does not even reach 200 dollars?! These pennies didn’t give me away in vain - I want serious income!” There is immediately an increase in risks (increasing the amount of investment in a transaction), and attempts to win back after unprofitable transactions (trading on Martingale), and erratic opening of trades. In general, a whole bunch of all sorts of “useful things”, after which it is no longer possible to revive the trade balance - it is completely lost by the trader. What if this is your last money? What if, financially, you're having a hard time making ends meet? What if you have a low salary or no job at all? There are a lot of such traders - they all came to trading for quick money, but what if you lost your entire deposit and you simply don’t have money for a new one?

It will hurt you! It will hurt like hell! The most powerful thing that will be in your mind is to quickly get rid of this feeling of “complete loss”! In this state, you will not care that this was your last money - you will find new ones. There are friends who will give you money for a long time, there are loans...

Completely disregarding the rules of money management, you will begin to trade under the power of emotions: with inflated risks, not according to the rules of the strategy, praying that the deal will close in profit. In trying to win back, you will lose everything you have left, thereby significantly aggravating an already difficult situation.

There are thousands of traders who came into trading as cheerful, positive and confident people, and the market threw them to the sidelines with a lot of debt and doubts about their own existence. And all because of his own stupidity - stupidity that convinced the trader that he could easily do without rules for managing his capital.

Risk management tools in Binary options trading

In classical theory, there are only four risk management methods that are used in trading on any financial instrument:- Risk aversion method (Abandonment of very risky investments by reducing the transaction amount)

- Risk reduction method (We work with several instruments and adapt as much as possible to the changing market)

- Risk transfer method (Transferring management of your capital or part of it to other “hands”)

- Risk-taking method (Having sufficient capital to trade)

- Risk-off trading method - we do not trade in amounts that exceed 5% of the trade balance

- Method of taking risks in trading - having an optimal deposit, which is enough for 100 or more transactions, we have very large reserves for trading that can withstand even a very long drawdown of the deposit

- Have open accounts and trade with several different Binary Options brokers

- Have several different trading strategies available for trading in any market conditions

- Have trading techniques for trading on different instruments with brokers

Rules of psychological risk management in Binary options

Why do we violate all conceivable risk limits in Binary Options trading? Because during unprofitable trading, we are controlled not by common sense, but by emotions, which do not care about any rules that supposedly should save us from losing money. This is not the case when receiving losses, there is only “Give me back what’s mine!” I honestly earned it!” Psychological risk management is precisely what is needed so that a trader can understand when to stop. As in regular risk management or money management , psychological risk management consists of a strict set of rules that will protect the trader’s deposit from being completely drained, if, of course, the trader follows them. These rules look like this:- After three losing trades in a row, you must urgently stop trading before the end of the current day

- The next trading session begins with a couple of profitable trades, but already at demo account or on paper

- After this, you can return to real trading and, if everything repeats, you will end trading immediately after three losing trades

Why Binary Options Traders Want to Win Back

What do you think a novice Binary Options trader thinks about after losing three trades? The same situation works differently in the hands of a novice and an experienced trader:- For an experienced trader, three losing trades in a row is a signal that it’s enough to increase your losses and it’s time to stop

- For a novice trader, the loss of three trades “forces” him to try to win back - to quickly get back his money that he earned for so long

Why do you think so many traders trade using Martingale? Yes, they are simply choked by a toad, if they give even a penny to the broker - return everything and take everything from the Binary Options broker. The problem is that instead of “temporarily depositing a small part of their deposit with the broker,” they give everything to the broker, irrevocably!

The only way to avoid a complete loss of your deposit is to stop! Yes - forget about losses, close the tab with the broker's trading platform and do other things! And here, either you are able to force yourself to end trading at a loss - you have all the makings of a profitable trader, or you are a wimp and will enrich Binary Options brokers for a very long time! The choice is always yours!

Psychological stop tap in binary options trading

In binary options, the risk is known even before opening a transaction on the broker's trading platform - it is equal to the investment amount itself (100%). Therefore, it is very important that the trader himself can stop during periods of unprofitable trading - a psychological stop tap. Trading should be stopped after three transactions are closed in a row.99.999% of new traders simply don’t know how to do this (I “should” get my money back!). But that’s why they are newbies. Trading professionals know very well that even the most experienced traders experience losses. But when will they start? How long will this last? There is no answer to these questions, and there never will be.

Therefore, experienced traders stop trading at the first sign (3 losing trades in a row) of the beginning of a losing period. Indeed, why continue to lose your money if you can just try to wait out this period? Perhaps something is happening in the market that an experienced trader was not prepared for, and tomorrow everything will return to normal and there will be hundreds of opportunities to make money. And if not, then it’s much easier to “test the strength of the market” - to catch a series of three losing trades every day (you can even do it on demo account) and stop trading until the next day. The period of losses cannot last forever and sooner or later it will be replaced by a period of profit. In the meantime, it’s worth looking for the reasons for your losses - there’s plenty of time.

Psychologically stopping losses eliminates many mistakes. After a series of three losing trades, you need to:

- Stop trading, thereby stopping further loss of money

- Avoid price charts and everything else related to trading for several hours

- Do not trade until the next day (morning is wiser than evening)

- “Test the market for strength” by trading on demo-account or on paper

- After several successful predictions, return to trading on a real account

But who am I telling this to? Most of you will read this article, remember these instructions, nod your head in approval and... while trading, put a huge bolt on any rules of psychological and mathematical risk management. But you need to stop! Very necessary! You have no idea how important it is to force yourself to stop when there are already losses.

If you don’t stop now, when the market plainly says that you won’t be able to make money today, and then lose money, then you will lose something more important than finances - faith in yourself. In some cases (as I had at the beginning of trading), a fear of trading may develop - a fear of making transactions, because previously these actions led to the loss of the deposit. Getting out of this hole is much more difficult than finding/earning money for a new deposit. The only thing that can save you here is a very long work on your psychology, and this does not always help.

The rules of psychological and mathematical risk management, coupled with the rules of money management, make it possible to transform a trading deposit into a stable amount, which, with the right approach, cannot be drained. Experienced traders know this, therefore, over a long period of time, although their deposit is subject to minor drawdowns, there is absolutely no risk of losing the entire deposit. Here is the answer to the question I asked you at the very beginning of this article.

The rules of risk and money management simply will not allow you to lose everything! Yes, you definitely need a lot of serious work on yourself to learn how to use these rules, but without it you can’t make money in trading! Typically, traders begin to study these rules only a few months after they start trading, because they are tired of losing their deposits. But many traders never come to risk management and money management - after that, do not be surprised that 95% of traders consistently lose their money in trading. Of course, ignorance of the rules does not exempt you from consequences!

Reviews and comments