SabioTrade – A Comprehensive Review and Comparison of This Prop-Trading Broker (2026)

SabioTrade is an emerging prop-trading company (prop firm) offering funded CFD accounts with a profit share of up to 90%. In today’s bustling world of online trading, SabioTrade stands out for its 360° approach, blending a funding program, an integrated trading platform, and educational resources for traders—all in one ecosystem.

This in-depth review explores SabioTrade’s key features, trading conditions, account types, and reliability. We’ll also compare SabioTrade with two significant competitors—SmartPropTrader and FundedNext—to see how this firm stacks up against industry-leading prop companies in the current year.

Whether you are a Forex/CFD trader or a binary options trader eager to try prop trading, this thorough overview offers expert, impartial insights. We’ll examine SabioTrade’s funding program, profit sharing, trading rules, platform, pros and cons, and show how it differs from competitors in crucial areas like challenge conditions, fees, and trustworthiness. By the end, you’ll have a clear picture of SabioTrade’s potential and market position, helping you make a well-informed decision for your trading journey.

Contents

- What Is SabioTrade? A Brief Look at This Prop-Trading Broker

- Key Features and Trading Conditions at SabioTrade

- Profit Share and Withdrawals

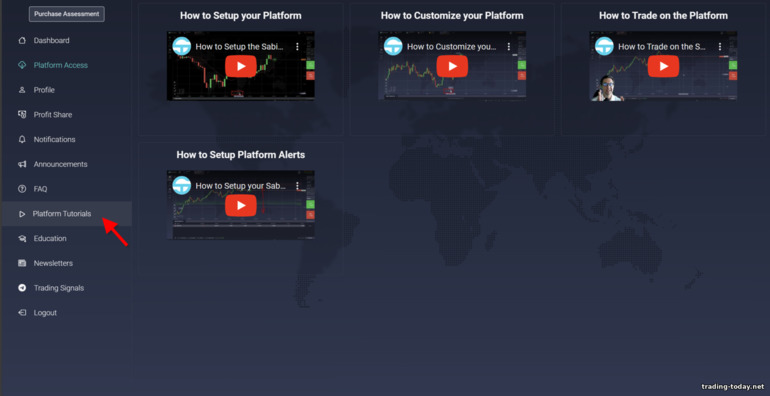

- SabioTrade’s Trading Platform and Tools

- Education and Community Support

- Customer Service and Overall Experience

- SabioTrade Pros and Cons

- Is SabioTrade Legitimate and Safe?

- Comparison with Competitors: SabioTrade vs SmartPropTrader vs FundedNext

- Why SabioTrade Appeals to Traders (Including Binary Options Traders)

- Conclusion: Is SabioTrade Right for You?

What Is SabioTrade? A Brief Look at This Prop-Trading Broker

SabioTrade is a proprietary trading firm (sometimes referred to as a “prop trading broker”) that funds traders with company capital once they successfully complete an evaluation challenge. Unlike a standard brokerage model where you deposit your own money, SabioTrade’s model lets you “trade with our capital and keep up to 90% of the profits.”

Here’s a quick overview of SabioTrade:

- Year Established: Legally registered in 2020 but launched in 2023, so the company is relatively new.

- Location: Dublin, Ireland. (SabioTrade is based in Ireland, giving it a global reach beyond a single regional market.)

- Funding Program: Single-step evaluation. Traders pick an account size, meet a profit target on a demo account without violating risk management guidelines, and then receive a funded account.

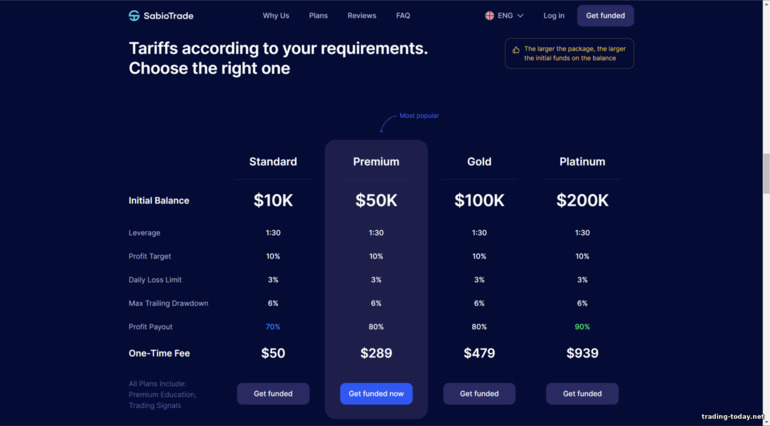

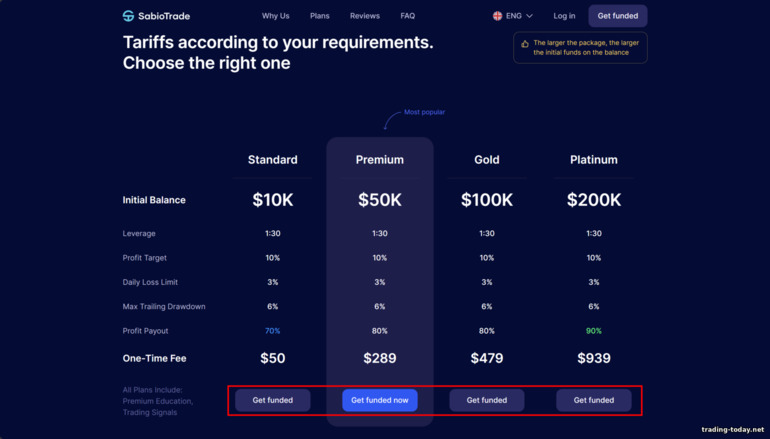

- Account Sizes: Four main options—Standard ($10,000), Premium ($50,000), Gold ($100,000), and Platinum ($200,000).

- Profit Share: 70–90% goes to the trader (SabioTrade offers one of the highest industry splits—up to 90% on the largest account).

- Leverage: Up to 1:30 on Forex. This balanced leverage reflects a focus on risk control, aligning with the interest of a prop firm that wants its traders to sustain performance long-term.

- Instruments: Over 250 assets, including currencies, metals, indices, commodities, crypto, ETFs, and even stocks. Many prop firms have narrower selections; SabioTrade focuses on variety, covering everything from major currency pairs to top tech stocks or cryptocurrencies.

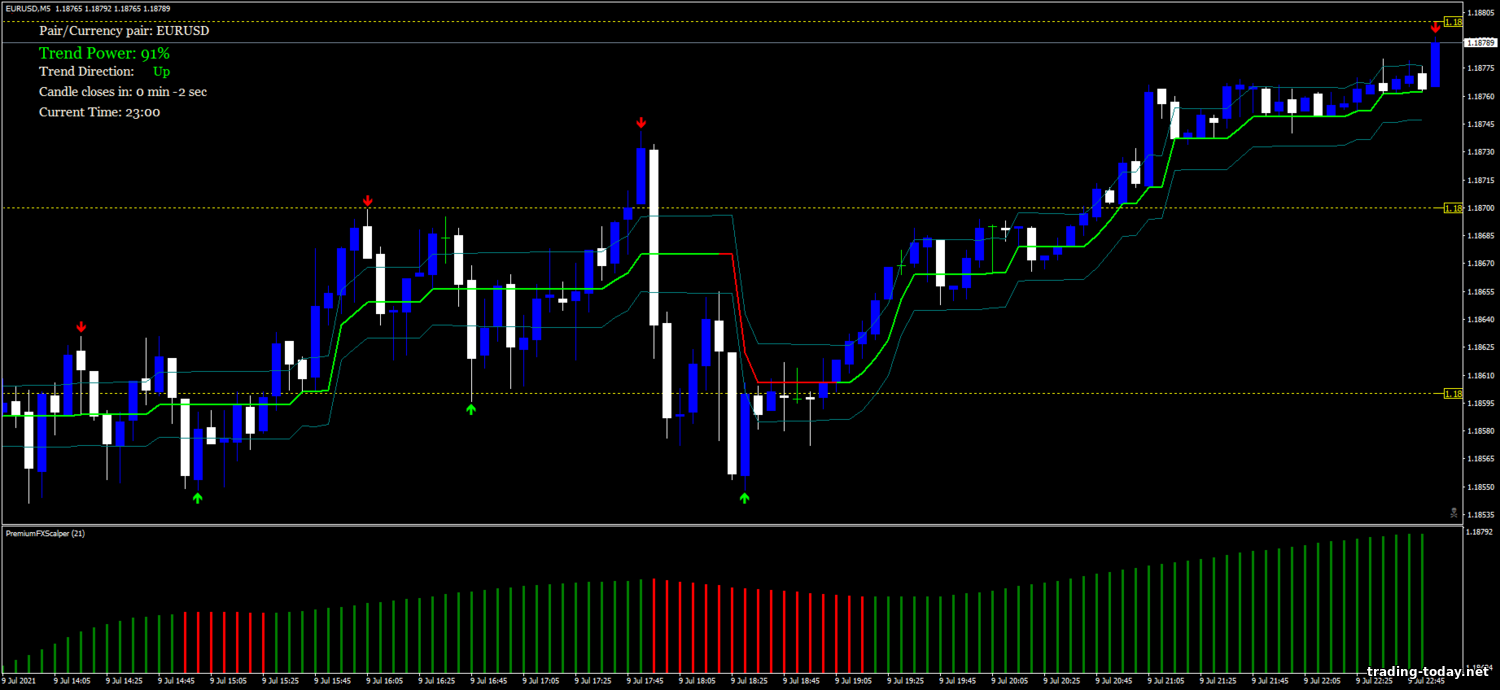

- Trading Platform: SabioTraderoom, a proprietary web terminal built on Quadcode technology, integrated directly into the trader’s dashboard. It means you can execute trades right on SabioTrade’s site, without needing MetaTrader or another external platform. Traderoom supports up to nine charts simultaneously, numerous technical indicators, customizable layouts, price alerts, and more. The user-friendly yet advanced interface provides an all-in-one trading environment.

- Target Audience: Global traders (no major regional restrictions aside from OFAC-sanctioned countries)—ranging from novices to pros looking to trade Forex and CFDs on a funded account. Even binary options traders who want a smoother entry into the standard markets may find SabioTrade appealing for its simplified platform, high potential payouts, and zero risk of losing personal funds.

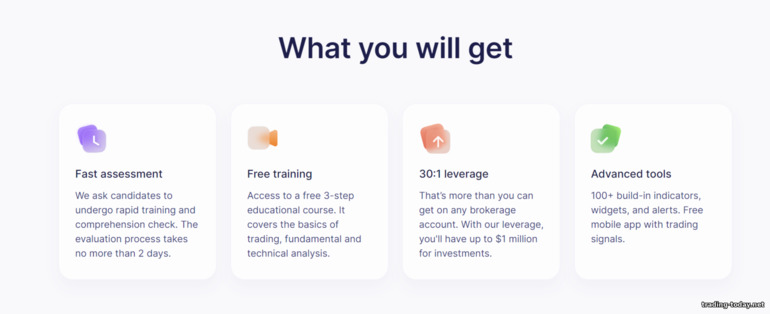

- Unique Advantages: Low entry fee (challenge costs start from $50), on-demand payouts anytime, no minimum trading days or time frames to pass the challenge, free training and trading signals, plus a comprehensive ecosystem (dashboard + platform + education in one place).

SabioTrade’s mission is to empower traders by removing the risk of losing their own capital: “Our funds, your skills – you have nothing to lose,” as their tagline suggests.

In other words, if you prove your trading ability by reaching the required profit without breaking risk rules, SabioTrade provides the capital so you can earn profits without risking personal money.

Key Features and Trading Conditions at SabioTrade

Let’s take a closer look at SabioTrade’s offerings—account types, evaluation rules, fees, trading platform specifics, and other core elements that matter to traders.

Account Types and the Evaluation Program

SabioTrade follows a straightforward approach: a single evaluation program with four account sizes.

Unlike some competitors that have multiple challenge types or instant funding options, SabioTrade maintains a single-step evaluation for everyone:

- One-Step Evaluation Challenge: You need to reach +10% profit on the evaluation account without breaching the loss limits. There’s no deadline—you can take as long as you need. This is psychologically appealing because you’re not forced into risky trades just to meet a short window, a factor that also resonates with former binary options traders who prefer shorter timeframes but appreciate flexibility.

- No Minimum Trading Days: Some firms require a specific number of active trading days (e.g., five), to rule out “lucky” single trades. SabioTrade imposes no such requirement. If you manage 10% profit in one day—fair and square—you pass in one day.

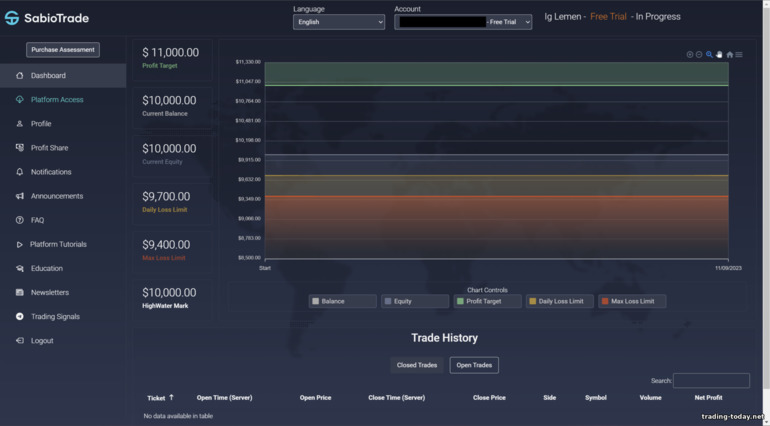

- Drawdown Limits: The risk management rules are fairly strict: a 3% daily loss cap and a 6% total loss cap. The 6% cap is trailing (linked to your highest account balance), meaning if your equity grows, the permissible drawdown also shifts upward. For instance, on a $100,000 account, you can’t lose more than $3,000 in a single day or more than $6,000 overall (including from your new equity highs). This structure helps traders remain disciplined, akin to a built-in stop-loss system, preserving long-term viability.

- Additional Trading Rules: Positions can’t remain open over the weekend (close them by Friday), and you should execute at least one trade every 30 days to avoid inactivity. There’s no mandatory stop-loss on each order, and no profit ceiling. Most trading styles—including scalping, day trading, swing trading, or news-based strategies—are allowed, provided you respect the drawdown rules.

- Unlimited Retakes: If you break a rule or fail the challenge, you can retry indefinitely (paying the fee each time). This standard practice ensures your path isn’t blocked forever—when you’re prepared again, you can attempt it once more.

When you successfully complete the single-step evaluation by achieving 10% profit without infractions, your account is “funded”—you get a real capital account in the amount selected (10k / 50k / 100k / 200k) provided by SabioTrade.

- Scaling Up: As of this writing, SabioTrade does not offer an official scaling plan (increasing the funded account beyond $200,000). The maximum capital per account is $200k (Platinum). Some competitors do provide expansions after consistent profitability. SabioTrade may add this feature later, but for now, you can purchase additional challenges and manage multiple accounts if you need more capital.

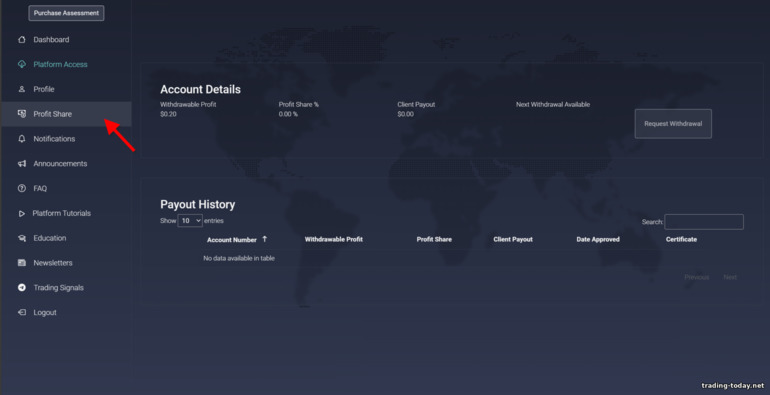

Profit Share and Withdrawals

SabioTrade’s profit-sharing model is quite enticing:

- Profit Split: Traders keep between 70% and 90% of their gains, depending on the account size:

- $10k (Standard): 70%

- $50k (Premium) and $100k (Gold): 80%

- $200k (Platinum): 90%

- Payouts: You can withdraw your profits any time in any amount—instantly. There are no fixed monthly cycles or minimum thresholds. This “on-demand” feature is a huge plus. If you earn $5,000 in a single week, you can withdraw it immediately rather than waiting for month’s end. SabioTrade processes withdrawals 24/7, illustrating its commitment to transparent dealings—no unnecessary hold-ups on your funds.

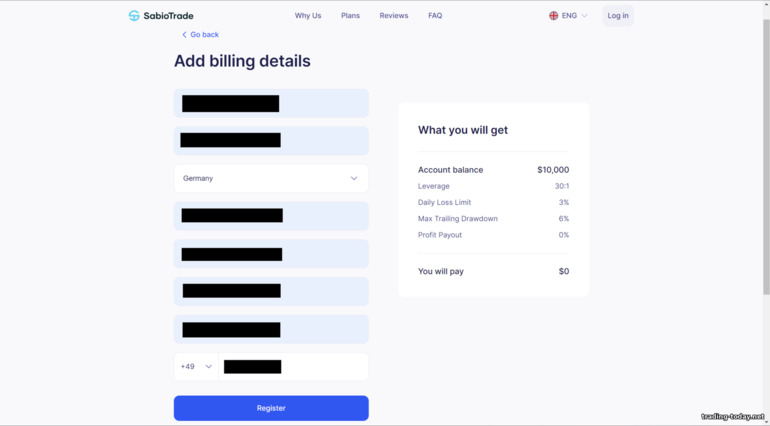

- Payment Methods: Challenge fees can be paid by credit card (Visa/MasterCard).

Profit withdrawals go to your bank account (details provided when you sign up). Notably, SabioTrade does not store payment info or charge automatically—each payment is entered manually, improving security. - Refund Policy: If you pass the evaluation, SabioTrade refunds your fee (usually alongside your first payout). For example, if you conquer the Platinum 200k challenge—which costs $939—that amount is refunded once you are funded and request your first profit withdrawal.

This practice is common among top prop firms, effectively making your challenge free if you succeed. - Withdrawal Requirements: Before receiving a funded account or any payout, you must complete KYC (ID verification) and sign a service agreement with your banking details.

These measures help prevent fraud and ensure funds reach the correct recipient. Additionally, to avoid misuse, each fee payment requires you to reconfirm your billing address and acceptance of terms.

Although it may feel like extra paperwork, these steps reinforce security and trust (benefiting both the firm and the traders).

Overall, SabioTrade’s profit-sharing setup is highly competitive, and its withdrawal process is extremely convenient. Generous earning potential plus rapid payouts are pivotal factors drawing in ambitious traders (including ex-binary option participants, who appreciate that the lion’s share of profits remains theirs while any losses are absorbed by the firm).

SabioTrade’s Trading Platform and Tools

One of SabioTrade’s defining advantages is its integrated trading platform. Instead of a third-party system (like MT4/MT5 or cTrader), SabioTrade offers its own SabioTraderoom:

- This web-based platform is developed in partnership with Quadcode—a technology provider that powers platforms for other well-known brokers. Traderoom is embedded in your personal dashboard at SabioTrade’s website. Log in, manage your account, and place trades all in one place.

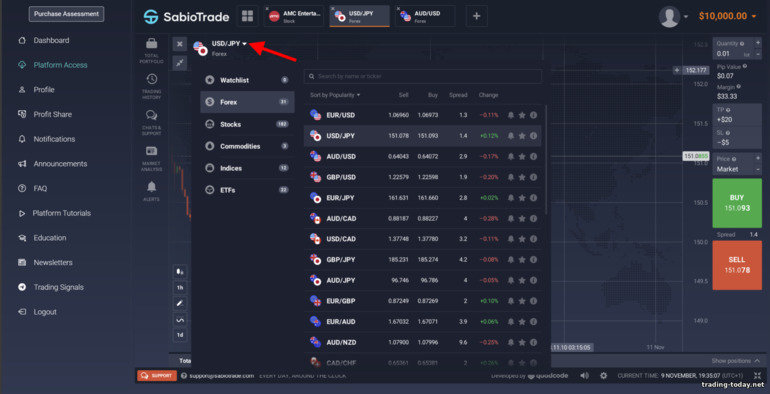

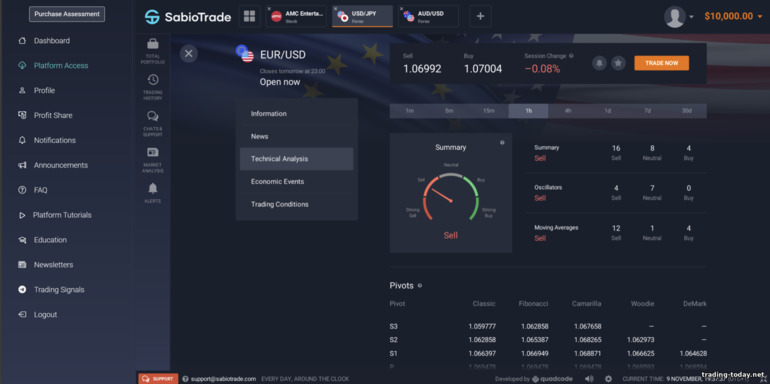

- Interface: Modern and highly customizable, featuring up to nine charts on one screen, over 100 technical indicators, drawing tools, and alerts. This is particularly handy if you rely heavily on technical analysis and track multiple assets simultaneously (like EUR/USD, GBP/USD, Gold, S&P 500 index, etc.).

- Charts and Order Execution: You’ll find advanced tools comparable to MT4/MT5—fast quote feeds, different order types, real-time data on all instruments. The web format allows you to trade from anywhere without installing extra software. For those accustomed to web terminals (including many binary options traders), Traderoom feels intuitive yet more robust.

- SabioDashboard: Alongside the platform, you have a monitoring panel that shows real-time statistics of your account, including drawdown, profit, remaining loss limit, etc. It updates every minute. Many prop firms require manual calculations for these metrics; here, it’s all automated, reducing the chance of errors.

- Mobile Trading: SabioTrade has the “SabioTrader” mobile app for Android (and likely iOS as well).

The mobile version is streamlined for quick oversight and trade execution, so you’re not tied to a desktop. - Comparison: Many experienced traders enjoy MetaTrader, but SabioTrade’s unique platform simplifies the process (no bridging or separate software setup). This lowers barriers for beginners. It’s reminiscent of binary options interfaces; however, Traderoom’s CFD feature set is far more extensive than typical binary options platforms. A downside is the lack of support for custom Expert Advisors (EAs) or MT4 scripts, which might disappoint algorithmic or automated traders.

Trading Instruments and Market Conditions

SabioTrade offers an unusually wide range of markets for a prop firm:

- Forex: Major, minor, and even some exotic pairs.

- Commodities: Gold, silver, oil, and other metals/energy products (over ten different symbols).

- Indices: Prominent global stock indices (US, Europe, Asia).

- Stocks: A substantial catalog of CFDs on individual shares (250+ tickers from US and European markets).

- Cryptocurrency: Key coins like BTC, ETH, XRP, etc., paired with USD or USDT.

- ETFs: A range of popular exchange-traded funds (like QQQ, SPY).

The presence of 250+ instruments allows traders to diversify or look for opportunities across multiple arenas. If the Forex market is flat, switch to NASDAQ or Apple stock. If you’re knowledgeable about crypto, trade BTC. Many older prop firms limit asset lists; SabioTrade’s broad scope is a competitive edge.

- Spreads and Commissions: SabioTrade charges no direct commission on these instruments—spreads cover the cost. An official spread list isn’t publicly available, but as the system runs on Quadcode tech (also used by established brokers), expect spreads comparable to typical retail brokers (a few pips on major pairs, etc.). Zero commissions on Forex, commodities, indices, and crypto is a plus.

- Leverage: SabioTrade offers up to 1:30 on Forex.

This is lower than many retail brokers (1:100 or higher) but aligns with risk management principles. In reality, 30:1 is ample for most strategies. On a 100k account, that’s up to $3 million in nominal position size, which suffices for most. Other instruments may have different leverage (likely lower for crypto and equities). The rationale is to discourage excessive risk. Serious prop firms often use modest leverage (1:10–1:40) to safeguard capital and nudge traders toward long-term consistency. - Trading Hours: Standard market times apply. Since leaving positions open over the weekend is prohibited, everything must be closed by Friday’s market close. Cryptocurrencies theoretically trade 24/7, but the firm likely requires weekend closures to avoid gap risk.

- News Trading: There’s no explicit ban on news trading, so presumably it’s allowed (most prop firms do not forbid it). No dedicated info on high-frequency or algorithmic trading is provided. As long as you stay within the drawdown rules, you should be fine.

In short, SabioTrade offers a versatile environment with plenty of tradable instruments, zero commissions, and reasonable leverage—suitable for diverse trading styles, from short-term scalping on EUR/USD to swing trading on Amazon shares, all within a single funded account.

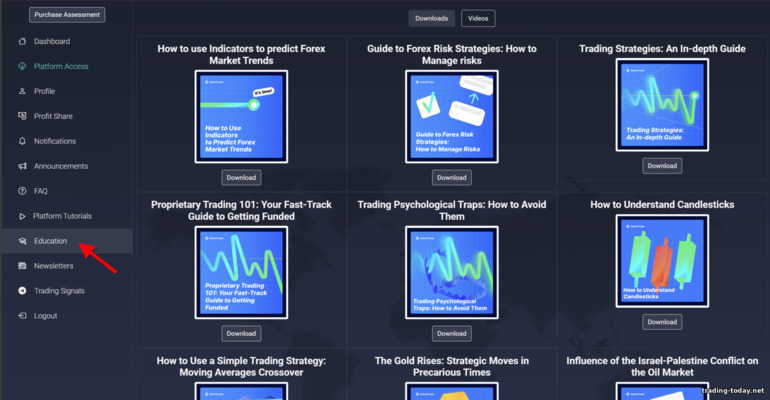

Education and Community Support

SabioTrade goes beyond just funding; it also invests in trader development—consistent with the concept of fostering better results:

- Free Educational Course: Every SabioTrade user can access a free, three-stage course.

It covers core and advanced topics (fundamental and technical analysis, risk management, and more), hosted by professional traders. This is valuable for newcomers or ex-binary traders aiming to learn more about CFDs. The course is right inside your dashboard. - Trading Blog and Content: SabioTrade’s ecosystem features a blog with educational materials.

Articles cover a broad range of themes—strategies, industry news, tips, etc. Consistent content updates help traders continuously refine their skills. - Community and Communication: They mention an “active community” and SabioTrade presence on social media.

Exact details are unclear, but they likely have forums, social channels, or contests. Interaction with fellow traders can combat the isolation of remote prop trading. - Trading Signals: SabioTrade even provides free signals within the platform.

These signals can serve as a helpful reference for potential trade ideas, but shouldn’t replace your own analysis. Still, it’s another sign that SabioTrade strives to support its traders (since the firm only benefits when traders profit).

Having an educational suite and signals is unusual for a prop firm, but it shows SabioTrade’s commitment to its clients’ success. Many competitors leave learning entirely in the trader’s hands. Here, it’s integrated and complimentary.

Customer Service and Overall Experience

Quality support is particularly vital when real money and technicalities are in play. SabioTrade appears to address this adequately:

- Round-the-Clock Support: SabioTrade claims 24/7 customer service.

Contact channels: email, on-site chat, social media.

This is useful for traders in different time zones who might need immediate assistance. - Knowledge Base/FAQ: The website hosts an FAQ section for common issues.

This is helpful for quick answers (“Is copy trading allowed?” – no, SabioTrade prohibits trade copying). - Languages: English is the main language (the international standard for trading). They may offer other languages (DailyForex references a multilingual approach, but specifics are limited). Since SabioTrade is globally oriented, it’s likely they will expand their language support.

- No Phone Line: Some people prefer voice communication, but like many modern prop firms, SabioTrade does not run a call center. In the digital age, chat and messaging often suffice.

- User Feedback: Because the company is new, it has fewer reviews. Early comments, however, praise the helpfulness of their team. For instance, some have noted that SabioTrade’s staff quickly resolves technical matters, similar to what traders appreciate at SmartPropTrader.

As SabioTrade’s client base expands, maintaining responsive service will be crucial. - Accepted Countries: SabioTrade welcomes traders globally, barring a few restricted locations (likely those under sanctions).

With such global reach, they must handle various cultures and languages. Early reports indicate traders from around the world are signing up (based on Trustpilot and other review sites).

SabioTrade Pros and Cons

Let’s summarize the main strengths and drawbacks of SabioTrade:

Pros:

- High profit split: up to 90%—among the best in the industry. Traders keep the majority of their gains.

- Low entry barrier: challenge fees start at just $50 for a 10k account, making it very accessible and reducing risk for newer traders.

- No time limits: no minimum or maximum days to finish the challenge. You can pass quickly or take your time without feeling rushed.

- Integrated platform: SabioTraderoom with advanced charting; no need for external platforms. User-friendly for both beginners and pros.

- 250+ instruments: covering Forex, stocks, crypto, ETFs, and more—offering broad diversification.

- Free training and signals: fosters trader skill development.

- Instant payouts: request withdrawals anytime, no set payout cycle.

- Global availability: few regional restrictions, 24/7 support.

- Transparency: clear rules, no hidden fees, well-documented conditions on the website. They display their Trustpilot rating and Dublin address publicly.

Cons:

- New in the market: though legally registered in 2020, it launched in 2023, so it lacks a long track record. It’s unregulated (like all prop firms) and hasn’t “stood the test of time” to fully establish trust.

- Limited reviews: fewer independent testimonials and payout confirmations compared to older firms. (Initial feedback is positive, and trust typically grows with time.)

- No two-phase option: if you prefer to split your goal into two smaller steps (e.g., 5% + 5%), SabioTrade doesn’t offer that. You must achieve 10% in one shot. However, no time limit mitigates this challenge.

- Lack of MT4/MT5: Fans of MetaTrader or automated trading systems can’t use their EAs or scripts here. You have to trade on the proprietary terminal.

- Strict drawdown rules: 3% daily and 6% total can be tight, especially for volatile strategies. One overly aggressive day can ruin your account.

- Limited payout methods: currently only bank transfers. Some competitors offer crypto or digital wallet options, which can be more convenient.

- Potential growth pains: as a newer firm, SabioTrade may encounter service delays or “growing pains” as it scales. Also lacks certain features that established firms have (e.g., a built-in scaling plan).

Overall, SabioTrade’s advantages significantly outweigh its disadvantages for many traders. Its shortfalls mainly stem from its youth and certain preferences (like needing MT4/MT5). If you want an affordable, promising prop-trading option with a modern platform and generous payouts, SabioTrade looks appealing. Still, due diligence is crucial—don’t invest more in challenge fees than you can afford, as any prop firm’s stability depends on its business model and integrity.

Is SabioTrade Legitimate and Safe?

When choosing a brokerage or prop firm—especially a new one—trust and security take center stage. SabioTrade doesn’t collect client deposits in the classic sense (other than the one-time challenge fee), so traditional considerations (like segregated funds or regulatory oversight) are less applicable. Let’s evaluate SabioTrade’s legitimacy based on the firm’s openness, reviews, and overall behavior:

- Corporate Transparency: SabioTrade publishes its corporate information. It’s incorporated in Ireland with a public address in Dublin.

Having a verifiable address is better than operating anonymously. Ireland is an EU nation, implying certain standards of business conduct. There isn’t much info about top executives (CEO, etc.), which is common among prop firms, but details about their tech partner (Quadcode) and sponsorships are available. - No Regulatory License (Typical for Prop Firms): Prop-trading companies generally aren’t regulated by financial authorities because they’re not taking conventional client investments—it’s more akin to a talent-scouting business model. SabioTrade follows this structure, so it lacks a formal financial license. They claim to use a “reputable brokerage” for order execution.

Essentially, trades on SabioTrade’s platform run in a “simulated environment” powered by Quadcode, while SabioTrade profits from a share of successful traders’ earnings and challenge fees, not from “dealing desk” manipulations. The absence of regulation means you must rely on the firm’s honesty, but the prop model inherently aligns trader success with the firm’s interests. - Security Measures: SabioTrade implements internal checks:

- Every fee payment requires acknowledging terms so you understand the agreement.

- KYC is mandatory before funding, preventing fraudulent sign-ups.

- Withdrawals only go to verified accounts; changing details demands new verification.

- The company does not store confidential payment data on its servers.

- Trustpilot Reviews: Early feedback on SabioTrade is generally positive. As of the beginning of the year, it holds a 4.0 out of 5.0 rating with over 400 reviews. About 59% gave it the maximum 5 stars. People praise the user-friendly platform and responsive support. Earlier, at around 42 reviews, it was rated 4.3, so the average dipped slightly with more feedback, which is normal. A 4.0 rating is still respectable, though some competitors have higher marks (see the comparison below). SabioTrade actively replies to reviews, which is a good sign. Its reputation will likely solidify further if consistent service continues.

- Industry Recognition and Sponsorships: Notably, SabioTrade has sponsored sporting events and athletes on an international scale. For instance, it supported tennis players (Jasmine Paolini, Jonny O’Mara, Juan Manuel Cerundolo) at the 2023 Wimbledon final.

A newly launched prop firm investing in high-profile sponsorships is unusual—scam entities typically avoid this level of visibility. This suggests SabioTrade possesses a budget and is planning long-term growth. - Affiliates: Certain websites (like DailyForex) mention potential affiliate links in their broker reviews. This is standard practice—many prop firms run referral or affiliate programs. This article relies on factual data, not mere marketing. SabioTrade’s presence on portals like Investing.com and ForexPropReviews (where it’s recommended) boosts its credibility, since those platforms typically vet partners.

- Real Trader Experience: The key question is whether the company truly issues funded accounts and pays out profits. As a new entrant, fewer public proofs exist, but the model (90% splits, etc.) is clearly laid out. No controversies or major complaints have surfaced. In contrast, some prop firms became infamous for refusing payouts; SabioTrade has had no such incidents. On Reddit, the prop-trading community has started referencing SabioTrade among trustworthy newcomers.

Comparative Trust Level vs Competitors

Established rivals have more reviews: FundedNext boasts over 25k Trustpilot reviews with a 4.6 rating, SmartPropTrader has ~2k reviews with a 4.7 rating.

SabioTrade is catching up, but quantity of reviews isn’t the only indicator of reliability. The absence of negative incidents and a transparent payout framework are just as important. Expert summaries call SabioTrade “a reliable prop firm” and “safe in general,” anticipating that as it expands, more details will emerge.

All in all, SabioTrade appears legitimate and reasonably secure. Yes, it’s a young company, but it’s taking visible strides to build trust, such as open information, community engagement, sports sponsorships, and robust security protocols. As always, practice prudent risk management (don’t overspend on repeated challenges, withdraw profits routinely). But from the available evidence, SabioTrade offers an appealing blend of innovation and reliability.

Comparison with Competitors: SabioTrade vs SmartPropTrader vs FundedNext

SabioTrade is entering a competitive prop firm market. Let’s compare it to SmartPropTrader (a popular company offering two-step challenges) and FundedNext (a fast-growing global prop firm) to see how SabioTrade measures up in terms of funding approach, rules, fees, and trust.

Quick Comparison Overview

The table below highlights key features of SabioTrade, SmartPropTrader (SPT), and FundedNext:

| Aspect | SabioTrade (Prop Broker) | SmartPropTrader (Prop Firm) | FundedNext (Prop Firm) |

|---|---|---|---|

| Evaluation Model | 1-Step Challenge – target +10% profit, single phase. | 2-Step Challenge – Phase 1: +7.5%, Phase 2: +5%. | Choice of 1-Step or 2-Step – multiple programs (Express, Stellar, Evaluation) |

| Account Sizes | 10k, 50k, 100k, 200k. | 10k, 25k, 50k, 100k, 200k (up to 200k in standard challenge). | From 5k up to 200k (program-dependent); can reach 300k (two-step) |

| Profit Share | 70–90% (70% on 10k, 90% on 200k). | Up to 90% (often 80% initial, then 90% after first payout). | 80–90% (some pathways up to 95% over time). |

| Max Capital | 200k per account, no announced scaling plan yet. | 200k per challenge; up to $2.5 million with scaling. | Up to 300k combined; scaling to larger amounts (e.g., +40% every 4 mos.) |

| Profit Target | 10% (single step). | 7.5% + 5% (~12.5% total). After funding, no target—just consistency. | 10% + 5% for two-step (typical of FTMO-like). Express (1-step) might require up to 25%. |

| Daily Drawdown | 3% of starting balance or equity (strict). | 4% of balance. | 5% (standard at FN, varies by account type). |

| Total Drawdown | 6% trailing (based on peak balance). | 8% fixed. | 10% (standard). |

| Minimum Days | 0 – no minimum duration. | 0 – no min days. | 2 days (two-step Evaluation) or none (Express). |

| Max Time | None – no limit. | 150 days total – 50 (Phase1) + 100 (Phase2), quite generous. | 60 days (30+60) for two-step; Express often no time limit. |

| Instruments | 250+: Forex, commodities, indices, stocks, crypto, ETFs. | Forex, indices, commodities, crypto (likely no single stocks). | Forex, indices, commodities, crypto (stocks not commonly offered by FN). |

| Platform | Proprietary SabioTraderoom (web/mobile). No MT4/MT5. | MT4 & MT5 (through Eightcap broker). | MT4, MT5, cTrader. Some integration with TradingView. |

| Challenge Fee | $50 for 10k; $939 for 200k. Refunded upon success. | ~$90–100 (10k), ~$500 (100k), ~$949 (200k) – typical SPT fees. Also refundable. | ~$155 (10k), $549 (100k), $999 (200k) for two-step. Express is pricier (~$749 for 50k). All refundable upon success. |

| Payout Frequency | Anytime – no fixed cycle. | Usually monthly, with the possibility of more frequent payouts after first withdrawal. | Every 2 weeks or monthly – first payout at 15 days (Evaluation) or instantly (Express). |

| Scaling Plan | Not yet (fixed account sizes). | Yes – you can grow the account (e.g. +25%, etc.) up to 2.5M. | Yes – +40% every 4 months if conditions met. |

| Key Features | Free education & signals; low entry fee; proprietary platform; sports sponsorships. | Very low Phase1 target (7.5%); no min days; quick funding; payouts via crypto/Deel/Wise + community challenges. | Multiple challenge types (flexibility); partial payouts even during challenge (Express); massive community. |

| Trustpilot Rating | 4.0 / 5 (422 reviews) – new but growing. | 4.7 / 5 (2,320 reviews) – fairly reputable. | 4.6 / 5 (25,000+ reviews) – extremely popular worldwide. |

| Founded | 2023 (legally 2020), Ireland. | 2022, USA (SPT LLC, associated with VVS community). | 2022, UAE & Bangladesh (CEO – Abdullah Jayed). |

Below is a brief breakdown of how these differences play out.

Funding Model: Single Step vs. Two Steps

SabioTrade uses a single-step challenge: hit 10% profit once, no second phase. Also, there’s no time cap.

SmartPropTrader offers a two-step model: +7.5% first, then +5% next. That’s a total of 12.5% but split into two smaller segments, plus you get ample time (150 days total).

FundedNext lets you pick: a standard two-phase “Evaluation” (10% then 5%, similar to FTMO) or an “Express” one-step route with stricter terms but partial profit payouts during the challenge.

Many traders find a single step simpler mentally: “earn 10% and get funded.” Also, with SabioTrade, there’s no deadline. Two-step firms (SPT, FundedNext’s Evaluation) impose time frames (though SPT’s is quite long). Some prefer dividing the target into two phases with lower each-step targets; at SabioTrade, if you’re at +9% but have a setback, you stay in the same challenge (though you can take unlimited time to recover).

SmartPropTrader is considered among the most “friendly” two-step challenges because Phase1 requires only 7.5% and there are no minimum days. SabioTrade could theoretically be quicker (one day for 10%), but the 3% daily cap can make it tricky to do so swiftly.

Bottom Line: SabioTrade is great for those seeking a single-step approach with no ticking clock. SmartPropTrader might suit those who don’t mind two phases and want slightly more relaxed drawdown or lesser initial targets. FundedNext is the most flexible in terms of program choices but usually sets time windows (30–60 days per phase).

Profit Share and Earning Potential

SabioTrade: 70–90%, with 90% immediately available on a 200k account.

SmartPropTrader: Often 80% base, up to 90% after an initial period or certain conditions.

FundedNext: 80–90%, sometimes up to 95% for long-term traders. Also, in the Express model, you can receive partial profit payouts even during the challenge.

All three provide high-end splits. SabioTrade’s instant 90% on the largest account is appealing, whereas many competitors start lower. FundedNext potentially reaches 95% but only after you’ve proven consistent performance.

Payout Frequency:

SabioTrade – anytime, no fixed schedule.

SmartPropTrader – typically monthly, though after the first withdrawal you might opt for a biweekly cycle.

FundedNext – either every two weeks or monthly, with the first withdrawal after 15–30 days depending on the program.

Hence, SabioTrade has the most flexible payout model—very convenient if you want immediate access to your earnings.

Risk Management Rules

SabioTrade: 3% daily limit, 6% total trailing.

SmartPropTrader: 4% daily, 8% overall (fixed).

FundedNext: 5% daily, 10% overall (standard).

SabioTrade enforces the strictest daily drawdown and uses a trailing concept for total drawdown. SPT’s is a fixed percentage from the start, so if the account grows, you gain extra safety. SabioTrade’s trailing approach prevents big pullbacks after you’ve accumulated profits.

SmartPropTrader is a bit more accommodating for aggressive strategies; FundedNext is moderate; SabioTrade is tighter but compensates by removing time pressure. You can trade small-lot positions and patiently build to 10% without a deadline.

Fees and Entry Cost

SabioTrade: $50 for a 10k account—extremely cheap. $939 for 200k—still competitive.

SmartPropTrader: ~$90–100 for 10k, $500 for 100k, $949 for 200k—close to industry standards, sometimes with promo codes.

FundedNext: ~$155 for 10k, $549 for 100k, $999 for 200k (two-step), while the Express option costs more.

SabioTrade stands out for low pricing on smaller accounts. Fees get refunded upon success, so the difference might matter if you’re on a tight budget. For larger accounts, the price disparity isn’t massive.

Platform and Execution

SabioTrade: Proprietary web platform; user-friendly, but no MT4/MT5 or EA automation.

SmartPropTrader: Classic MT4/MT5 (through Eightcap).

FundedNext: MT4, MT5, cTrader, plus a TradingView connection in some cases.

If you rely on MetaTrader or custom robots, SabioTrade won’t accommodate. If you prefer a ready-to-go web interface, SabioTrade is compelling.

Unique Highlights

SabioTrade: Complimentary education and signals, inexpensive challenges, custom platform, sports sponsorships.

SmartPropTrader: Arguably one of the easiest two-step challenges (lower profit targets), robust community, quick funding, crypto payouts.

FundedNext: A variety of challenge formats, a vast user base, partial payouts even in-challenge, promotional bonuses, etc.

Reputation and Trust

SmartPropTrader: 4.7/5 with ~2k reviews, operating since 2022.

FundedNext: 4.6/5 with 25k+ reviews, very popular worldwide.

SabioTrade: 4.0/5 with ~400 reviews, no reported scandals but still new.

SabioTrade is catching up in user feedback. The older firms simply have more time to accumulate reviews. But so far, SabioTrade’s sentiment is mostly positive.

Final Takeaway: SabioTrade is undeniably competitive with its lack of time limits, affordable fees, and extensive trader support. Its drawdown rules are on the stricter side, and there’s no official scaling yet. SmartPropTrader is known for forgiving drawdowns and an easy two-step approach; FundedNext stands out for its variety of programs and massive scale. From a trust perspective, SPT and FN are more established, yet SabioTrade is steadily building a solid reputation. The best choice depends on your priorities: no deadlines, a specific platform, risk parameters, cost, brand recognition, or growth potential. Many traders spread their risk across multiple prop firms anyway.

Why SabioTrade Appeals to Traders (Including Binary Options Traders)

For practical insight, let’s highlight why SabioTrade might attract a segment of binary options traders seeking to shift to a more conventional market. If you previously traded binaries and are looking for your next step, SabioTrade’s prop-trading approach could be intriguing:

- No Risk to Personal Funds: In binary options, you typically deposit your own money, and every losing trade is a direct personal loss. With SabioTrade, your cost is just the one-time challenge fee—after that, you trade with the firm’s capital. Your only risk is this fee; further losses are covered by the prop firm. This lets you trade methodically, without fear of total personal ruin.

- Higher Earning Potential: Binary options traditionally have capped returns (70–90% per trade, if correct). In SabioTrade’s CFD-based model, profits aren’t restricted by a fixed payout—if price moves further in your favor, your gains can grow. Plus, your share can go up to 90%. So the upside can be substantially larger.

- Longer Trade Durations: Binary options are often tied to short expirations (minutes or hours). In SabioTrade’s model, you can day trade or even hold positions for multiple days, broadening your strategic scope. You’re no longer forced to pick an arbitrary expiry time.

- A Step Toward Professional Trading: Prop trading is viewed as more “institutional” than binaries. Success here builds a professional track record since you’re operating in standard markets (Forex, stocks, commodities). SabioTrade also provides structured training and capital, elevating your skills and standing within the trading community.

- User-Friendly Platform: One reason people like binary options is their straightforward interfaces. SabioTraderoom also offers a web-based interface that feels natural, but includes deeper functionalities. This makes the transition smoother than jumping straight to MT4/MT5. Meanwhile, the platform is more versatile than typical binary platforms.

- Global Availability: Many binary brokers are offshores that get banned in certain regions. SabioTrade accepts clients worldwide (excluding heavily sanctioned jurisdictions) with uniform conditions, simplifying access.

- Enhanced Risk Management Skills: Binaries often feel “all or nothing.” SabioTrade’s 3%/6% loss caps enforce rigorous risk management—no infinite “martingale” or going “all-in.” Over time, that fosters a more professional, disciplined mindset.

So SabioTrade offers a path to more serious, profitable trading for those moving on from binary options. Naturally, you must adjust to new rules and markets, but the company supports your learning process.

Conclusion: Is SabioTrade Right for You?

This year, SabioTrade has quickly earned recognition as a robust contender among prop firms, offering an accessible path to funding and a cutting-edge platform. Our comparison with well-known competitors like SmartPropTrader and FundedNext shows that SabioTrade holds its own on several fronts and even surpasses them in certain areas:

- If you value a sleek interface that integrates all features in one place, minimal challenge fees, and zero deadlines, SabioTrade absolutely warrants attention.

- If you’re more comfortable with a two-phase approach and don’t mind waiting, SmartPropTrader may be simpler in terms of drawdown and steps.

- If you want large-scale expansion plus multiple challenge options, FundedNext might be your top pick.

However, no matter how generous a prop firm’s terms are, ultimately your success hinges on your skill and discipline. A high profit share does nothing if you violate the risk rules. Beginners can benefit from SabioTrade’s training resources, possibly starting with a smaller account. Experienced traders may jump straight into the 200k tier for that 90% split if they trust their system.

Final Verdict: SabioTrade is a legitimate prop-trading broker where traders worldwide can secure significant funding and keep the majority of their profits. It’s carving out its niche with an integrated approach and a trader-centric philosophy. Whether you’re a complete beginner or a seasoned veteran (including former binary options traders) looking for new possibilities, SabioTrade has a lot to offer.

Given its combination of affordable fees, wide asset selection, and generous payouts, SabioTrade is increasingly singled out as one of the most appealing prop-firm opportunities of the year. Industry insiders already refer to it as a “go-to choice in the prop-trading scene” for individuals prepared to demonstrate their expertise and trade professionally with external capital.

Reviews and comments