Binary Options Trader Psychology: Mastering Emotions (2026)

Updated: 25.01.2026

Trading psychology of a Binary options trader: psychology in trading Binary Options (2026)

Well, friends, the time has come to discuss a very important topic in Binary Options trading (and in any other financial trading). Today we will talk about the trading psychology of a trader. Without this knowledge, you will never become a profitable and successful trader.

At that time, there were practically no Binary Options brokers that allowed you to trade for very small amounts, so I didn’t have much choice at all. I found a broker with a cent account a couple of days later - this was not the most difficult problem. I deposited $20 into my trading account and a week later withdrew $100. The beginning of my success, you might think, but no - it’s pure luck, because a week later I already returned the $100 to the broker, and even added my own.

After spending a year and a half (I traded several times a month) with this broker, I came to the conclusion that trading simply requires a large deposit amount and a good trading strategy - all experienced traders on YouTube do this, why not listen to them. At the same time, I had a desire to trade not with my cent broker Binary Options, but with the broker OptionBit, which just at that time released (or released in beta test mode, I don’t remember exactly) its “robot” AlgoBit. I didn’t want to miss this opportunity.

Without thinking twice, I found a trading strategy, registered with a broker, and then replenished my trading balance by $1000. Trading began: I won back every losing trade using Martingale in my trading. For literally every transaction I fought with myself - I was simply scared. Like any other “experienced trader,” I traded until I was completely tired—8-12 hours a day (that’s how professionals trade, right?). In the first two days I increased my trading balance to $2100, on the third day I lost my balance to $980, which I lost a couple of days later. My joy from making very fast money was instantly changed by fear of losses, and then by depression from failure, because it was my last money at that moment. After this stunning failure, I literally had to live on $10 for two weeks, waiting for a scholarship and a salary for my part-time job. And I also had to go to school every day, go to work part-time... In general, during these two weeks I lost several kilograms - it was sort of a forced diet. But this was not the worst thing that awaited me. After that, I began to steadily lose my money in trading - the deposits were scattered in a few hours, not even surviving until the next day. And so on for more than two years.

Then I thought for a very long time what exactly my mistake was: maybe the trading strategy had let me down and I should have chosen another one, maybe it was a lack of knowledge, maybe I didn’t open trades correctly, etc.. In fact, I was wrong in everything , but realized it too late.

If we analyze this situation from my life, then the error lies in every component of my trading, and these errors are associated with trading psychology:

Over the course of my entire career as a trader, I have tried hundreds of trading strategies, but what good were they if I didn’t know how to manage my emotions - greed was always in the first place, which led to the loss of money. It's like trying to put a steel roof on a foundation made of cardboard - a futile exercise. It’s the same with my trading – what’s the point in a trading strategy if all my knowledge about trading psychology is zero?! Trading psychology of a trader is like a universal reference book, comparable to studying at school. Once you completed your basic education course in school, you were ready to learn whatever you wanted—to become whatever you wanted. So, having studied trading psychology, you can also choose any direction of development for yourself:

I think you have all experienced fear during your trading. Most often, a trader is afraid for a particular transaction of his - he thinks how it will close: in plus or minus. Moreover, if the price goes in the direction of the forecast, then there is less fear, but it is still there (what if the price reverses and the transaction closes at a loss?), in contrast to moments when the price is at a loss - here the fear is present throughout the entire transaction .

But there are other reasons for fear in trading, for example: fear of making a mistake, fear of opening a deal, fear of the unknown. In any case, for a trader this means only one thing - he is initially far from being in a profitable situation, which means he will make a lot of mistakes that will lead to loss of money. Fear pushes a trader to take rash actions, for example, it forces him to increase the transaction amount in order to quickly recover losses, forces him to win back, and forces him to bet everything on one trade. But why does fear appear at all?

Fear in trading is a response from our psychology, indicating that we have made a mistake that is too serious. Typically, this error lies in the amount the trader invested in the trade. But fear can also be developed from the trader’s past actions, for example, past unsuccessful attempts to trade, which led to the loss of money - the trader is afraid that the same thing will happen now and he will lose his money again.

Fear also arises when a trader trades with money that he cannot afford to lose - he is obliged to earn money, and this obligation makes him fear for every trade he makes. A person may develop a fear of trading when he has had many unsuccessful endeavors in life - “I’m afraid to trade because I’m afraid that nothing will work out again!”

To fight your fear, you need to understand the reason for its occurrence. First of all, try trading on a demo account, if there is fear there, then you have certain psychological problems - fear of starting something new or fear of making a mistake and not achieving anything. If there is no fear on a demo account and you trade very easily and calmly, then you have a certain fear of losing money - a demo account and a real account differ only in the currency in which you trade.

To fight your fears, you must initially eliminate all those factors that will always cause fear of loss:

All trading is based on probability: there are no 100% trading strategies, so there is a chance that the deal will close in the black and then there is a chance that the deal will close in the minus - the trader’s task is to incline the probability of a correct forecast in his favor. This is why we use trading strategies.

Let's say your trading strategy shows 75% profitable trades in the long term, this means that for every 100 trades there will be about 25 losing signals, and about 75 trades should close in the black. As traders, we never know in advance the outcome of each specific trade, so we open a trade ON EVERY signal of the strategy. As a result, we will end up with 75 profitable trades, and 25 trades will close at a loss.

To understand the principle of this thinking, take a dice, on the sides of which there will be numbers from 1 to 6. Your trading strategy is this dice. You bet that a number greater than “1” will appear on the die - the probability of such an outcome is approximately 83%, and the probability that exactly “1” will appear is 16-17%. When throwing a dice, you never know what number will come up, but the probability is on your side - in 83% of cases the number from 2 to 6 will appear. It is on this positive probability for the trader of a correct forecast that all trading on Binary Options is based.

You should never regard each transaction as a whole - the result of one transaction cannot be predicted, but you have a trading strategy in your hands, following the signals of which you will earn more than you lose. You never know in what order the winning and losing trades will be, so your job is to simply open trades as soon as your trading strategy gives a signal.

With this approach to trading, the fear for each of your transactions disappears, because... the whole picture is considered. But here there may be a fear of losing large sums, but this is already a problem in your risk -management – you have allowed yourself to lose too much, you urgently need to reduce the amount of investment in the transaction and reconsider the risks.

Another trading fear that traders often experience is the fear of losing money too quickly. It occurs when a trader loses huge chunks of his deposit - 10-50% for each trade. This fear very often arises among novice traders who think, “I’d rather put only $10 on my trading balance than risk $100!” This fear is caused by a violation of risk management rules - the trading deposit should be enough for at least 20-100 transactions. If this is not the case, then try to correct this error.

A similar fear is caused by Martingale trading - when the next investment amount in a transaction can reach 30-60 % of trade balance. Unfortunately, the Martingale method violates a huge number of rules for profitable trading, so you just need to abandon this trading technique!

Sometimes, a trader's greed forces him to earn less than he wants. It is not uncommon for traders to want to make a profit here and now, rather than look at an open position. It is for such traders that Binary Options brokers have prudently added the function of early closing of a transaction. As a rule, if the option is in the money, then the broker is willing to pay a smaller amount than originally planned; if the option is in the red, then early closing will return only part of the option amount.

By closing a profitable trade ahead of schedule, a greedy trader receives less than planned. A similar situation often happens with closing a losing trade: the trader closes it, having received a small return, and the price turns towards the previous forecast and closes the no longer existing trade in the black. The trader drives himself into such a trap.

But this is the lesser of the evils that can happen to a greedy trader. Greed forces a trader to trade until the last moment: either until the trader finally collapses from fatigue, or until the money in the trading account runs out. A greedy trader believes that there is no point in wasting free time - this time can be spent on making money. It gets to the point where even experienced traders make money in the morning, but in the evening they lose all their profits and begin to lose their money.

To combat greed, there is a trading plan, which provides for such a development of events and has rules in advance for stopping trading after a certain number of transactions are completed. But there are also psychological rules that stop a trader at the very last moment, for example:

A trader's hope and expectations are very close to fear of loss. A trader who is unhappy with the current state of an open trade is ready to pray that the situation will change and the trade will close in the black. But, as we know, if a trader starts praying, then he has already lost. Hopes and expectations are a very murky component. You can't rely on hope! But a trader can rely on statistics or his trading plan. There is no trading plan place of hope - everything is spelled out there down to the smallest details and any scenario for the development of events is provided for.

The absence of a trading plan is precisely what leads to hope - the trader has no clear support, he does not know what to do now and what to do next. In such a situation, you can only hope that it will pass this time - and this is pure luck and it will end someday.

Likewise, novice traders force themselves to believe that they can close every trade in the black - show 100% trading results. Of course, this opinion is very erroneous, but it develops into another - “since you can’t close 100% of trades in profit, then you can definitely close every day in profit!” And this already leads to fears of loss, Martingale trading, violations of risk management rules, and so on.

In general, here is another target client of any Binary Options broker who made a mistake without even starting to trade. And it all started because the trader relied more on hope and expectations, rather than on a trading plan and risk management.

Self-confidence makes a trader believe in his professionalism - as a novice trader, he considers himself almost the most outstanding trader. In fact, this is not the case at all. Great self-confidence is followed by a stunning failure and a serious loss of money, because the amounts in the trading account of self-confident traders are not small at all (in order to earn more quickly and more).

But the market doesn’t care at all what kind of trader he is: rich or poor, self-confident or afraid of trading, whether he uses a trading strategy or trades at random. The market is not to blame for anything and also does not deserve thanks for good results - it just exists and that’s all. If you made a mistake - this is your merit, you became an experienced trader - you also achieved this yourself!

In Binary Options trading, overconfidence is another enemy of the trader. Self-confident people do not know how to adapt to a changing market, do not know how to admit their mistakes, and are not prepared for failure. There is no flexibility that a successful trader should have.

All a trader needs to trade profitably is:

Your trading algorithm is written in the same trading plan! Just follow this plan and take trades where you should, not where you want (or don't want to).

The difference is huge, so how do you understand when to trust your intuition and when to act strictly according to plan and not even think about something extraneous? Experience is knowledge accumulated over time. It is believed that a trader learns to accurately identify price movements on a chart after spending 10,000 hours observing price movements.

Take these 10,000 hours as a basis - once you have spent a lot of time trading, then allow yourself to rely on your intuition. By the way, then you will no longer need my advice.

Trader - “I’m right!” is not able to even admit his mistakes, which means that he is not able to find a way to correct them. That is why these traders behave like “sheep” - they bang their heads against the same problem, trying to prove to themselves (the market, someone else) that they are right. But in trading, the market does not know about the existence of such individuals, and it is completely useless to prove something to it.

Therefore, the trader - “I’m right!” consistently loses his money, trying to prove to himself and others that his approach to trading is exclusively correct, and since everyone around him trades differently, they are fools who are not able to understand the whole essence of trading.

This is a psychological mistake into which the trader drives himself. Lack of flexibility does not allow you to adapt to a changing market, self-confidence does not allow you to look at the price from a different angle and make opposite forecasts, repeating the same mistake is a common state for such traders.

Dealing with this problem is very difficult. First of all, you need to force yourself to look at everything from a different angle - to admit to yourself that you were wrong. Many simply cannot do this, hence all the ensuing problems in life and in trading. But you need to not only admit to yourself that you are wrong, but also find a way to change your thinking.

In the place where there was self-confidence, there should be a conscious approach in the form of a trading plan, and in the place where there was “the rightness of the trader,” there should be a trading discipline that will force the trader to perform the right actions, even where he wants to do it his own way . At first, you will have to frankly force yourself to do what you are obliged to do, and this is not at all easy.

Many traders, even after realizing they were wrong in trading, cannot cope with such a problem as the need to completely change their thinking and approach to trading. This process is long, and the result depends only on the trader himself - if somewhere you doubt the necessity of all this, then you can return to where it all began - to the state of “I’m right!”, which has never worked in trading.

As stated earlier, the main goal of a trader is to make money in trading, and not to be right. It is, of course, good to be right, but only if it does not harm trading results. For example, you can be right by drawing up a good trading plan and following it - no one will ever blame you for doing something wrong.

Many novice traders forget about this rule; they trade until the last minute - until they lose their entire deposit (they don’t cut their losses). And where they should have ended the day with a good profit, they continue to trade, which leads to another loss of money. For a novice trader, losses are everywhere.

Choose from two options:

Psychologically, it is better for you to get a guaranteed profit than to try to get more, but with a small probability of not getting anything. Also, there is a very high probability that you use Martingale in your trading - with it you can get a 100% chance of making money, of course, if a profitable transaction occurs before the trading account runs out of money.

The situation with the choice between losses is also obvious - by choosing the second answer in the first question, you want to get at least a tiny chance of avoiding losses, instead of stopping them right away by stopping trading. Instead, you will violate the rules of risk management and violate the amount of the established daily risks, which will cause you to lose more than you can afford.

The correct answers in this test are the first answer in the first question and the second answer in the second question. Only with this approach will you learn to stop losses and allow profits to grow.

The problem is that it only sounds good. If you use averaging, relying on emotions and your own greed, then the trader will only face huge losses and disappointment in trading.

Averaging can only be used when there are strict risk management rules in this regard. The trader must also understand the technical component of averaging - in what situations it can be done, and in what situations it will be a waste of money and nerves.

Averaging is an opportunity to make smaller losses or larger profits, but it cannot be used in every trade. At a minimum, new traders should not mindlessly use this trading method in their trading.

Where a player relies on luck, an experienced trader has a strict action plan that he will not violate. The player, on the contrary, will open trades where he wants, predict the direction of the price at random, and win back after losing trades.

The psychology of a Binary Options player is such that it is quite normal for him to:

You, as a trader, need to decide on your trading method from the very beginning and spell out all the possible risks. Without limiting risks, your trade will go to the entire trade balance: here you will either make money by chance, or lose everything, which is more likely. You came into trading not to play around, but to earn money, so treat trading accordingly!

The fact is that the market has its own psychology - the price is controlled by traders who work in banks, large financial organizations or investment companies. They decide where the price will go: up, down, or mark time. But how do they decide this and why can other traders predict these actions?!

It’s not for nothing that they say that price has memory. Market psychology is such that it is based on the history of price movement - the psychological levels of these same traders who control price movement. How it works?

Through trial and error, a certain protective algorithm of actions is developed, which, on a psychological level, forces the “smart money” to act in exactly the same way as before: the price has reached the last year’s maximum - it will not go further, you need to sell the asset at the best price. We found out - this is how the resistance level appears! The support level works in a similar way: the price will not fall lower – now is the best price to buy an asset. Smart money buys an asset “at the best price” because they are afraid that they will miss a profitable moment of purchase, meanwhile, the price of the asset rises.

The psychology of the market or smart money is such as to invest your money as profitably as possible - “Buy low, sell high.” But, nevertheless, this is a model of human psychology - we are afraid of making mistakes, so we try to do everything as correctly as possible. Have you ever wondered why the support and resistance level is not a thin level (even though that’s what it’s called), but a zone of different widths? It’s just that smart money starts buying or selling an asset a little earlier than the price reaches a certain price value, and we set the levels approximately, and not with 100% accuracy. Now imagine that other traders also set support and resistance levels, if we combine them, we will get zones of interest for buyers and sellers.

All price movements in the market are psychologically justified - this is an indicator of how interesting the asset was in a given period of time. What about indicators and trading strategies - why do they work in the market and allow us to find the best points to enter a trade?

Everything here is also very simple - the psychology of the market is such that in the same situations, with a high probability, the same action will be taken by the smart money or the crowd. No one wants to go against the system and lose their money - it will be much more profitable to act in the same way as others. Indicators and trading strategies are designed to identify deviations from the usual norms or, conversely, to identify the highest probability that the further price movement will be exactly as intended.

For example, if we take the RSI indicator, it is capable of showing overbought and oversold price zones (possible reversal zones). How does he determine this? It analyzes past price movements and creates a "pattern" of the asset's stable state. As soon as the price goes beyond this pattern, the indicator gives us a signal that an unusual situation is happening in the market - “A price reversal is possible - would you like to take advantage of the opportunity to make money on this?”

The same is true for trading using trend strategies - they determine the state of the market, indicating the opportunity to open a trade in the direction of the current trend. Of course, only the probability of the forecast being fulfilled is indicated, and not 100% accuracy. The probability directly depends on the trading strategy or indicator. For example, your trading strategy showed 86% of profitable trades out of 100, it turns out that each signal of this trading strategy will close in positive territory with a probability of 86%, and 14% remain that the forecast will be incorrect.

Why are there no 100% trading strategies and indicators? The market is a very complex environment where price movements depend on millions of factors. Someone will buy currency, and someone will sell it very sharply, thereby increasing or decreasing the price of the asset. This is all so unpredictable that it is impossible to determine the price movement 100%, since no one ever knows about all the transactions carried out in trading right now - we can only know about them in the past tense.

All we have is the history of price movement. We can and should rely on it in order to at least somehow predict the future. The main thing is to find a way to tilt the probability of a correct forecast on your side, and then it’s a matter of technology!

Contents

- Trading psychology and why a trader needs it

- Basics of trading psychology as a Binary Options trader

- "I'm right!" - a serious psychological mistake in trading Binary options

- The psychological stress of a trader or the easiest path is not always the right one

- Averaging a losing trade in Binary Options trading

- Player psychology in Binary Options trading

- market psychology

- Very useful books about trading psychology

Trading psychology and why a trader needs it

I don't know about you, but I learned about Binary Options trading back in 2011 when I saw a video on YouTube. In this video, some trader showed a way to trade on Binary Options and in real time earned several thousand dollars - at that time, this was unthinkable money for me. Of course, interest in trading immediately appeared, and the spark was added by the fact that I was already looking for a way to start working only for myself. As a result, the decision in favor of trading Binary Options was made very quickly.At that time, there were practically no Binary Options brokers that allowed you to trade for very small amounts, so I didn’t have much choice at all. I found a broker with a cent account a couple of days later - this was not the most difficult problem. I deposited $20 into my trading account and a week later withdrew $100. The beginning of my success, you might think, but no - it’s pure luck, because a week later I already returned the $100 to the broker, and even added my own.

After spending a year and a half (I traded several times a month) with this broker, I came to the conclusion that trading simply requires a large deposit amount and a good trading strategy - all experienced traders on YouTube do this, why not listen to them. At the same time, I had a desire to trade not with my cent broker Binary Options, but with the broker OptionBit, which just at that time released (or released in beta test mode, I don’t remember exactly) its “robot” AlgoBit. I didn’t want to miss this opportunity.

Without thinking twice, I found a trading strategy, registered with a broker, and then replenished my trading balance by $1000. Trading began: I won back every losing trade using Martingale in my trading. For literally every transaction I fought with myself - I was simply scared. Like any other “experienced trader,” I traded until I was completely tired—8-12 hours a day (that’s how professionals trade, right?). In the first two days I increased my trading balance to $2100, on the third day I lost my balance to $980, which I lost a couple of days later. My joy from making very fast money was instantly changed by fear of losses, and then by depression from failure, because it was my last money at that moment. After this stunning failure, I literally had to live on $10 for two weeks, waiting for a scholarship and a salary for my part-time job. And I also had to go to school every day, go to work part-time... In general, during these two weeks I lost several kilograms - it was sort of a forced diet. But this was not the worst thing that awaited me. After that, I began to steadily lose my money in trading - the deposits were scattered in a few hours, not even surviving until the next day. And so on for more than two years.

Then I thought for a very long time what exactly my mistake was: maybe the trading strategy had let me down and I should have chosen another one, maybe it was a lack of knowledge, maybe I didn’t open trades correctly, etc.. In fact, I was wrong in everything , but realized it too late.

If we analyze this situation from my life, then the error lies in every component of my trading, and these errors are associated with trading psychology:

- I was not ready to trade profitably - I overestimated my capabilities

- I celebrated my trading success too much - it made me even more confident that I was already a professional trader

- I fought back when there were losses in trading - emotions controlled me, not me emotions

- I was afraid for every deal I made - fear pushed me to rash actions

- I traded using Martingale - the desire to quickly return everything was much stronger than common sense

- I exceeded my psychological deposit limit – hence the fear for every trade

- I did not know how to control my emotions - greed and thirst for quick money were the only motives for trading

- I was disappointed in myself after this failure - I received serious psychological trauma, which for a long time prevented me from trading profitably

Over the course of my entire career as a trader, I have tried hundreds of trading strategies, but what good were they if I didn’t know how to manage my emotions - greed was always in the first place, which led to the loss of money. It's like trying to put a steel roof on a foundation made of cardboard - a futile exercise. It’s the same with my trading – what’s the point in a trading strategy if all my knowledge about trading psychology is zero?! Trading psychology of a trader is like a universal reference book, comparable to studying at school. Once you completed your basic education course in school, you were ready to learn whatever you wanted—to become whatever you wanted. So, having studied trading psychology, you can also choose any direction of development for yourself:

- Make the most profitable use of any trading strategy

- Explore any trading methods

- Go to any other foreign exchange market

- EARN, not lose your money

Basics of trading psychology as a Binary Options trader

Everything related to profitable trading is based on trading psychology. If you want to become a professional trader and make money on Binary Options, then you cannot do without trading psychology - you must understand it, just as you must be able to control your emotions. Fortunately, all of this can be learned.Fear in Binary Options Trading

Fear in Binary Options trading is a fairly common occurrence among many traders. Fear can arise both during trading and before it begins, but, in any case, fear will not allow you to make money - you need to find the cause of the fear and get rid of it or limit its influence on you.I think you have all experienced fear during your trading. Most often, a trader is afraid for a particular transaction of his - he thinks how it will close: in plus or minus. Moreover, if the price goes in the direction of the forecast, then there is less fear, but it is still there (what if the price reverses and the transaction closes at a loss?), in contrast to moments when the price is at a loss - here the fear is present throughout the entire transaction .

But there are other reasons for fear in trading, for example: fear of making a mistake, fear of opening a deal, fear of the unknown. In any case, for a trader this means only one thing - he is initially far from being in a profitable situation, which means he will make a lot of mistakes that will lead to loss of money. Fear pushes a trader to take rash actions, for example, it forces him to increase the transaction amount in order to quickly recover losses, forces him to win back, and forces him to bet everything on one trade. But why does fear appear at all?

Fear in trading is a response from our psychology, indicating that we have made a mistake that is too serious. Typically, this error lies in the amount the trader invested in the trade. But fear can also be developed from the trader’s past actions, for example, past unsuccessful attempts to trade, which led to the loss of money - the trader is afraid that the same thing will happen now and he will lose his money again.

Fear also arises when a trader trades with money that he cannot afford to lose - he is obliged to earn money, and this obligation makes him fear for every trade he makes. A person may develop a fear of trading when he has had many unsuccessful endeavors in life - “I’m afraid to trade because I’m afraid that nothing will work out again!”

To fight your fear, you need to understand the reason for its occurrence. First of all, try trading on a demo account, if there is fear there, then you have certain psychological problems - fear of starting something new or fear of making a mistake and not achieving anything. If there is no fear on a demo account and you trade very easily and calmly, then you have a certain fear of losing money - a demo account and a real account differ only in the currency in which you trade.

To fight your fears, you must initially eliminate all those factors that will always cause fear of loss:

- Never trade with your last money - when you have to make money, you will never make money

- Do not trade if you have bank loans, mortgages or debts - solve these problems first. Trading Binary Options is not a way to solve financial problems

- Always trade only with money that you would not mind losing - the loss of which will not change your financial situation

All trading is based on probability: there are no 100% trading strategies, so there is a chance that the deal will close in the black and then there is a chance that the deal will close in the minus - the trader’s task is to incline the probability of a correct forecast in his favor. This is why we use trading strategies.

Let's say your trading strategy shows 75% profitable trades in the long term, this means that for every 100 trades there will be about 25 losing signals, and about 75 trades should close in the black. As traders, we never know in advance the outcome of each specific trade, so we open a trade ON EVERY signal of the strategy. As a result, we will end up with 75 profitable trades, and 25 trades will close at a loss.

To understand the principle of this thinking, take a dice, on the sides of which there will be numbers from 1 to 6. Your trading strategy is this dice. You bet that a number greater than “1” will appear on the die - the probability of such an outcome is approximately 83%, and the probability that exactly “1” will appear is 16-17%. When throwing a dice, you never know what number will come up, but the probability is on your side - in 83% of cases the number from 2 to 6 will appear. It is on this positive probability for the trader of a correct forecast that all trading on Binary Options is based.

You should never regard each transaction as a whole - the result of one transaction cannot be predicted, but you have a trading strategy in your hands, following the signals of which you will earn more than you lose. You never know in what order the winning and losing trades will be, so your job is to simply open trades as soon as your trading strategy gives a signal.

With this approach to trading, the fear for each of your transactions disappears, because... the whole picture is considered. But here there may be a fear of losing large sums, but this is already a problem in your risk -management – you have allowed yourself to lose too much, you urgently need to reduce the amount of investment in the transaction and reconsider the risks.

Another trading fear that traders often experience is the fear of losing money too quickly. It occurs when a trader loses huge chunks of his deposit - 10-50% for each trade. This fear very often arises among novice traders who think, “I’d rather put only $10 on my trading balance than risk $100!” This fear is caused by a violation of risk management rules - the trading deposit should be enough for at least 20-100 transactions. If this is not the case, then try to correct this error.

A similar fear is caused by Martingale trading - when the next investment amount in a transaction can reach 30-60 % of trade balance. Unfortunately, the Martingale method violates a huge number of rules for profitable trading, so you just need to abandon this trading technique!

Greed of a trader in trading Binary options

Trading Binary Options is not a sprint, it's a marathon! Remember this phrase once and for all! In Binary Options trading, only those who know how to wait and profitably postpone the moments of their unprofitable trading make money. All other traders who are in a hurry to earn a million by the evening consistently fail. Greed in Binary Options trading forces a trader to overtrade (open much more trades than planned), increase risks in trades, and win back after a losing trade.Sometimes, a trader's greed forces him to earn less than he wants. It is not uncommon for traders to want to make a profit here and now, rather than look at an open position. It is for such traders that Binary Options brokers have prudently added the function of early closing of a transaction. As a rule, if the option is in the money, then the broker is willing to pay a smaller amount than originally planned; if the option is in the red, then early closing will return only part of the option amount.

By closing a profitable trade ahead of schedule, a greedy trader receives less than planned. A similar situation often happens with closing a losing trade: the trader closes it, having received a small return, and the price turns towards the previous forecast and closes the no longer existing trade in the black. The trader drives himself into such a trap.

But this is the lesser of the evils that can happen to a greedy trader. Greed forces a trader to trade until the last moment: either until the trader finally collapses from fatigue, or until the money in the trading account runs out. A greedy trader believes that there is no point in wasting free time - this time can be spent on making money. It gets to the point where even experienced traders make money in the morning, but in the evening they lose all their profits and begin to lose their money.

To combat greed, there is a trading plan, which provides for such a development of events and has rules in advance for stopping trading after a certain number of transactions are completed. But there are also psychological rules that stop a trader at the very last moment, for example:

- You cannot lose more than 50% of your existing earnings - any profitable day is much better than a day closed with losses

- Three losing trades and you're dead - after three losing trades in a row, you should immediately stop trading

The hopes and expectations of a trader in Binary Options trading

Hope is the desire to get the desired result in any situation. And what is the hope of a Binary Options trader - he expects that his trading will bring stable profits. But in reality, expectations very often diverge from reality.A trader's hope and expectations are very close to fear of loss. A trader who is unhappy with the current state of an open trade is ready to pray that the situation will change and the trade will close in the black. But, as we know, if a trader starts praying, then he has already lost. Hopes and expectations are a very murky component. You can't rely on hope! But a trader can rely on statistics or his trading plan. There is no trading plan place of hope - everything is spelled out there down to the smallest details and any scenario for the development of events is provided for.

The absence of a trading plan is precisely what leads to hope - the trader has no clear support, he does not know what to do now and what to do next. In such a situation, you can only hope that it will pass this time - and this is pure luck and it will end someday.

Likewise, novice traders force themselves to believe that they can close every trade in the black - show 100% trading results. Of course, this opinion is very erroneous, but it develops into another - “since you can’t close 100% of trades in profit, then you can definitely close every day in profit!” And this already leads to fears of loss, Martingale trading, violations of risk management rules, and so on.

In general, here is another target client of any Binary Options broker who made a mistake without even starting to trade. And it all started because the trader relied more on hope and expectations, rather than on a trading plan and risk management.

Confidence in Binary Options Trading

What is the overconfidence of a trader in Binary Options trading? A self-confident trader very often relies on his intuition when opening trades and often risks larger amounts than he can afford - “Why risk pennies if you can earn more money on a transaction whose outcome is already clear?!”Self-confidence makes a trader believe in his professionalism - as a novice trader, he considers himself almost the most outstanding trader. In fact, this is not the case at all. Great self-confidence is followed by a stunning failure and a serious loss of money, because the amounts in the trading account of self-confident traders are not small at all (in order to earn more quickly and more).

But the market doesn’t care at all what kind of trader he is: rich or poor, self-confident or afraid of trading, whether he uses a trading strategy or trades at random. The market is not to blame for anything and also does not deserve thanks for good results - it just exists and that’s all. If you made a mistake - this is your merit, you became an experienced trader - you also achieved this yourself!

In Binary Options trading, overconfidence is another enemy of the trader. Self-confident people do not know how to adapt to a changing market, do not know how to admit their mistakes, and are not prepared for failure. There is no flexibility that a successful trader should have.

All a trader needs to trade profitably is:

- Trading plan

- Trading Diary

- Good rules for risk management

- Sustainable trading discipline

- Lack of emotions during trading

Doubts when opening a trade

Don't spend too much time wondering whether this trade is worth opening or not. Practice has shown that the more a trader thinks about the current transaction, the more reasons he sees not to open it. Your task is much simpler - be a trading robot. The robot does not think whether to open a deal or not - it has an algorithm of actions, within the framework of which it is obliged to open a deal if certain conditions for opening it are met (a trading signal from the trading strategy appears). There is a signal - there is an open deal!Your trading algorithm is written in the same trading plan! Just follow this plan and take trades where you should, not where you want (or don't want to).

Intuition in trading Binary options

In fact, there is no intuition in trading - this is the usual experience of a trader. But, if for a novice trader, “intuition” is a reason to break the rules of your trading strategy or the rules of a trading plan, then for an experienced trader, “intuition” is a reason to double-check yourself.The difference is huge, so how do you understand when to trust your intuition and when to act strictly according to plan and not even think about something extraneous? Experience is knowledge accumulated over time. It is believed that a trader learns to accurately identify price movements on a chart after spending 10,000 hours observing price movements.

Take these 10,000 hours as a basis - once you have spent a lot of time trading, then allow yourself to rely on your intuition. By the way, then you will no longer need my advice.

“I’m right!” - a serious psychological mistake in trading Binary options

I am sure you have met people who are 200% sure that they are right and do not accept any other point of view except their own. Their rightness lies in their confidence, not in their vast experience or knowledge. These are typical “rams” that are also found among Binary Options traders. Such people consider themselves right in everything, even in the fact that the market is obliged to obey them and give money for this very confidence and “rightness”. Here one involuntarily recalls the words of D. Soros: “It doesn’t matter whether you are right or wrong. What’s much more important is how much you earn when you’re right and how much you lose when you’re wrong!”Trader - “I’m right!” is not able to even admit his mistakes, which means that he is not able to find a way to correct them. That is why these traders behave like “sheep” - they bang their heads against the same problem, trying to prove to themselves (the market, someone else) that they are right. But in trading, the market does not know about the existence of such individuals, and it is completely useless to prove something to it.

Therefore, the trader - “I’m right!” consistently loses his money, trying to prove to himself and others that his approach to trading is exclusively correct, and since everyone around him trades differently, they are fools who are not able to understand the whole essence of trading.

This is a psychological mistake into which the trader drives himself. Lack of flexibility does not allow you to adapt to a changing market, self-confidence does not allow you to look at the price from a different angle and make opposite forecasts, repeating the same mistake is a common state for such traders.

Dealing with this problem is very difficult. First of all, you need to force yourself to look at everything from a different angle - to admit to yourself that you were wrong. Many simply cannot do this, hence all the ensuing problems in life and in trading. But you need to not only admit to yourself that you are wrong, but also find a way to change your thinking.

In the place where there was self-confidence, there should be a conscious approach in the form of a trading plan, and in the place where there was “the rightness of the trader,” there should be a trading discipline that will force the trader to perform the right actions, even where he wants to do it his own way . At first, you will have to frankly force yourself to do what you are obliged to do, and this is not at all easy.

Many traders, even after realizing they were wrong in trading, cannot cope with such a problem as the need to completely change their thinking and approach to trading. This process is long, and the result depends only on the trader himself - if somewhere you doubt the necessity of all this, then you can return to where it all began - to the state of “I’m right!”, which has never worked in trading.

As stated earlier, the main goal of a trader is to make money in trading, and not to be right. It is, of course, good to be right, but only if it does not harm trading results. For example, you can be right by drawing up a good trading plan and following it - no one will ever blame you for doing something wrong.

The psychological burden of a trader or the easiest path is not always the right one

Every trader experiences psychological stress - this is not surprising when it comes to the financial freedom of a trader, and trading is completely built on this. In addition, trading is based on the principle “Lose less and earn more” - earn more to cover all your losses.Many novice traders forget about this rule; they trade until the last minute - until they lose their entire deposit (they don’t cut their losses). And where they should have ended the day with a good profit, they continue to trade, which leads to another loss of money. For a novice trader, losses are everywhere.

Choose from two options:

- Loss of $8000 with 100% probability

- Losing $10,000 with a 95% probability and with a 5% probability of avoiding losses

- Earn $8000 with 100% probability

- Earn $10,000 with a 95% probability and with a 5% probability of getting nothing

Psychologically, it is better for you to get a guaranteed profit than to try to get more, but with a small probability of not getting anything. Also, there is a very high probability that you use Martingale in your trading - with it you can get a 100% chance of making money, of course, if a profitable transaction occurs before the trading account runs out of money.

The situation with the choice between losses is also obvious - by choosing the second answer in the first question, you want to get at least a tiny chance of avoiding losses, instead of stopping them right away by stopping trading. Instead, you will violate the rules of risk management and violate the amount of the established daily risks, which will cause you to lose more than you can afford.

The correct answers in this test are the first answer in the first question and the second answer in the second question. Only with this approach will you learn to stop losses and allow profits to grow.

Averaging a losing trade in Binary Options trading

Averaging is used by many Binary Options traders. Beginners find this method very tempting - it’s a good idea to open an additional trade when the price goes against an already open position, and when the price reverses, you can lose less money or even earn twice as much.The problem is that it only sounds good. If you use averaging, relying on emotions and your own greed, then the trader will only face huge losses and disappointment in trading.

Averaging can only be used when there are strict risk management rules in this regard. The trader must also understand the technical component of averaging - in what situations it can be done, and in what situations it will be a waste of money and nerves.

Averaging is an opportunity to make smaller losses or larger profits, but it cannot be used in every trade. At a minimum, new traders should not mindlessly use this trading method in their trading.

Player psychology in Binary options trading

Playing Binary Options is much easier than trading. Many traders have seen trading as an easy way to make money, so why not take the path of least resistance - trading the method Martingale in Binary Options?! The trader himself, who plays on Binary Options, relies only on his own luck, and not on cold calculation. A player can always lose all his money; a trader cannot lose his deposit. That's the whole difference between a trader and a player.Where a player relies on luck, an experienced trader has a strict action plan that he will not violate. The player, on the contrary, will open trades where he wants, predict the direction of the price at random, and win back after losing trades.

The psychology of a Binary Options player is such that it is quite normal for him to:

- Experience different emotions while trading

- Fear for your open transactions

- Hope for luck

- Get even

- Increase the amount invested in the transaction

- Use the Martingale method

- Do not follow the rules of the trading strategy, if there is one at all

You, as a trader, need to decide on your trading method from the very beginning and spell out all the possible risks. Without limiting risks, your trade will go to the entire trade balance: here you will either make money by chance, or lose everything, which is more likely. You came into trading not to play around, but to earn money, so treat trading accordingly!

Market psychology

Have you ever wondered why trading strategies work? Why does price behave in the same way very often, allowing us to make predictions? Why can we make money on Binary Options?The fact is that the market has its own psychology - the price is controlled by traders who work in banks, large financial organizations or investment companies. They decide where the price will go: up, down, or mark time. But how do they decide this and why can other traders predict these actions?!

It’s not for nothing that they say that price has memory. Market psychology is such that it is based on the history of price movement - the psychological levels of these same traders who control price movement. How it works?

Through trial and error, a certain protective algorithm of actions is developed, which, on a psychological level, forces the “smart money” to act in exactly the same way as before: the price has reached the last year’s maximum - it will not go further, you need to sell the asset at the best price. We found out - this is how the resistance level appears! The support level works in a similar way: the price will not fall lower – now is the best price to buy an asset. Smart money buys an asset “at the best price” because they are afraid that they will miss a profitable moment of purchase, meanwhile, the price of the asset rises.

The psychology of the market or smart money is such as to invest your money as profitably as possible - “Buy low, sell high.” But, nevertheless, this is a model of human psychology - we are afraid of making mistakes, so we try to do everything as correctly as possible. Have you ever wondered why the support and resistance level is not a thin level (even though that’s what it’s called), but a zone of different widths? It’s just that smart money starts buying or selling an asset a little earlier than the price reaches a certain price value, and we set the levels approximately, and not with 100% accuracy. Now imagine that other traders also set support and resistance levels, if we combine them, we will get zones of interest for buyers and sellers.

All price movements in the market are psychologically justified - this is an indicator of how interesting the asset was in a given period of time. What about indicators and trading strategies - why do they work in the market and allow us to find the best points to enter a trade?

Everything here is also very simple - the psychology of the market is such that in the same situations, with a high probability, the same action will be taken by the smart money or the crowd. No one wants to go against the system and lose their money - it will be much more profitable to act in the same way as others. Indicators and trading strategies are designed to identify deviations from the usual norms or, conversely, to identify the highest probability that the further price movement will be exactly as intended.

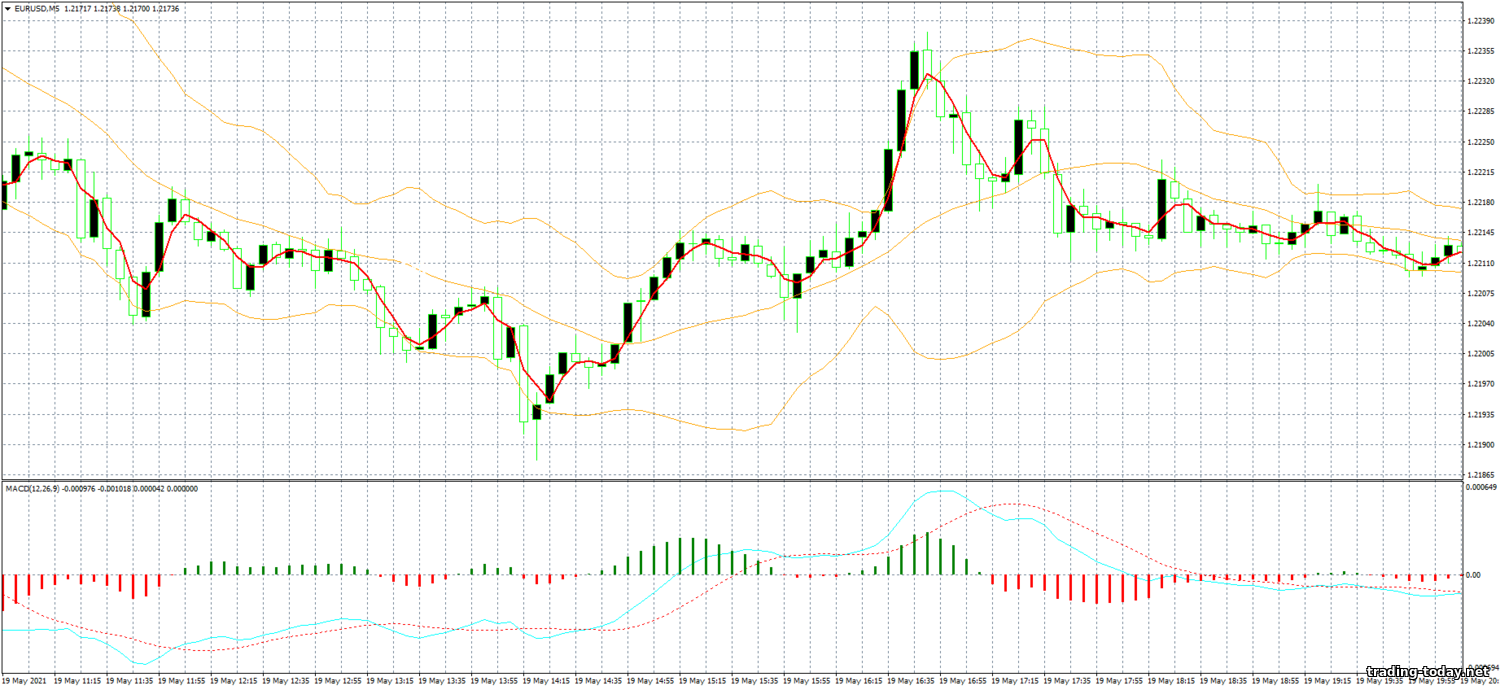

For example, if we take the RSI indicator, it is capable of showing overbought and oversold price zones (possible reversal zones). How does he determine this? It analyzes past price movements and creates a "pattern" of the asset's stable state. As soon as the price goes beyond this pattern, the indicator gives us a signal that an unusual situation is happening in the market - “A price reversal is possible - would you like to take advantage of the opportunity to make money on this?”

The same is true for trading using trend strategies - they determine the state of the market, indicating the opportunity to open a trade in the direction of the current trend. Of course, only the probability of the forecast being fulfilled is indicated, and not 100% accuracy. The probability directly depends on the trading strategy or indicator. For example, your trading strategy showed 86% of profitable trades out of 100, it turns out that each signal of this trading strategy will close in positive territory with a probability of 86%, and 14% remain that the forecast will be incorrect.

Why are there no 100% trading strategies and indicators? The market is a very complex environment where price movements depend on millions of factors. Someone will buy currency, and someone will sell it very sharply, thereby increasing or decreasing the price of the asset. This is all so unpredictable that it is impossible to determine the price movement 100%, since no one ever knows about all the transactions carried out in trading right now - we can only know about them in the past tense.

All we have is the history of price movement. We can and should rely on it in order to at least somehow predict the future. The main thing is to find a way to tilt the probability of a correct forecast on your side, and then it’s a matter of technology!

Very useful books about trading psychology

There are several important books on trading psychology that will help you set yourself up for proper trading. These books include:- Mark Douglas – “The Disciplined Trader”

- Mark Douglas – “Trade in the Zone”

- Novels about trading psychology

Reviews and comments