Elliott Wave Theory: Analysis, Patterns, Strategies (2026)

Updated: 25.01.2026

Elliott Waves: Elliott Wave Analysis and Elliott Wave Theory (2026)

It's no secret that the price moves in waves. For a long time, traders have tried to find ways to analyze these movements and predict the future of prices. Taking wave analysis as a basis, many different theories were created, the main one of which was “Elliott Wave Analysis”.

Ralph Nelson Elliott was a professional accountant who had access to extensive data on price movements going back decades. Elliott noticed that price movements looked like waves and began analyzing the charts. He analyzed the price charts of many trading instruments, and devoted time to annual price charts, as well as monthly, weekly, daily, hourly and minute ones.

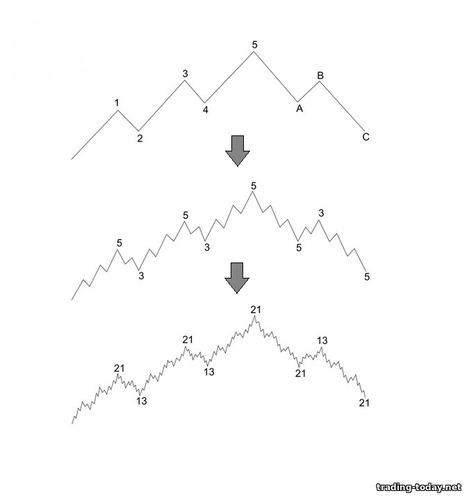

Elliott's theory was that any trend consists of three impulsive price movements and two pullbacks against the trend - a total of 5 waves, after which the trend ended. Each impulse wave can be decomposed into 5 smaller waves, and each correction into three more waves. The resulting waves could also be viewed on a smaller scale: Elliott outlined the results of his work in the book “The Wave Principle,” which was published in 1938. But the theory of wave analysis was not popular among traders. Only 50 years after Elliott's death did they begin to take a serious interest in the theory of wave analysis. Such popularity is the merit of Robert Prechter, who popularized “Elliott Waves” and also brought them to mind.

The waves themselves are divided into categories (time frames):

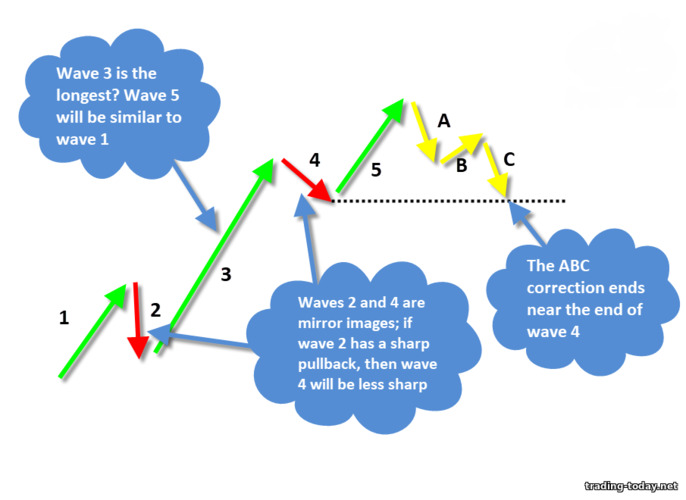

After the formation of wave 2 (corrective wave), we can predict what wave 4 will be like. If wave 2 was sharp (strongly directed against the trend), then wave 4 will be a mirror one - the rollback will be moderate and smooth. If wave 2 was smooth and the pullback was weak, then you should expect a sharp pullback from wave 4.

If wave 3 is the longest wave, then wave 5 will be the size of the first wave. Typically, if wave 3 is two or more times longer than wave 1, then it can be considered the longest wave in a 5-wave pattern. This allows us to determine the approximate length of wave 5, which will begin to form immediately after the end of wave 4.

The ABC correction, which is formed after an impulsive wave pattern, very often ends at correction level 4. I.e. the entire correction is approximately equal to wave 5. This definition of the end of the correction arose due to the nesting of some wave categories within others. The entire impulse wave pattern (5 waves) is one wave in the senior category, which means that the ABC correction is the second wave in the senior category.

It would seem that there are three important rules for the formation of Elliott waves - stick to them and live calmly. The wave analysis itself implies the formation of 5 impulse waves (3 trend and 2 corrective), after which a corrective pattern of three waves is formed - it doesn’t seem difficult either. At the very least, this can be understood.

At the same time, this entire formation, consisting of 8 waves (5 impulse and 3 correction waves) can be just two waves of the senior category and only the very beginning of a trend. Oh, mother... Each impulse wave can be divided into 5 waves of a junior category, and each corrective wave - into 3 waves of a junior category. It is not surprising that these waves cause so much misunderstanding among traders.

This is really difficult - to understand whether a trend has ended, you need to go very deep into multi-frame analysis, and this takes a lot of time. This is why Elliott waves take months of analysis for professionals, what can we say about ordinary traders?! To give you an idea, this article covers the bare minimum (basic knowledge) of what you need to know about Elliott Wave Theory if you want to study it further.

Is it worth it? It's up to you to decide. Personally, I still have enough basic knowledge about Elliott theory. This knowledge is quite enough to understand how the price moves, how trends and rollbacks form. I also understand where the waves begin and end. For binary options you don't need more.

But I’m sure there are those among you for whom binary options are a common stepping stone to the Forex market. If this is the case, then studying Elliott waves is highly recommended. All Forex trading is based on whether the trader was able to find his “trend wave” wave or not, and this theory teaches how to identify really strong price movements and roughly imagine their duration. In general, you can't imagine anything better!

Ralph Nelson Elliott was a professional accountant who had access to extensive data on price movements going back decades. Elliott noticed that price movements looked like waves and began analyzing the charts. He analyzed the price charts of many trading instruments, and devoted time to annual price charts, as well as monthly, weekly, daily, hourly and minute ones.

Elliott's theory was that any trend consists of three impulsive price movements and two pullbacks against the trend - a total of 5 waves, after which the trend ended. Each impulse wave can be decomposed into 5 smaller waves, and each correction into three more waves. The resulting waves could also be viewed on a smaller scale: Elliott outlined the results of his work in the book “The Wave Principle,” which was published in 1938. But the theory of wave analysis was not popular among traders. Only 50 years after Elliott's death did they begin to take a serious interest in the theory of wave analysis. Such popularity is the merit of Robert Prechter, who popularized “Elliott Waves” and also brought them to mind.

Contents

Elliott Wave Analysis Theory - Impulse Wave Pattern

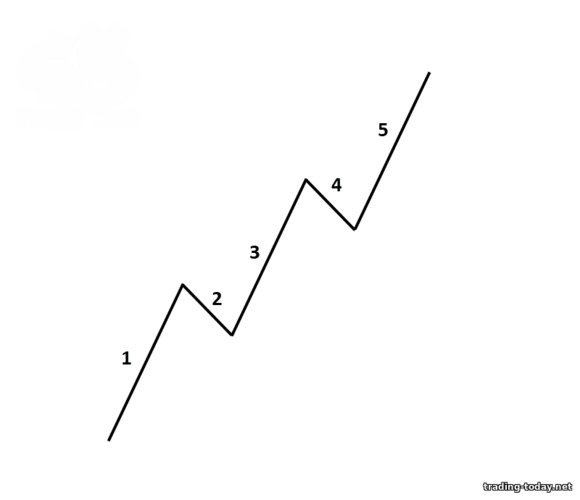

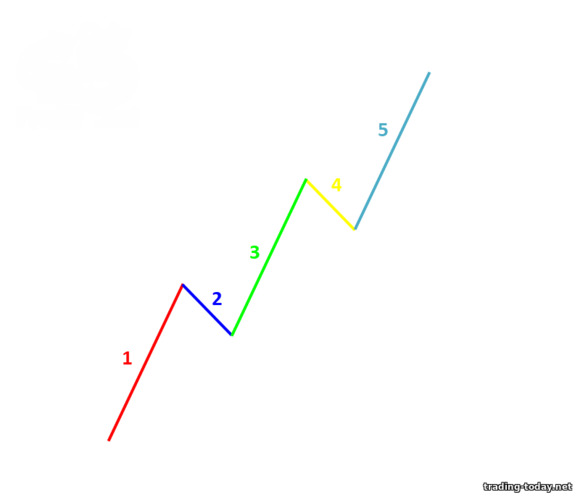

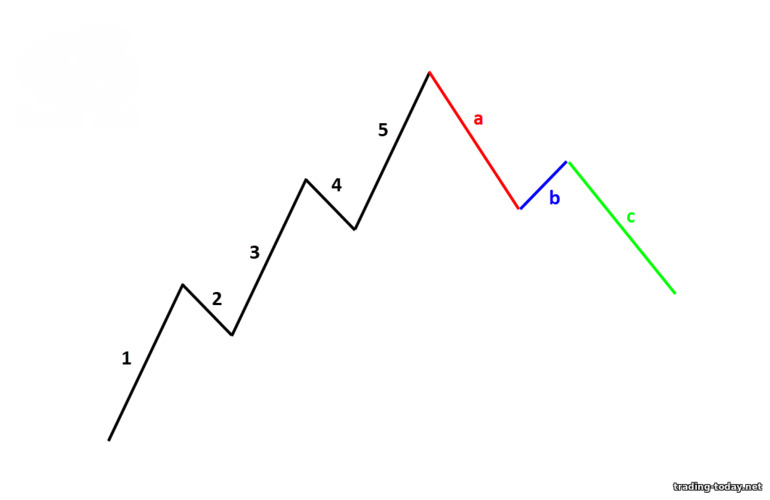

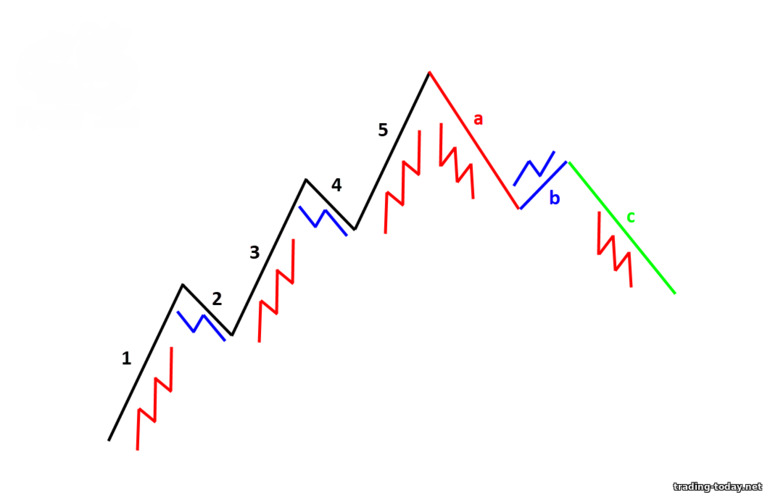

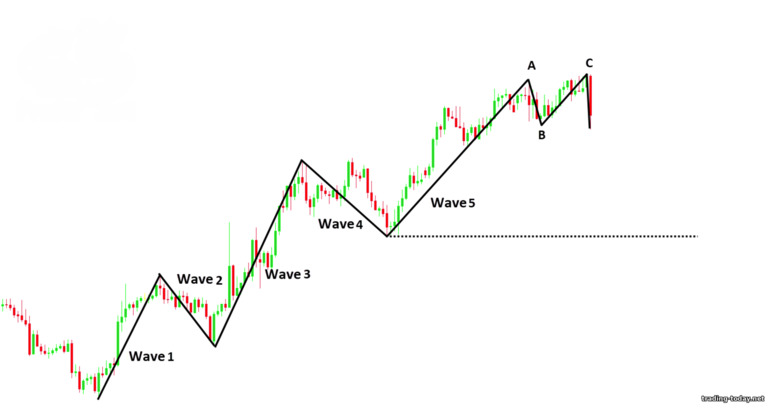

The theory of Elliott wave analysis is that any trend can always be decomposed into 5 waves: 3 impulse waves towards the trend and 2 correction waves. Also, according to the theory, after the end of the trend there are three waves of pullback. The whole theory of Elliott wave analysis comes down to:- The first five waves are an impulse wave pattern

- The last three waves are correctional waves

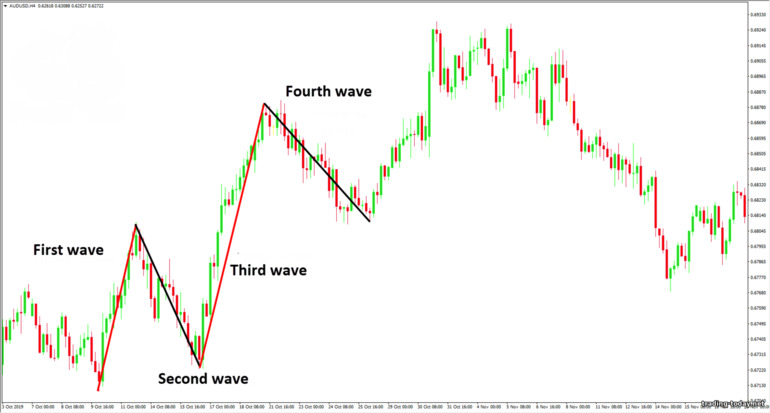

First wave in Elliott wave theory

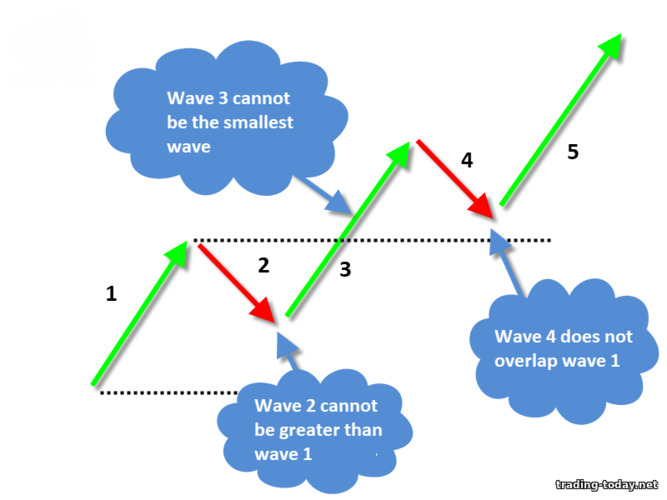

The first impulse wave is directed towards the trend. As a rule, it is quite difficult to determine it on price charts until the end of its formation.Second wave in Elliott wave theory

The second wave is a correction of the first wave. It cannot be as long as the first one. This means that, for example, in an uptrend, the rollback, in the form of the second wave, will not reach the minimum (beginning) of the first wave. Also, the second wave very often ends at Fibonacci retracement levels from 0.382 to 0.5The third wave in the Elliott wave theory

The third wave is directed towards the main trend - this is an impulse wave. It is considered to be the most interesting for Forex traders. Usually, the third wave is one strong sharp price movement - it is the shortest in terms of formation time. At the same time, the third wave is usually larger than the first.Fourth wave in Elliott wave theory

The fourth wave, like the second, is corrective. During the formation of this wave, sideways movement can be observed. The pullback of the fourth wave itself cannot reach the maximum (in an uptrend) of the first wave.Fifth wave in Elliott wave theory

The fifth impulse wave ends the trend. It is the longest and, in most cases, does not have much strength.Advanced impulse waves

Taking into account all three impulse waves, it is generally accepted that one of them will necessarily be “extended”, since it is longer than the other waves. Elliott always believed that the extended wave was the 5th. But now it is generally accepted that the third wave can also be extended (a striking example above). In practice, this does not matter at all, because... All that matters is the result and the correct use of wave theory.Elliott correction waves

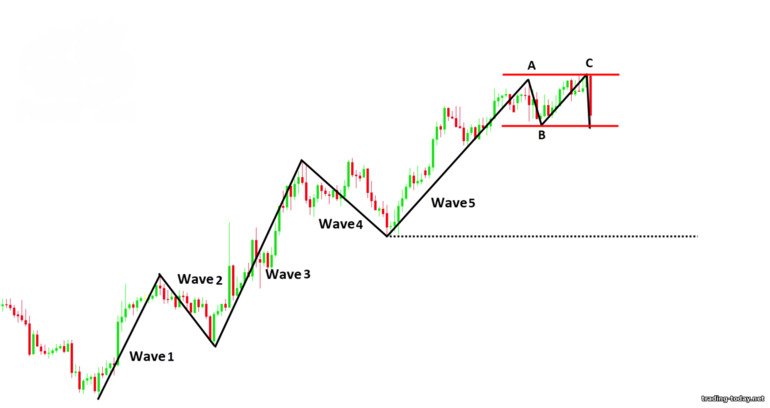

As soon as the fifth wave has finished forming, the impulse wave pattern can be considered complete. Next come three corrective waves, which are designated a, b, c, etc.: In a downtrend, Elliott correction waves will look like this: Corrective waves can have different shapes - Elliott counted 21 patterns in total, consisting of waves a, b, c. But all these patterns come down to three graphical models, which we will now analyze.Types of Elliott correction waves

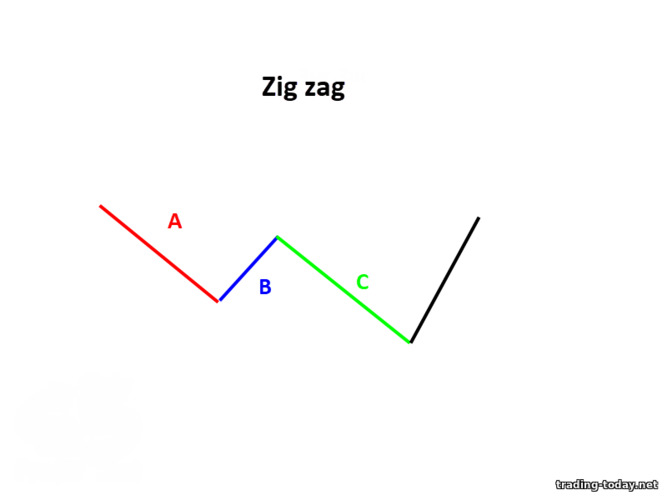

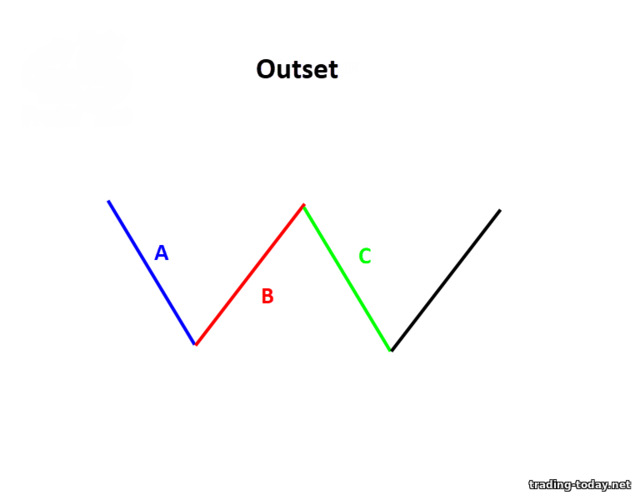

All ABC correction waves form three patterns:- Zig Zag

- Sidewall

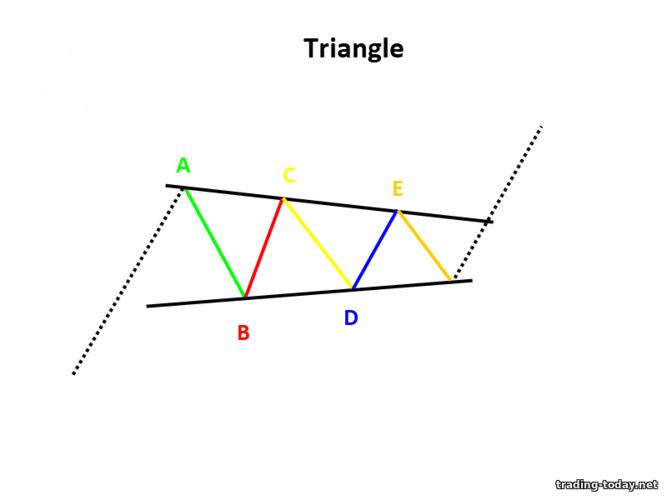

- Triangle

Zig Zag

Zig Zag is an oblique price movement against the main trend. Waves A and C are longer than wave B, which is a correction to wave A.Side

As the name implies, this type of correction is a sideways price movement. The length of the waves can be either identical or different, but the price moves in a certain horizontal price corridor:Triangle

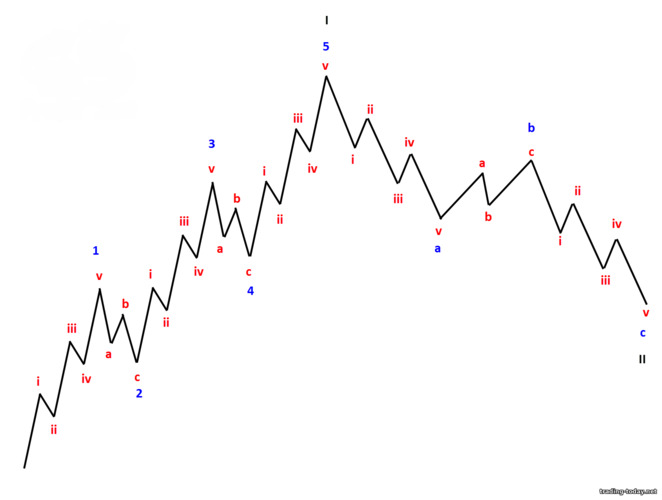

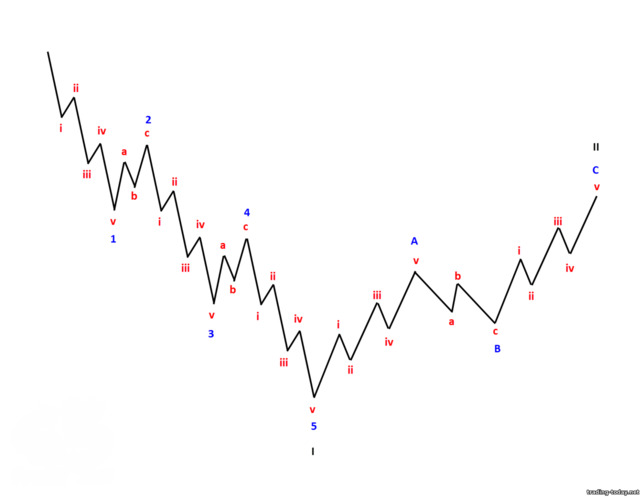

The triangle is one of the technical analysis figures. The pattern itself consists of five waves that form in a tapering sloping channel:Fractal structure of Elliott waves

All Elliott waves are fractals. Inside each wave there may be other waves hiding, to understand this, you just need to reduce the time frame (multiframe analysis). Each impulse wave can have 5 waves, and each corrective wave can have 3 waves: Each of these waves can again be broken down into its components: each of the resulting impulse waves consists of an impulse wave pattern, and each corrective wave will include an ABC move. Any senior wave will include junior waves.The waves themselves are divided into categories (time frames):

- Main cycle (century-old)

- Super cycle (40-70 years)

- Cycle (several years)

- Primary level (several months or several years)

- Intermediate level (several weeks or several months)

- Secondary level (weeks)

- Minute level (days)

- Small level (clock)

- Extra-low level (minutes)

Elliott wave markings

In order not to be confused in waves formed on different time frames, markings were used for each specific category of waves:- Main cycle [I] [II] [III] [IV] [V], correction against the trend [A] [B] [C]

- Supercycle (I) (II) (III) (IV) (V), correction against the trend (A) (B) (C)

- Cycle I II III IV V, correction against the trend A B C

- Primary level I II III IV V, correction against the trend A B C

- Intermediate level [1] [2] [3] [4] [5], correction against the trend [a] [b] [c]

- Secondary level (1) (2) (3) (4) (5), correction against the trend (a) (b) (c)

- Minute level 1 2 3 4 5, correction against the trend a b c

- Small level 1 2 3 4 5, correction against trend abc

Three main rules for constructing Elliott waves

Elliott waves are formed according to three main rules:- Corrective wave 2 should not roll back further than 100% of wave 1

- Wave 3 cannot be the shortest of the three impulse waves

- Corrective wave 4 cannot overlap wave 1

Practical tips on Elliott waves

In practice, there are different Elliott wave formations. Many analysts spend months and years studying waves. Of course, there are some features in wave analysis that will help you better predict future price movements.- Corrective waves 2 and 4 are mirror images: if wave 2 had a strong slope, then wave 4 will have a less pronounced and sharp correction. The reverse situation is also equivalent,

- If wave 3 is the largest, then the 5th wave will be approximately the size of the first wave

- After the impulse wave pattern (5 waves), the ABC correction will most likely end at the end of the 4th wave

After the formation of wave 2 (corrective wave), we can predict what wave 4 will be like. If wave 2 was sharp (strongly directed against the trend), then wave 4 will be a mirror one - the rollback will be moderate and smooth. If wave 2 was smooth and the pullback was weak, then you should expect a sharp pullback from wave 4.

If wave 3 is the longest wave, then wave 5 will be the size of the first wave. Typically, if wave 3 is two or more times longer than wave 1, then it can be considered the longest wave in a 5-wave pattern. This allows us to determine the approximate length of wave 5, which will begin to form immediately after the end of wave 4.

The ABC correction, which is formed after an impulsive wave pattern, very often ends at correction level 4. I.e. the entire correction is approximately equal to wave 5. This definition of the end of the correction arose due to the nesting of some wave categories within others. The entire impulse wave pattern (5 waves) is one wave in the senior category, which means that the ABC correction is the second wave in the senior category.

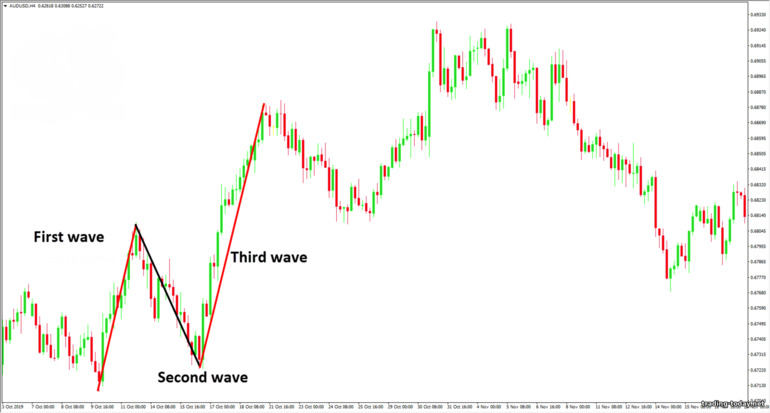

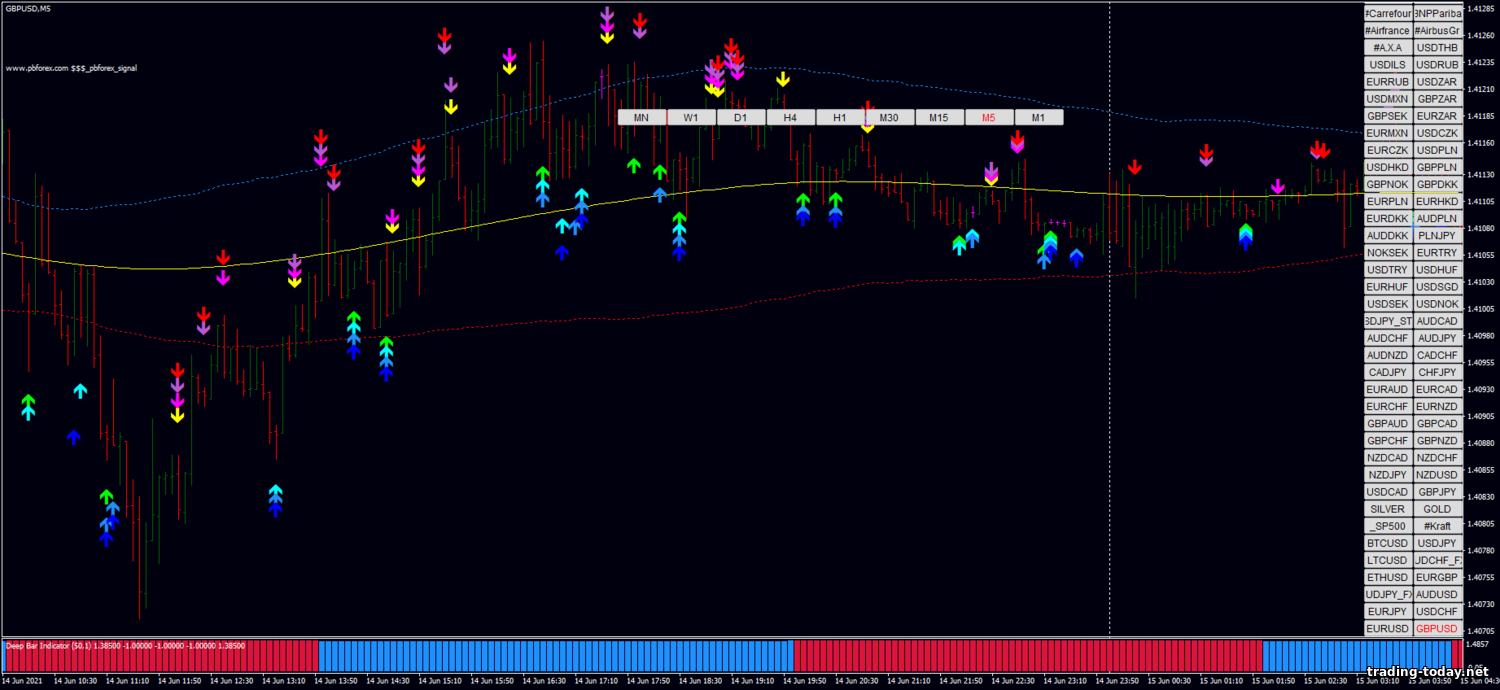

Elliott waves in practice

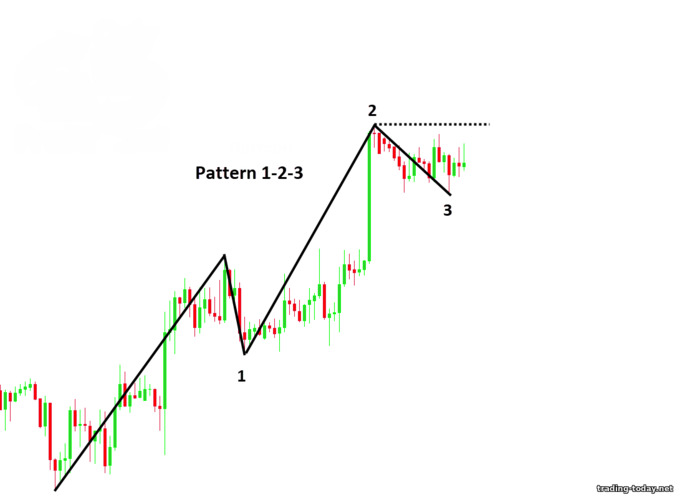

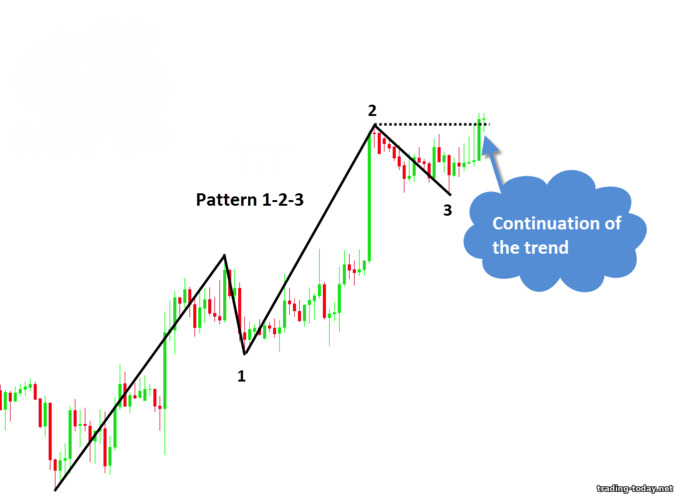

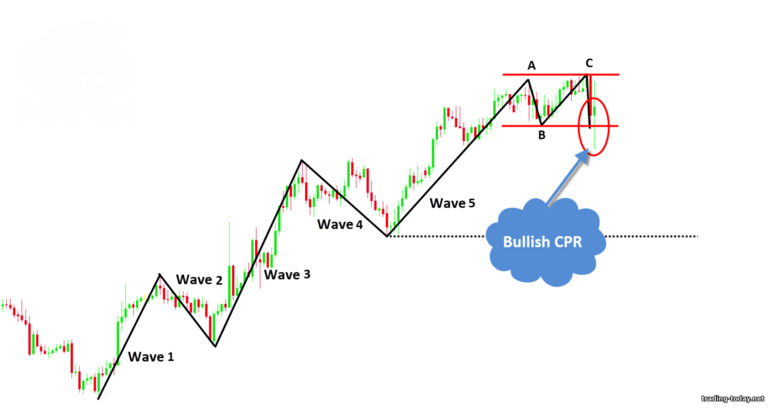

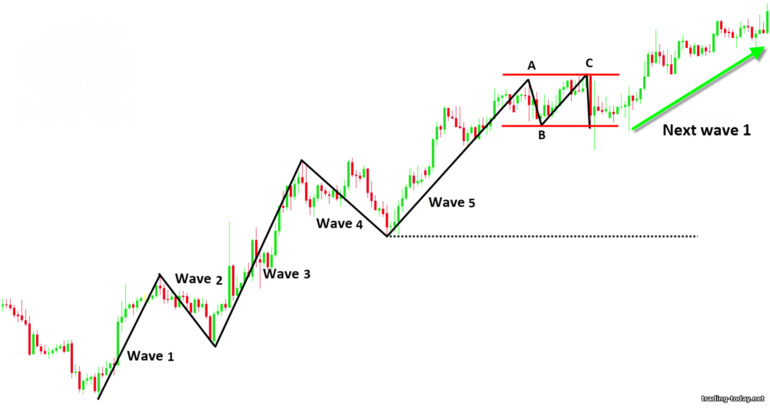

Theory is great, but how to use the acquired knowledge in practice?! As I said above, wave 1 is quite difficult to determine - we wait for its completion and look for a rollback. We need the completion of the first wave to understand whether this is a sideways movement and to be sure that this is the beginning of a trend: Our first wave has formed, and the rollback has begun. We need to find an upward entry point - to determine the beginning of the formation of the third wave. The most logical option is to combine Fibonacci levels with resistance support levels or Price Action candlestick patterns: We stretch the Fibonacci levels and remember that wave 2 cannot be greater than wave 1, and it would also not hurt to remember that wave 2 very often ends at levels from 0.382 to 0.5. Now the price is right at the level of 0.382, and the entry point will be indicated to us by the “Bullish Closing Price Reversal” pattern - a green candle that broke through the low of the previous candle and closed much higher than the opening price. A good entry point in an uptrend: The third wave should not be the smallest, but it is already larger than the first wave, which means everything is fine. It’s worth looking at corrective wave 2 – it consisted of 4 candles, i.e. the pullback was sharp. You should expect a smoother rollback from wave 4: Corrective wave 4 is indeed smoother, but how to determine the end of the correction? I propose to again resort to Price Action patterns, namely the “1-2-3” pattern. Let me remind you that this pattern is perfect for trend trading: Let me remind you: 1st point of the pattern is the beginning of a trend impulse (end of wave 2), the second point is the top of a trend impulse (end of wave 3), the third point is the low of wave 4. Through point two we draw a horizontal level and as soon as the price breaks through it, we open a trade at increase: As a result, the price began to form the 5th Elliott wave: This is approximately how you can analyze and predict price movements using Elliott waves. There is nothing complicated here if you follow the rules and know the Price Action patterns.Elliott corrective waves in practice

Everything is clear with the impulse wave pattern, but what to do with the corrective Elliott waves? Let's look at the following situation: From practical advice, we know that we should expect a pullback around the end of wave 4. On the chart, the price is very far from this level. We look at the correctional waves ABC - they move in the same horizontal range - a sideways price movement is formed. The only question is where the price will go after the sideways trend: It would be reasonable to enter a rise from the lower border of the channel - the trend was upward, so there is a high probability that the trend will continue: The next candle completely confirms our guesses - a bullish Closing Price Reversal has formed, indicating an increase in price. So, if you doubt for a long time and do not enter into a rise from the lower border of the sideways band, then after the formation of a bullish Closing Price Reversal there should be no doubt - a trade for a rise can be opened after the formation of the pattern. Let's see where this leads: Here comes the continuation of the trend! Why is that? It's simple - the entire impulse wave pattern, consisting of 5 waves, is one wave in the senior category, followed by a rollback in the form of an ABC correction - this is the second wave, the continuation of the trend is the third wave in the senior category. Simply put, the trend is not over yet!Elliott waves and wave analysis of charts: results

Elliott waves are another topic “not for weaklings”. This is truly difficult even for experienced traders - there is no shame in it.It would seem that there are three important rules for the formation of Elliott waves - stick to them and live calmly. The wave analysis itself implies the formation of 5 impulse waves (3 trend and 2 corrective), after which a corrective pattern of three waves is formed - it doesn’t seem difficult either. At the very least, this can be understood.

At the same time, this entire formation, consisting of 8 waves (5 impulse and 3 correction waves) can be just two waves of the senior category and only the very beginning of a trend. Oh, mother... Each impulse wave can be divided into 5 waves of a junior category, and each corrective wave - into 3 waves of a junior category. It is not surprising that these waves cause so much misunderstanding among traders.

This is really difficult - to understand whether a trend has ended, you need to go very deep into multi-frame analysis, and this takes a lot of time. This is why Elliott waves take months of analysis for professionals, what can we say about ordinary traders?! To give you an idea, this article covers the bare minimum (basic knowledge) of what you need to know about Elliott Wave Theory if you want to study it further.

Is it worth it? It's up to you to decide. Personally, I still have enough basic knowledge about Elliott theory. This knowledge is quite enough to understand how the price moves, how trends and rollbacks form. I also understand where the waves begin and end. For binary options you don't need more.

But I’m sure there are those among you for whom binary options are a common stepping stone to the Forex market. If this is the case, then studying Elliott waves is highly recommended. All Forex trading is based on whether the trader was able to find his “trend wave” wave or not, and this theory teaches how to identify really strong price movements and roughly imagine their duration. In general, you can't imagine anything better!

Reviews and comments