Pivot Points in Trading: How to Trade Using Pivot Levels (2026)

Updated: 25.01.2026

Pivot Points or pivot levels: how to work with pivot points in trading (2026)

Pivot points (also known as Pivot Points – support points) are a tool for technical analysis of a chart, similar to support and resistance levels. At a minimum, their goal is the same - to identify areas of interest for market participants. But, unlike classic support and resistance levels, pivot levels are built according to certain formulas, and the data for calculation is taken for the previous period.

To put it simply, pivot points are support and resistance levels that try to predict the appearance of these same levels in the future, based on past data (we look into the past and predict the future). If you consider that the price has a memory, then the idea is very interesting. Let's understand how Pivot Point works and how you can use them to make money in trading.

As a rule, the most popular are the pivot points:

P = (High + Low + Close)/3

You also need to calculate additional levels of support (R - Resistance) and resistance (S - Support). All this is done according to the following formulas:

The table is located on the investing website, in the technical analysis section – “Turning Points”: Here you can select the type of pivot points:

The resistance level becomes a support level and vice versa - the support level becomes a resistance level after a breakout. Everything is the same as with the classic horizontal levels of supply and demand.

As for the application of the zone of interest around the pivot points, everything here is the same as with the usual horizontal zones of supply and demand: The procedure is as follows:

At the same time, false breakouts are determined in the same way as when working with regular support and resistance zones: As before, the price must break through the support and resistance zone and remain outside it for a certain time. Confirmation of a breakdown is the return of the price to the broken level, followed by continuation of the trend movement.

Also, on higher time frames, you should pay special attention to candlestick formations and patterns. Let's look at the H1 USD/CAD chart:

Don’t forget one important thing - although pivot points are built automatically, which eliminates the problem of building support and resistance levels, there are a limited number of these points (levels) and they are built according to the same formulas. Even if we assume that a support and resistance zone can be identified around each pivot level, this will still not be enough for full-fledged trading in most cases.

It is very important to understand that pivot points do not replace regular support and resistance levels , but only complement them. Of course, pivot points are strong levels, but they also tend to break through, so you should definitely analyze them and check the price reaction.

The best and most reliable option for using pivot points is to overlay the indicator on top of hand-drawn support and resistance levels. Only in such a combination will it be possible to achieve the maximum effect from trading.

To put it simply, pivot points are support and resistance levels that try to predict the appearance of these same levels in the future, based on past data (we look into the past and predict the future). If you consider that the price has a memory, then the idea is very interesting. Let's understand how Pivot Point works and how you can use them to make money in trading.

Contents

How do pivot points work - price reversal levels

It is not difficult to understand the principle of operation of pivot points; it is only important to know the formulas for their construction - how the support and resistance levels will be constructed depends on the formulas. There are several types of popular formulas for calculating pivot levels. You may ask, why use different formulas to build the same levels? The fact is that the formulas were invented/changed/added by different analysts who do not have the same views on the importance of certain “components” - they give more weight to something and neglect something.As a rule, the most popular are the pivot points:

- Traditional (Traditional) - pivot points that have been used on Wall Street for decades

- Classic (Classic) – pivot levels that differ from the previous method only by a slightly modified calculation formula

- Woodie – in the formulas, greater importance is given to the closing price

- DeMark (DeMark) - the formula for these pivot points was developed by an analyst at the hedge fund SAC Capital Advisors, who predicted price reversals in 2011-2013

- Fibonacci (Fibonacci) – calculation formulas are associated with price correction levels based on the numbers of Leonardo of Pisa (also known by the nickname Fibonacci)

- Camarilla (Camarilla) - another method of constructing pivot points, close to the formulas of classic pivots

Formula for constructing Traditional Pivot Points

Traditional pivot points are the simplest way of construction (it’s not for nothing that they say that everything ingenious is simple). Pivot points are calculated from past data, for example, from the previous day. For this calculation, you will need only three values: the maximum price (High), the minimum price (Low) and the closing level (Close) - add them all up and divide by 3. We get the following formula:P = (High + Low + Close)/3

You also need to calculate additional levels of support (R - Resistance) and resistance (S - Support). All this is done according to the following formulas:

- R1 = 2Pivot – Low

- S1 = 2pivot – High

- R2 = Pivot + (R1 – S1)

- S2 = Pivot – (R1 – S1)

- R3 = High + 2 x (Pivot – Low)

- S3 = Low - 2 x (High - Pivot)

Formula for calculating pivot points according to DeMark (DeMark Pivot Point)

If we talk about pivot points calculated using the DeMark formula, it is worth noting an interesting feature: the formula depends on the type of candle - whether the candle was bullish or bearish. Those. First, the direction in which the price moved for the selected period is determined, and only then the pivot points themselves are calculated:- If (Close < Open), then: Pivot = High + 2 x Low+ Close

- If (Close > Open) then: Pivot = 2 x High + Low + Close

- If (Close = Open) then: Pivot = High + Low + 2 x Close

- R1 = Pivot/2 – Low

- S1 = Pivot/2 + High

- Open – opening price (for example, candles D1)

- Close – closing price

- High – maximum value

- Low – minimum value

- Pivot – pivot level

Pivot points using Woodie's formula

Pivot points according to Woody's formulas are calculated using formulas where greater importance is given to the closing value (Close):- Pivot = (High + low + 2 x Close) / 4

- R1 = 2 x Pivot – low

- S1 = 2 x Pivot – High

- R2 = Pivot + High – Low

- S2 = Pivot – High + Low

- Close – closing price (for example, candles D1)

- High – maximum value

- Low – minimum value

- Pivot – pivot level

Formula for calculating Camarilla Pivot Points

Pivot points constructed using the Camarilla formulas are 8 levels indicating support and resistance for the current price movement. As a rule, these pivot levels are used by Forex traders to set stop losses and take profits. The formulas for these Pivot Points look like this:- R4 = (High – Low) x 1.1 / 2 + Close

- R3 = (High – Low) x 1.1 / 4 + Close

- R2 = (High – Low) x 1.1 / 6 + Close

- R1 = (High – Low) x 1.1 / 12 + Close

- S1 = Close – (High – low) x 1.1/12

- S2 = Close – (High – low) x 1.1/6

- S3 = Close – (High – low) x 1.1/4

- S4 = Close – (High – low) x 1.1/2

- Close – closing price (for example, candles D1)

- High – maximum value

- Low – minimum value

- R1, R2, R3, R4 – resistance levels

- S1, S2, S3, S4 – support levels

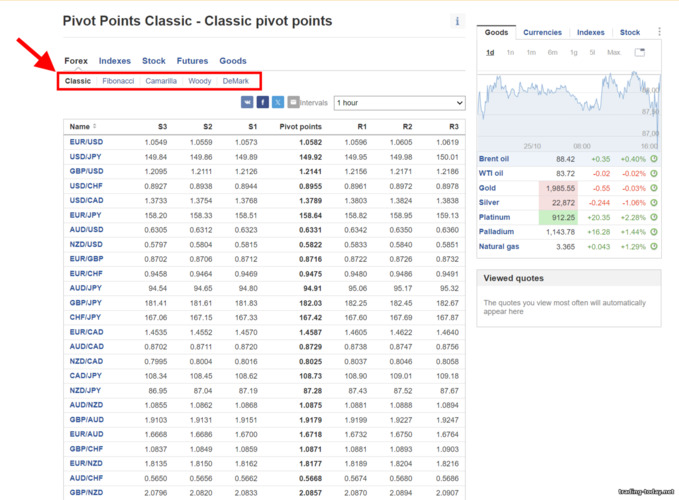

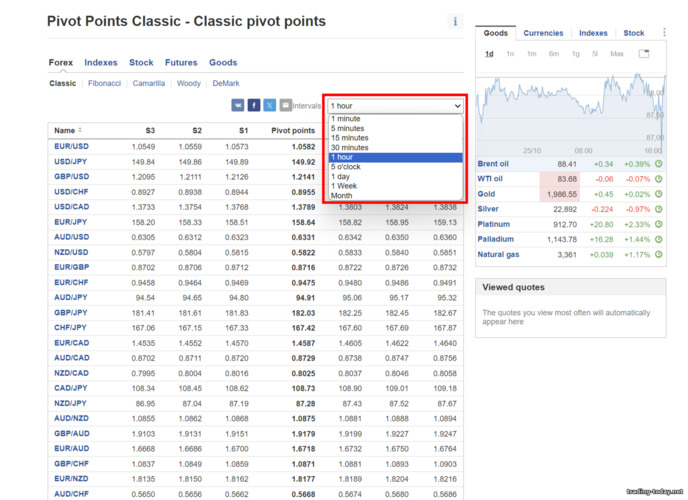

Online calculation of pivot points – table (calculator) of current pivot levels

To avoid calculating all these formulas manually, there are indicators that will do it for you. But it is also worth noting a very simple and ready-made way to find out the current pivot points - look at the ready-made table, which shows everything you need.The table is located on the investing website, in the technical analysis section – “Turning Points”: Here you can select the type of pivot points:

- Classic

- Fibonacci

- Camarilla

- Woody

- DeMark

- Pivot points (PP)

- S1, S2, S3 ... Sn – support levels

- R1, R2, R3 … Rn – resistance levels

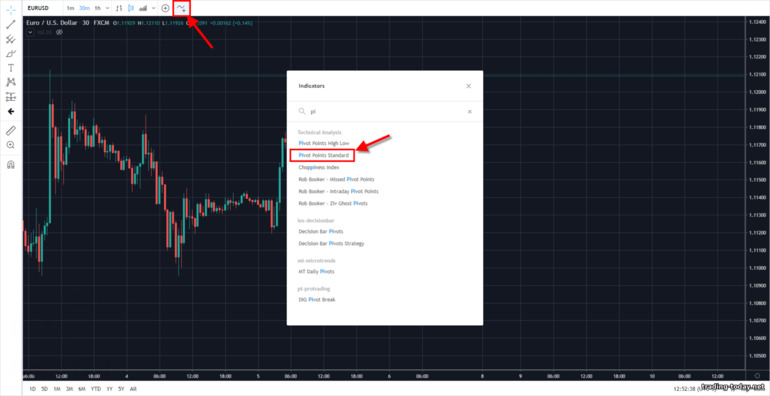

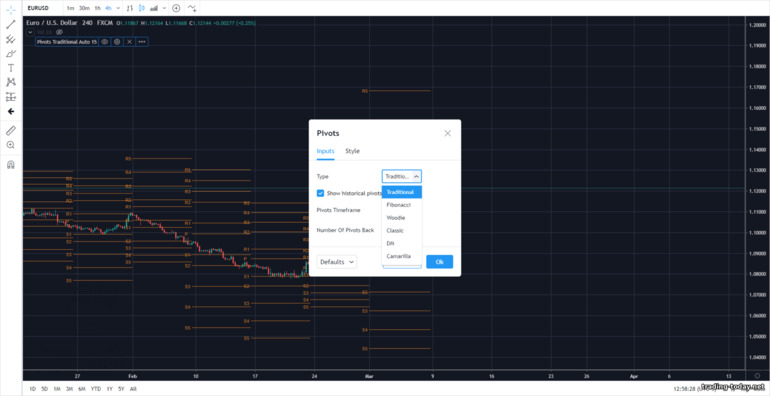

Pivot points on the Trading View live chart

Pivot points can also be built on the Trading View live chart - to do this, you need to open the chart and select “Pivot Points Standard” from among the indicators: Pivot points will be added to the chart: In the indicator settings you can specify:- Construction type (type)

- Show historical pivots

- Time frame of pivot points (Pivots timeframe)

- Traditional

- Fibonacci

- Woody

- Classic

- DeMark (DM)

- Camarilla

- To build pivot levels for M1, M5, M15, data for the previous day is used

- Data for the last week is used to construct pivot points for M30 and H1

- Data for the last month is used to build Pivot Points for the daily chart

How to work with pivot points correctly: using pivot levels in real trading

How to correctly work with pivot points plotted on the price chart of an asset? There are two ways to use pivot levels:- Like support and resistance levels

- As a tool for identifying support and resistance zones

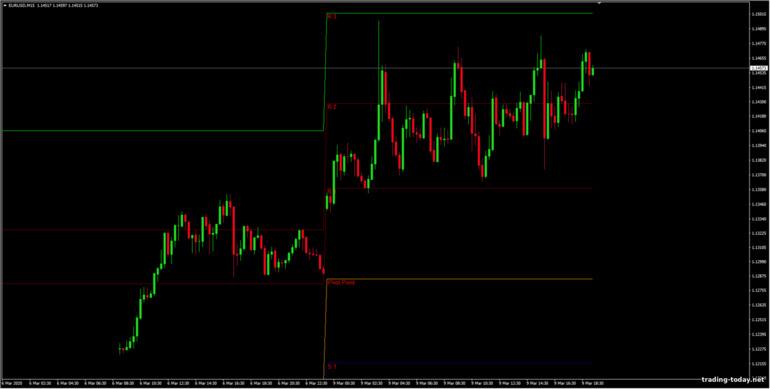

The resistance level becomes a support level and vice versa - the support level becomes a resistance level after a breakout. Everything is the same as with the classic horizontal levels of supply and demand.

As for the application of the zone of interest around the pivot points, everything here is the same as with the usual horizontal zones of supply and demand: The procedure is as follows:

- Select the desired pivot level

- By the shadows of candles and frequent reversals, we determine the boundaries of the support and resistance zone

- If the price has approached the zone from above, then it is worth opening trades for an increase (for a rollback from the zone)

- If the price has approached from below, then it is worth opening trades to reverse the price – i.e. down

At the same time, false breakouts are determined in the same way as when working with regular support and resistance zones: As before, the price must break through the support and resistance zone and remain outside it for a certain time. Confirmation of a breakdown is the return of the price to the broken level, followed by continuation of the trend movement.

Also, on higher time frames, you should pay special attention to candlestick formations and patterns. Let's look at the H1 USD/CAD chart:

- Two candles formed a reversal pattern - a long shadow with a relatively small body. This formation predicts further movement towards a reversal (in this case, downwards), which is exactly what happened

- The “Pinocchio” or “Pinocchio” pattern, which also formed at the Pivot level - a reversal formation

- The “Ski” pattern is also a reversal formation. As in case “1”, this model predicts further price movement against the former trend – i.e. down

- Another candle with a long “nose” formed at the pivot level. It is likely that you should wait for an upward movement, but you can also wait for the formation of the next candle and if it is bullish, then the signal will be confirmed - you should press for a price increase

Pivot point indicators for the MT4 terminal (Meta Trader 4)

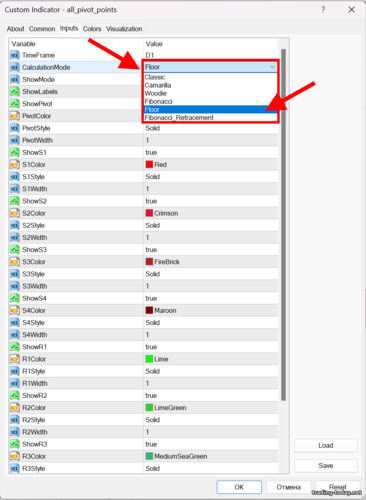

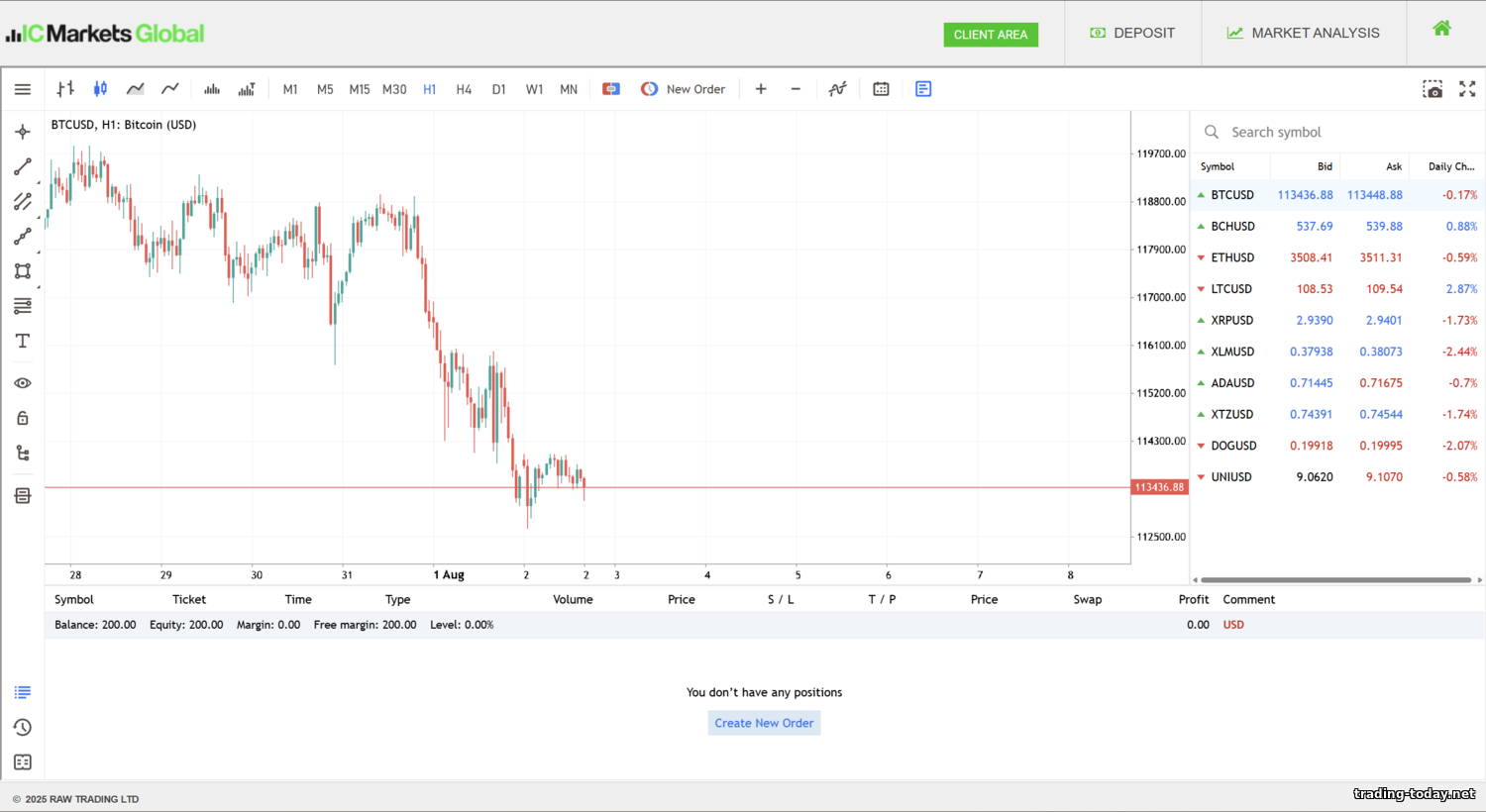

Many of you use the MT4 terminal (Meta Trader 4) as the main chart for price analysis. I have prepared for you several pivot point indicators for this terminal, which will allow you to use Pivot Points in conjunction with your strategies.ALL Pivot Points indicator for MT4

The ALL Pivot Points indicator is an indicator of pivot points that can be set using several formulas:- Classic pivot points

- DeMark

- Woody

- Fibonacci

- Camarilla

Pivots All Levels indicator for Meta Trader 4

The Pivots All Levels indicator is a quite suitable indicator that adds daily pivot levels calculated using the classical form to the chart. This indicator will be enough for most traders, because... there is no need to switch to DeMark or Camarilla. You can download the indicator for MT4 Pivots All Levels hereThe best and most reliable pivot points

Pivot points are a common tool for finding supply and demand zones (support and resistance levels). It works exactly the same as the horizontal support and resistance levels, so all trading rules will be identical.Don’t forget one important thing - although pivot points are built automatically, which eliminates the problem of building support and resistance levels, there are a limited number of these points (levels) and they are built according to the same formulas. Even if we assume that a support and resistance zone can be identified around each pivot level, this will still not be enough for full-fledged trading in most cases.

It is very important to understand that pivot points do not replace regular support and resistance levels , but only complement them. Of course, pivot points are strong levels, but they also tend to break through, so you should definitely analyze them and check the price reaction.

The best and most reliable option for using pivot points is to overlay the indicator on top of hand-drawn support and resistance levels. Only in such a combination will it be possible to achieve the maximum effect from trading.

Reviews and comments