Price Action - Trading Strategy for Profitable Trading 2026

Updated: 25.01.2026

Price Action - trading system for stable earnings: patterns and models Price Action for binary options (2026)

Price Action is a type of candlestick chart analysis and numerous trading systems, usually used on a clean chart (trading without indicators). By its nature, Price Action is a very high-quality method of market analysis, because it is based on patterns and patterns that often repeat with the same outcome.

Literally speaking, Price Action teaches you to find the same formations on price charts, the movement of which can be predicted with high probability. Of course, we are not talking about any 100% strategies, but the statistics of Price Action patterns are close to ideal (by the standards of trading strategies). That is why many experienced traders prefer this type of trading analysis of price charts.

So that you understand better, Price Action is not one universal strategy, but a set of several strategies:

Price Action allows you to fully understand price movements and teaches you how to make money on repeating patterns - candlestick patterns or technical analysis figures that you will often encounter during trading.

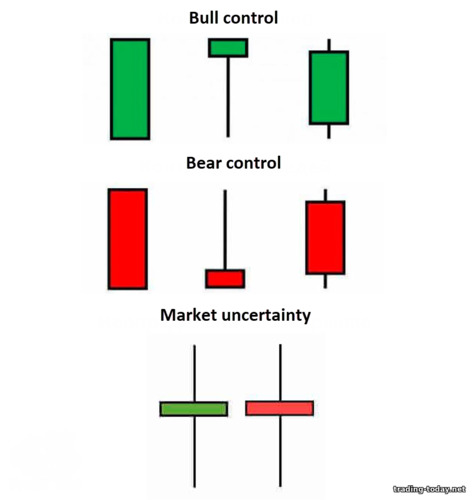

Price movement in the market occurs due to the difference in supply and demand of buyers and sellers. Buyers (bulls) raise the price, and sellers (bears) lower the price. The market itself is in constant motion:

To understand who currently controls the market (bulls or bears), we need some “tools”.

Very often, Price Action traders use Simple Moving Average with a period of 20. There are even Price Action schools that teach you to understand the chart and find patterns on it formed by Simple Moving Average (20) and candlestick patterns.

The price chart contains a lot of important information that a novice trader will not see: But an experienced trader who understands Price Action trading systems will notice many opportunities for making money: Looks simple? The simplicity of Price Action is one of the main advantages of this type of chart analysis. Patterns should be understandable to everyone, and their use should not be difficult - this is the key to the quality of Price Action trading systems.

Overall, it all comes down to memorizing candlestick combinations and knowing how to use them. As a bonus for your diligence, you will receive a trading system that will work both during trend movements and during price consolidation (sideways movements). Unlike trading strategies based on indicators, Price Action adapts to the market and allows you to make a profit at any time. Indicator trading strategies show good results only at certain times.

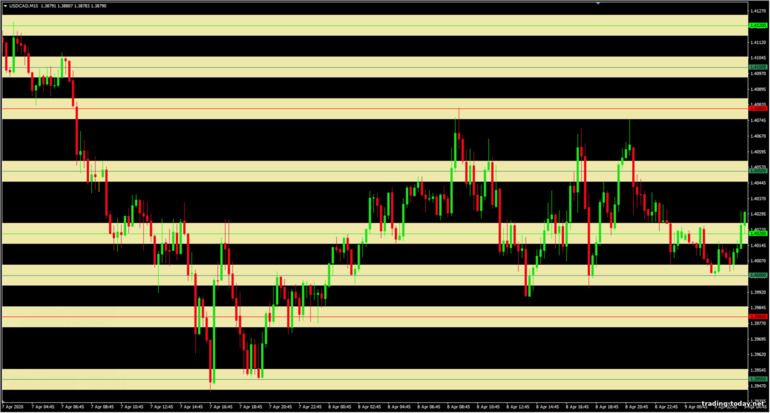

Another advantage of the Price Action trading strategy is its simplicity, which most indicator strategies do not have - their charts are filled with indicators that you often do not have time to follow: But indicators can be useful even in Price Action. For example, LEV00 indicator sets round price levels (strong support and resistance levels) and zones around them on the chart. True, the indicator was specially written for the M15 time frame and junior TFs:

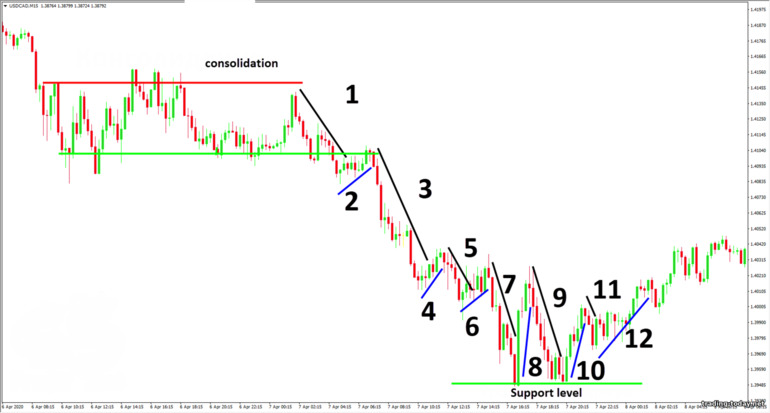

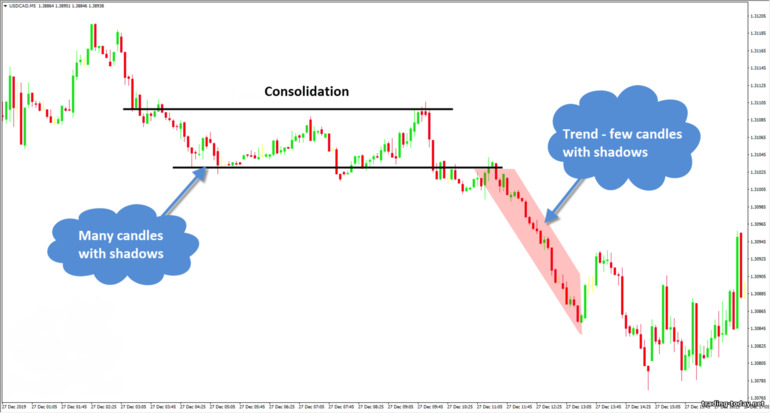

For example, you need to monitor trend impulses - if they gradually become more horizontal, and the price travels less distance, then this indicates a possible imminent end of the trend and a weakening of the price movement as a whole: The length of candles in a trend and their number can also indicate the strength of the current trend. For example, in a strong bearish (downward) trend there will be a lot of large red candles that will form one after another or with rare pullbacks. A weak bearish trend is characterized by red candles, which very often replace bullish candles: It is also worth paying attention to rollbacks during trending price movements - if they become steeper (the price rolls back against the trend further and further, compared to previous rollbacks, and the rollbacks themselves are sharper), then this also indicates a possible imminent end of the trend: The bodies of candles during pullbacks can also convey to us a lot of interesting and important information. For example, if during pullbacks large candles appear that are directed against the trend, then this is a reason to prepare for a possible price reversal. Such candles are most often formed at the very end of the trend (on the last pullbacks), because the current price is of interest to the bears (if the trend is upward) or the bulls (if the trend is downward): Let's look at an example that will help you better understand the price chart in practice:

Let's look at an example with a bullish (upward) trend:

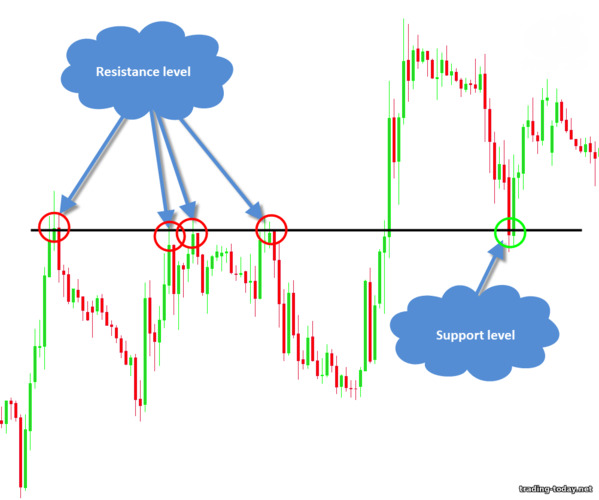

SR (support and resistance) levels are zones of interest - they divide the chart between zones of interest for sellers and buyers. Accordingly, support levels are buyer zones; they are located below the current price. Resistance levels are zones of interest for sellers; they are located above the current price. After breaking through such a zone, it changes its “owner”: support levels become resistance levels (of interest to sellers and will turn the price down), and resistance levels become support levels (areas of interest to buyers and the price will turn upward).

When the price approaches support and resistance levels, it experiences pressure from the zone holders, which can lead to a price rollback or even a trend reversal. This is due to the fact that large FOREX market participants: banks, hedge funds, etc. place their limit orders in support and resistance zones (zones of interest).

There is little point in “price-hunting” every support and resistance level you see and hoping you get lucky. It would be much more correct to use only strong levels of supply and demand:

The resistance zone, like the support zone, is formed by several separate levels located very close to each other. The boundaries of the zone can be very easily traced by the shadows of candles and reversals of price movements. The resistance zone also copes with its task very well – it turns the price down.

There is also a psychological level on the chart – “1.34100”. This is a round price level – it is also strong. Please note that the price very often reverses from this level, and after a breakout, uses it as a mirror support and resistance level, which also indicates the strength of the round level. By the way, this level also has a zone around itself, so you should expect early price reversals or slightly delayed ones.

It is not difficult to draw and plot support and resistance levels on a chart - it is enough to understand where the price turned, and if it did this repeatedly at the same price value, then this is exactly what we need. For convenience, there are some rules for plotting support and resistance levels on a chart:

Have you ever wondered why candlestick patterns work in some cases and not in others? Yes, there are no 100% trading strategies, but you can still significantly increase the probability of a correct forecast to the maximum. To do this, you need to consider not just “three candles of a candlestick pattern” separately from the entire chart, but consider them, paying attention to the following:

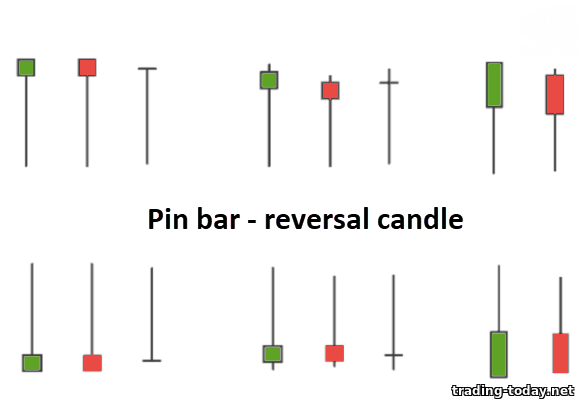

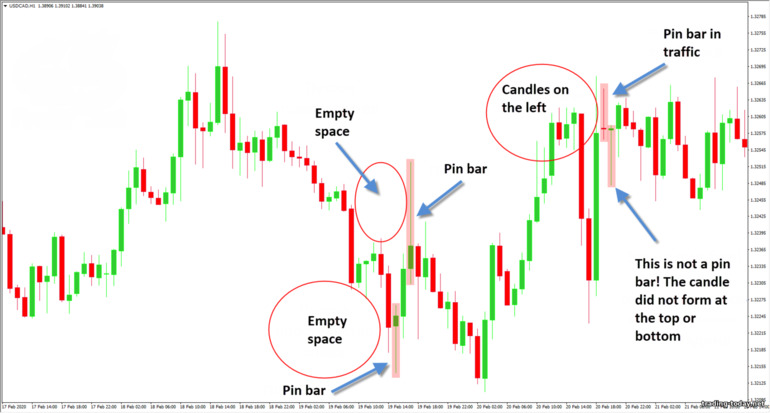

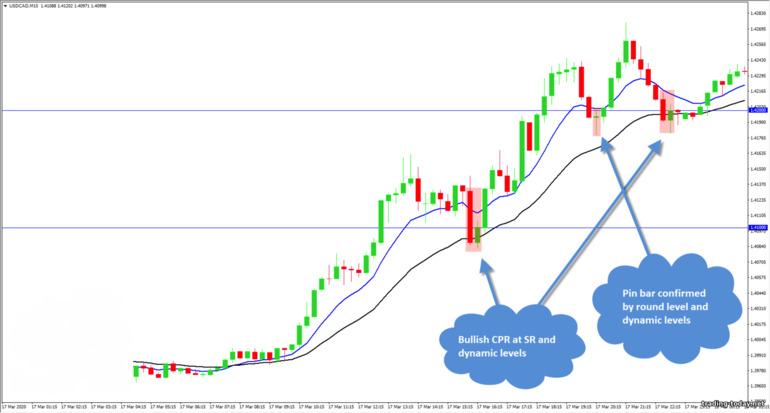

Let's take, for example, a pin bar (aka Pinocchio):

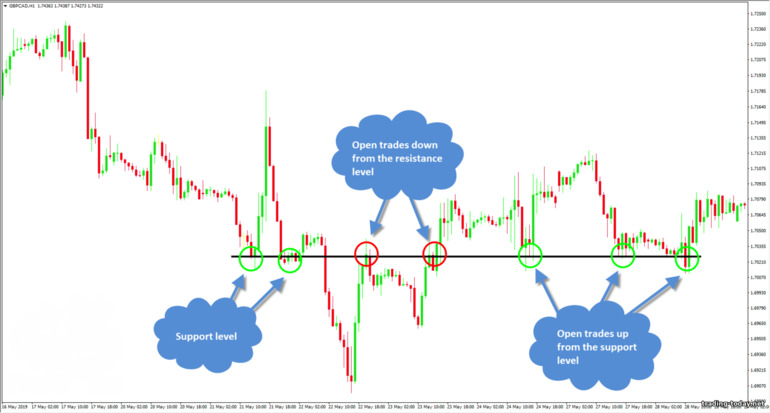

Let's look at the same picture from a different angle and with a different understanding of the market: Add strong support and resistance price levels to the chart and we get a picture that fully tells why one pin bar reversed the price and the other did not. The price moves between the support and resistance levels, so there is no point in waiting for a reversal between these levels. Don’t forget that one of the important rules for setting support and resistance levels is that the price must react to the level (bounce away from it)! If there is no such reaction, then there is no point in looking for a reversal at such levels, even if they are round.

So it turns out that the first pin bar is between the support and resistance levels, and the second is at the support and resistance level. In this situation, the “correctness” of the pin bar no longer plays a role; the place of its formation is much more important.

This is roughly what the main mistake of many binary options and Forex traders looks like. Having found some pattern, they expect that the price will act according to a known algorithm and they (traders) will receive their “deserved” profit. In some cases this will happen because they were just lucky, but are we here just because of luck?! I think everyone is interested in a stable result and finding the most profitable points for opening transactions.

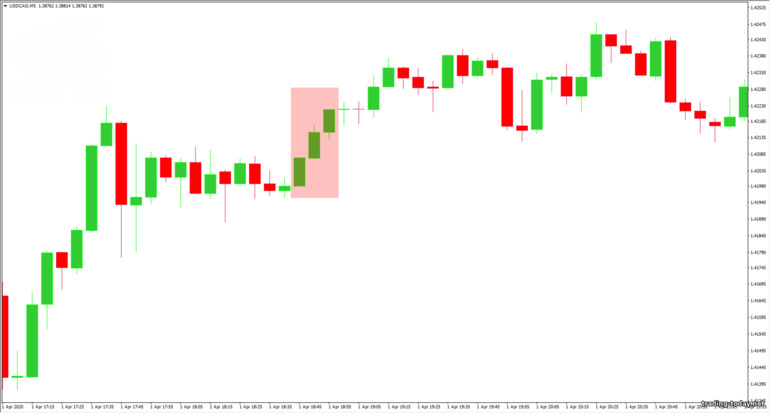

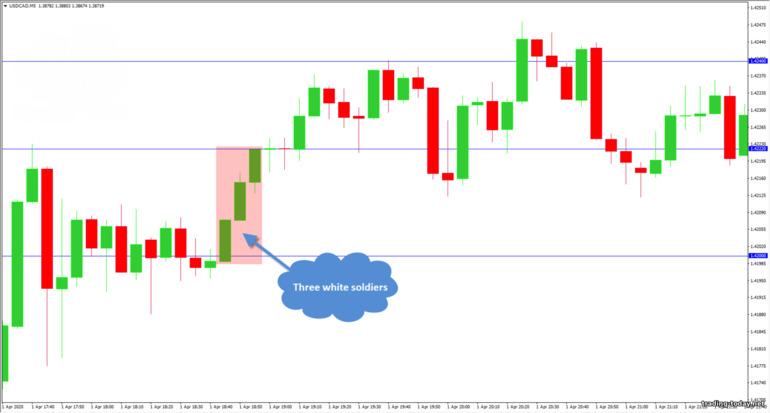

Let's look at one more example. We are interested in three candles of approximately the same size and without large shadows. The candles follow each other and form the “Three White Soldiers” candlestick pattern: Three white soldiers are a strong trend continuation candlestick pattern. It says that the bulls control the market, and there are practically no bears. After such a formation, it is expected that the next few candles will also be upward and have a large body. But what do we see on the graph? The next two candles are candles of uncertainty (Doji), and only after them the price rose a little higher, but there is no talk of any strong price movement. Where is the promised continuation of the trend? Let's add support and resistance levels to the chart: We get a picture where three white soldiers have occupied the entire space between two strong levels of support and resistance - the price simply has nowhere to rise, because A lot of bears have entered the market and want to challenge the current price of the asset. The conclusion is that trend continuation models work well between areas of interest for buyers and sellers. The Three Black Crows are a mirror image of the Three White Soldiers model. The model also speaks of a continuation of the trend, but in this example, unlike the previous one, the price fall was not hampered by strong support and resistance levels, so the pattern worked as expected.

Candlestick analysis is not only about memorizing candlestick patterns and patterns. You need to be able to correctly understand what is being said:

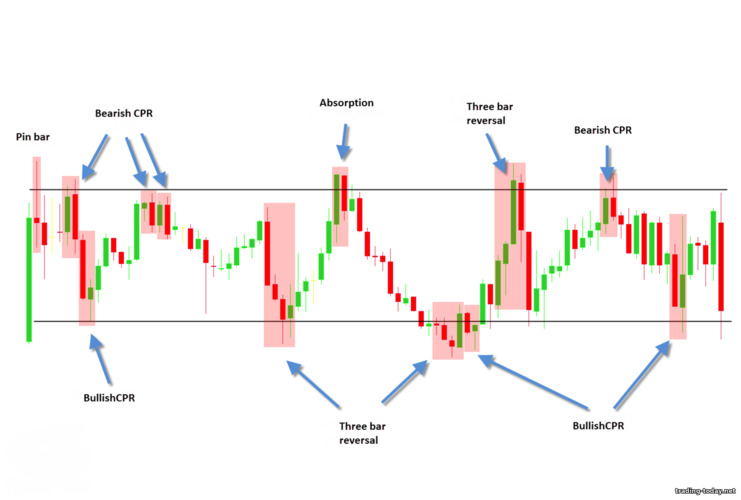

Of course, there are many Price Action trading patterns, but I will tell you about the most popular strategies that you will often encounter in practice.

It is worth paying attention to several components of the correct pin bar:

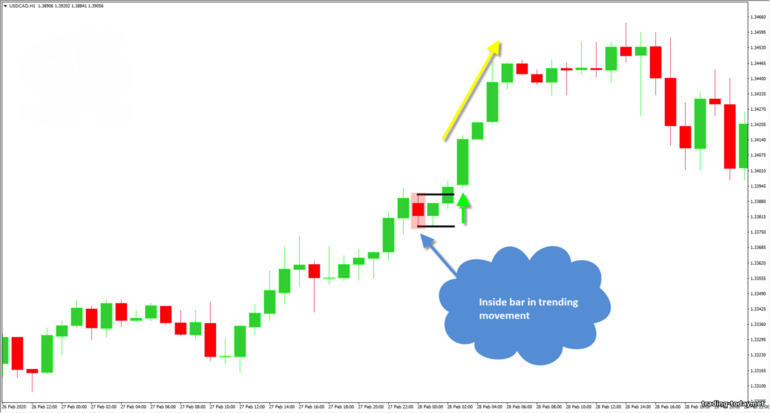

The “Inside Bar” pattern, as the name implies, is a candle whose body and shadow are within the boundaries of the body and shadow of the previous candle. So here it is:

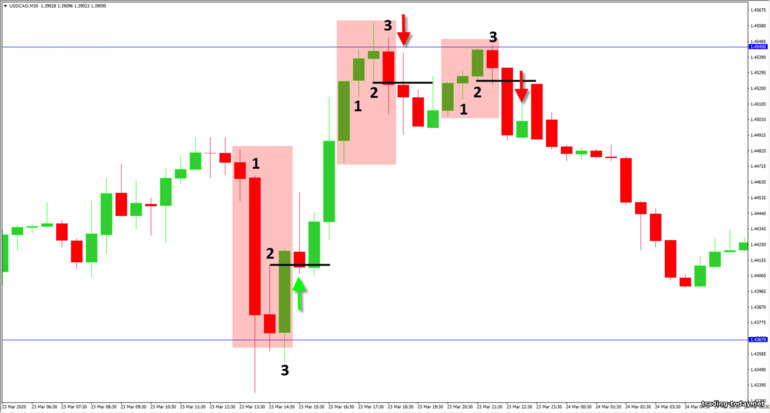

The essence of the Price Action pattern is that you need to wait until the low of the second candle in an uptrend or the high of the second candle in a downtrend is broken. Let's look at examples to make it more clear: After breaking through the high or low of the second candle and closing the candle behind this horizontal level, you should open a trade in the direction of a reversal of 3-5 candles. It is worth looking for a three-bar reversal only at strong support and resistance levels. In trend movements, it is better to look for entry points only in the direction of the current price trend.

The pattern should be looked for only at strong support and resistance levels and only after sustained price movements. The trade is entered after the formation of the third candle in the direction of the reversal. The expiration time is usually set to three candles.

The upper reversal pivot looks like this: Lower reversal pivot:

In theory, you can catch a very good trend price movement at the very beginning: This trading method is designed to exclude cases of trend displacement - when, after a breakout of the trend line, the trend continues, but in a more “smooth” form.

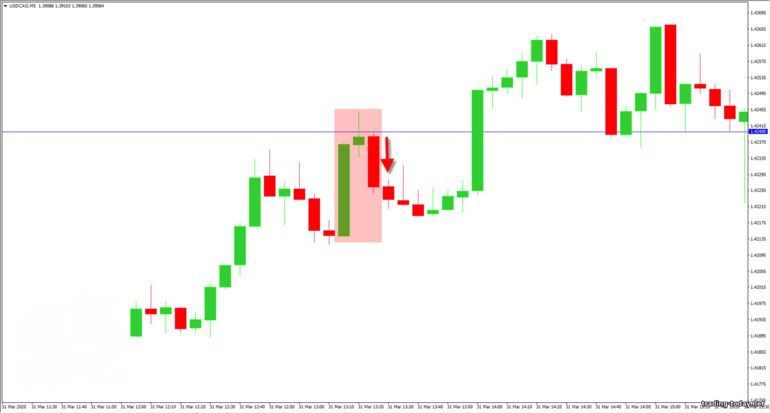

The Closing Price Reversal pattern itself is a formation of two candles. There are bearish Closing Price Reversal (downward price reversal) and bullish Closing Price Reversal (upward price reversal):

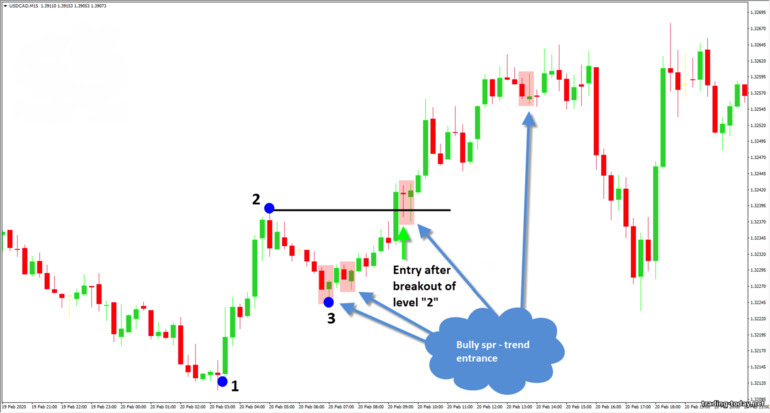

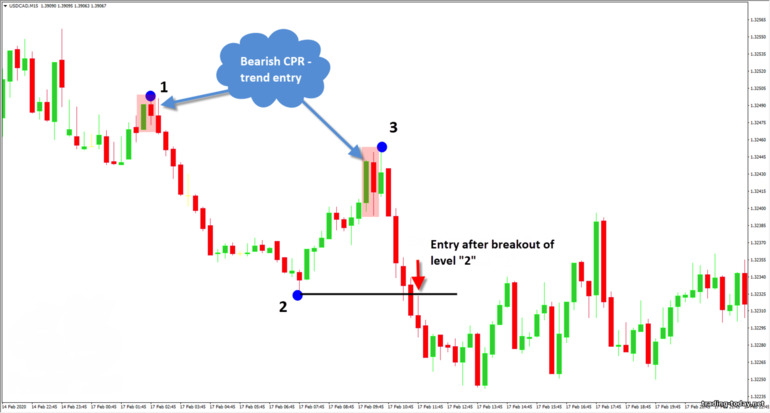

If we look at the “1-2-3” pattern in more detail, it consists of three points:

The price moves without our participation. Every day, 5 days a week, traders make a huge number of transactions, which leads to certain price movements. But, the price chart is not only a mirror of price movement, but also an extensive source of information. Knowing where to look, you can see a lot.

For example, candles will tell us who is dominant in the market now and what movements to expect, but we only have a few data:

The point is precisely in the chart itself - it is the same for all traders! If you take any indicator strategy, especially a very exotic one (with unique indicators and special entry rules), then who trades with it? Me, you and a couple of other people?! Yes, of course, indicator strategies can be very profitable, but they work at a certain time, while Price Action works around the clock.

The advantage of Price Action is obvious - there is nothing superfluous in it that could mislead some market participants. We have a candlestick chart and support and resistance levels, and many traders even use only round price levels, so even the levels can be set the same for everyone! If we talk about Price Action patterns, then there can be no disagreement here either - how can you understand otherwise a pattern consisting of three candles?! No way! Accordingly, when trading with Price Action, a trader always moves with the crowd, which means that the effectiveness of his trading will be very high. This is exactly why Price Action works - a set of trading systems that are used by tens of thousands of traders and read the market in the same way!

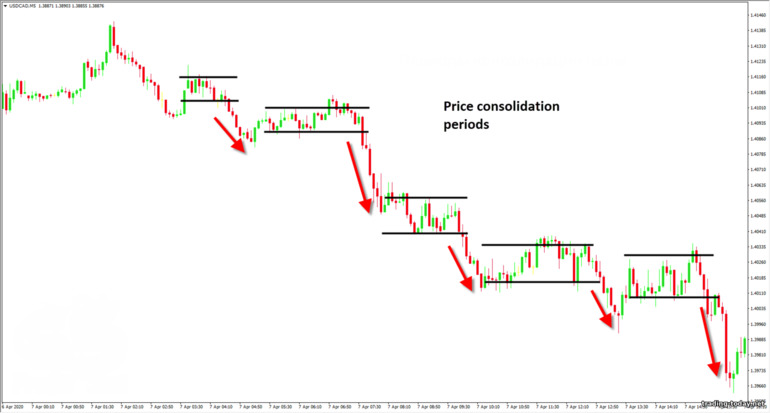

Trend retracements can represent price consolidation (sideways movement) that will lead to further continuation of the trend or a reversal. During consolidation, the price gains strength, so at the end you should expect a trend impulse: And so, it’s time to place all significant support and resistance levels on the price chart. Do not forget that strong levels are required to reverse the price earlier (there must be a price reaction to these levels), without this they will be useless: And since the market moves from left to right, we remember all the patterns that we know and predict the price movement, emphasizing that the trend is downward: Please note that not all patterns were used, but only those that are worth using in trend movements. For example, it is foolish to use a bullish Closing Price Reversal in a downtrend, so you should only use a bearish Closing Price Reversal to indicate entry points towards the trend! For the same reason, reversal patterns should only be looked for at strong support and resistance levels.

To trade Price Action, each trading system you intend to use must:

As an example, take the following confluence of factors pointing to one forecast:

Price Action is precisely the analysis of charts as a whole, and not the finding of any individual patterns or candlestick formations, so it is worth taking into account all the information that we can get from price movement. The combination of 3-4 signals may indicate a good entry point, but do not forget that there are no 100% trading systems, so always remember risk management and open transactions for an amount not exceeding the risks.

The goal of Price Action is not to “fire from a shotgun,” but to take several accurate “shots from a sniper rifle.” Unlike indicator strategies, where the rule “When a signal appears, I’ll definitely open a deal!” applies, Price Action forces you to be more selective in choosing entry points.

It's funny that Price Action is both simple and complex:

Another problem that you will definitely encounter in practice is the ability to apply patterns. Yes, you, like me, can memorize all the patterns, their trading algorithms and understand where to look for them, but you won’t be able to do one thing - see these patterns on the price chart. For example, my brain refuses to see the “Inside Bar” (this is always a difficult task for me), although I have no problems identifying patterns such as: Closing Price Reversal, pin bar, engulfing, etc.

Practice will save you! Lots of practice! Of course, it is better to hone your skills on a demo account, and only then move on to real trading. But don't think you'll get it right right away - learning Price Action trading is not an easy task. Be patient. Start by setting support and resistance levels, and then simply watch the price movement - mark the patterns that you find on the chart, or better yet, take screenshots of the forecasts.

At the end of the day (or trading session), your price chart should look like this: And so on every trading session until you learn to identify Price Action patterns instantly. The task is difficult, but doable.

If we talk about time frames of use, they can be anything. Of course, there will be a lot of noise on M1, but there are traders who even make good money on turbo options. So it all depends on your preferences. Also, the disadvantage of TFs is the difficulty in setting support and resistance levels - in addition to round price levels, you will very often have to use the levels that the price indicated to you.

Price Action teaches the main thing - to see price movement as it is. There is nothing superfluous, only information from the price chart. No arrows, indicators, histograms, and much more that prevents you from thinking “creatively” and assessing the full picture of what is happening.

Literally speaking, Price Action teaches you to find the same formations on price charts, the movement of which can be predicted with high probability. Of course, we are not talking about any 100% strategies, but the statistics of Price Action patterns are close to ideal (by the standards of trading strategies). That is why many experienced traders prefer this type of trading analysis of price charts.

So that you understand better, Price Action is not one universal strategy, but a set of several strategies:

- Some will allow you to earn money in the trend

- Others will find turning points

Contents

- What is Price Action?

- Using Price Action

- How to understand and analyze the market using Price Action

- Using support and resistance levels in Price Action trading strategies

- Candlestick analysis is the basis of Price Action trading systems

- Price Action patterns - Price Action trading systems

- Pin Bar Pattern (Pinocchio) – Price Action reversal pattern

- Inside bar pattern in Price Action

- Engulfing pattern or external bar - price action reversal pattern

- Three-bar reversal – Price Action reversal pattern

- Reversal pivot – Price Action trading system

- False breakout of the trend line

- Closing Price Reversal pattern - Price Action reversal pattern

- Price consolidation

- Pattern 1-2-3 or “False top or bottom” - trend continuation pattern Price Action

- Why Price Action Works

- How to trade with Price Action - making money on Price Action trading strategies

- Structural analysis of Price Action

- How to use Price Action in practice

- One week with Price Action

- Price Action: results

What is Price Action?

As stated earlier, Price Action is a method of analyzing pure price charts, consisting of several very profitable trading strategies built on candlestick analysis and support and resistance levels. A distinctive feature of this method is the partial or complete absence of technical chart analysis indicators.Price Action allows you to fully understand price movements and teaches you how to make money on repeating patterns - candlestick patterns or technical analysis figures that you will often encounter during trading.

Price movement in the market occurs due to the difference in supply and demand of buyers and sellers. Buyers (bulls) raise the price, and sellers (bears) lower the price. The market itself is in constant motion:

- The price moves up when there are more buyers (bulls) than sellers (bears) in the market

- We can observe a downward trend when there are more sellers than buyers in the market

- If the price moves in a narrow horizontal corridor, then there are the same number of bears and bulls in the market and they are satisfied with the current price of the asset

To understand who currently controls the market (bulls or bears), we need some “tools”.

Using Price Action

Price Action includes Dow theory and the basics of technical analysis of price charts . In addition, for a better understanding of the situation, the following is plotted on the graph:- Levels or zones of support and resistance

- Price channels or trend lines

Pure or “naked” Price Action

This variation of Price Action, as the name suggests, uses only the basic framework to search for trading signals and understand the market. Those. Naked Price Action uses:- Dow Theory

- Technical analysis figures

- Japanese candlestick models

- Support and resistance levels

- Channels

Price Action with volumes

It is logical to use Price Action with volumes only where there are real volumes:- Promotions

- Futures

- Indices

Price Action with technical analysis indicators

When they talk about Price Action and indicators, you shouldn’t think that you will see something exotic on the price charts. In most cases, everything is limited to adding one or more moving averages to the price chart.Very often, Price Action traders use Simple Moving Average with a period of 20. There are even Price Action schools that teach you to understand the chart and find patterns on it formed by Simple Moving Average (20) and candlestick patterns.

Levels and zones of support and resistance - the basis of Price Action

If we talk about the basic components of Price Action, then support and resistance levels (or zones) are the main components of the trading system. Therefore, you must understand how levels are formed and how to find strong support zones and resistance.The price chart contains a lot of important information that a novice trader will not see: But an experienced trader who understands Price Action trading systems will notice many opportunities for making money: Looks simple? The simplicity of Price Action is one of the main advantages of this type of chart analysis. Patterns should be understandable to everyone, and their use should not be difficult - this is the key to the quality of Price Action trading systems.

Candlestick analysis of price charts Price Action

Candlestick analysis is another basic component of Price Action. This type of analysis requires the trader to have certain knowledge that will help him in an instant understand who is now “at the helm” - bulls or bears.Overall, it all comes down to memorizing candlestick combinations and knowing how to use them. As a bonus for your diligence, you will receive a trading system that will work both during trend movements and during price consolidation (sideways movements). Unlike trading strategies based on indicators, Price Action adapts to the market and allows you to make a profit at any time. Indicator trading strategies show good results only at certain times.

Another advantage of the Price Action trading strategy is its simplicity, which most indicator strategies do not have - their charts are filled with indicators that you often do not have time to follow: But indicators can be useful even in Price Action. For example, LEV00 indicator sets round price levels (strong support and resistance levels) and zones around them on the chart. True, the indicator was specially written for the M15 time frame and junior TFs:

How to understand and analyze the market using Price Action

To correctly understand and analyze price charts using the Price Action trading strategy, you need to understand and understand some of the nuances.For example, you need to monitor trend impulses - if they gradually become more horizontal, and the price travels less distance, then this indicates a possible imminent end of the trend and a weakening of the price movement as a whole: The length of candles in a trend and their number can also indicate the strength of the current trend. For example, in a strong bearish (downward) trend there will be a lot of large red candles that will form one after another or with rare pullbacks. A weak bearish trend is characterized by red candles, which very often replace bullish candles: It is also worth paying attention to rollbacks during trending price movements - if they become steeper (the price rolls back against the trend further and further, compared to previous rollbacks, and the rollbacks themselves are sharper), then this also indicates a possible imminent end of the trend: The bodies of candles during pullbacks can also convey to us a lot of interesting and important information. For example, if during pullbacks large candles appear that are directed against the trend, then this is a reason to prepare for a possible price reversal. Such candles are most often formed at the very end of the trend (on the last pullbacks), because the current price is of interest to the bears (if the trend is upward) or the bulls (if the trend is downward): Let's look at an example that will help you better understand the price chart in practice:

- The beginning of a downward trend, after the price leaves the consolidation zone

- Reversal against the trend with a return to the border of the consolidation zone and consolidation on it

- Continuation of the trend movement – strong price impulse: many large red candles, the price has moved significantly downwards

- Typical pullback against the trend - nothing unusual

- A very short trend impulse is a sign of a weakening trend

- The counter-trend pullback is almost equal to the last trend impulse - the second confirmation of a weakening trend

- Breaking through the local minimum and continuing the trend

- Reversal, with large green candles. Steep and deep pullback – the price has almost returned to the beginning of the trend impulse (7). It is highly likely to expect a trend reversal

- Second attempt to break previous low

- Another pullback against the trend. The low was not broken, so the moves "7", "8", "9" and "10" formed Double Bottom pattern - reversal pattern

- Simple Moving Average ll price movement towards the former trend - the minimum has not been updated. This is the end of the bearish trend. You should expect an upward trend or sideways price movement

- The price has updated the previous maximum – the beginning of an uptrend

Let's look at an example with a bullish (upward) trend:

- Usual trend impulse – the price has updated the local maximum

- Reversal against the trend

- Weak and short-lived trend impulse - the price was unable to break through the resistance level, which was indicated by the top of the impulse (1)

- The pullback updated the previous low – the power of the bulls has not yet completely faded

- Strong trend impulse

- Pulseback with many big red candles

- Momentum towards the trend, but it did not update the highs and ended significantly lower than the previous one - the likely end of an uptrend

- Another pullback consisting of large red candles is the second sign of the end of the bullish trend

- Very weak upward movement, consisting of green candles – the uptrend is over. It is worth waiting for a downward trend or price consolidation

- Weak downward movement - the price has returned to the support level

- The upward movement is the last attempt of the bulls to move the price higher

- Updating local minima – a downward trend has begun

Using support and resistance levels in Price Action trading strategies

Levels and zones of support and resistance - this is very important tool for technical analysis and trading systems Price Action. The levels best indicate where it is best to open trades. The trader will be required to correctly place (draw) support and resistance levels on price charts.SR (support and resistance) levels are zones of interest - they divide the chart between zones of interest for sellers and buyers. Accordingly, support levels are buyer zones; they are located below the current price. Resistance levels are zones of interest for sellers; they are located above the current price. After breaking through such a zone, it changes its “owner”: support levels become resistance levels (of interest to sellers and will turn the price down), and resistance levels become support levels (areas of interest to buyers and the price will turn upward).

When the price approaches support and resistance levels, it experiences pressure from the zone holders, which can lead to a price rollback or even a trend reversal. This is due to the fact that large FOREX market participants: banks, hedge funds, etc. place their limit orders in support and resistance zones (zones of interest).

There is little point in “price-hunting” every support and resistance level you see and hoping you get lucky. It would be much more correct to use only strong levels of supply and demand:

- Annual, monthly, weekly highs and lows

- Round price levels – levels ending to *00, *50, *20 and *80 (for example, 1.1350 or 1.1400). They are also called psychological levels

- Areas on a price chart indicating a sharp price reversal

- Levels that push back the price as support, and then begin to push back the price, becoming resistance (mirror levels)

The resistance zone, like the support zone, is formed by several separate levels located very close to each other. The boundaries of the zone can be very easily traced by the shadows of candles and reversals of price movements. The resistance zone also copes with its task very well – it turns the price down.

There is also a psychological level on the chart – “1.34100”. This is a round price level – it is also strong. Please note that the price very often reverses from this level, and after a breakout, uses it as a mirror support and resistance level, which also indicates the strength of the round level. By the way, this level also has a zone around itself, so you should expect early price reversals or slightly delayed ones.

It is not difficult to draw and plot support and resistance levels on a chart - it is enough to understand where the price turned, and if it did this repeatedly at the same price value, then this is exactly what we need. For convenience, there are some rules for plotting support and resistance levels on a chart:

- To determine the level of support and resistance, you will need two pivot points located on the same horizontal price value

- Recent reversals are more important than reversals that formed a long time ago

- Mirror level is a good support and resistance level, it is interesting to both buyers and sellers

- Round price levels (psychological levels) can be noted immediately - they are most likely of interest to market participants

- Mark only important levels on the chart - if your entire chart consists of levels, and each candle “hits” several of them, then you have definitely overdid it!

Candlestick analysis is the basis of Price Action trading systems

What is candlestick analysis in your understanding? Most likely, this is a simple search for candlestick patterns on the price chart and this is not correct. But Price Action candlestick analysis is an analysis of candlestick patterns that is compatible with the entire chart. Those. we do not separate one from the other, but consider everything as one whole picture.Have you ever wondered why candlestick patterns work in some cases and not in others? Yes, there are no 100% trading strategies, but you can still significantly increase the probability of a correct forecast to the maximum. To do this, you need to consider not just “three candles of a candlestick pattern” separately from the entire chart, but consider them, paying attention to the following:

- Where did they form?

- What kind of candles were there before the candlestick pattern appeared?

- Candle shadows

Let's take, for example, a pin bar (aka Pinocchio):

Let's look at the same picture from a different angle and with a different understanding of the market: Add strong support and resistance price levels to the chart and we get a picture that fully tells why one pin bar reversed the price and the other did not. The price moves between the support and resistance levels, so there is no point in waiting for a reversal between these levels. Don’t forget that one of the important rules for setting support and resistance levels is that the price must react to the level (bounce away from it)! If there is no such reaction, then there is no point in looking for a reversal at such levels, even if they are round.

So it turns out that the first pin bar is between the support and resistance levels, and the second is at the support and resistance level. In this situation, the “correctness” of the pin bar no longer plays a role; the place of its formation is much more important.

This is roughly what the main mistake of many binary options and Forex traders looks like. Having found some pattern, they expect that the price will act according to a known algorithm and they (traders) will receive their “deserved” profit. In some cases this will happen because they were just lucky, but are we here just because of luck?! I think everyone is interested in a stable result and finding the most profitable points for opening transactions.

Let's look at one more example. We are interested in three candles of approximately the same size and without large shadows. The candles follow each other and form the “Three White Soldiers” candlestick pattern: Three white soldiers are a strong trend continuation candlestick pattern. It says that the bulls control the market, and there are practically no bears. After such a formation, it is expected that the next few candles will also be upward and have a large body. But what do we see on the graph? The next two candles are candles of uncertainty (Doji), and only after them the price rose a little higher, but there is no talk of any strong price movement. Where is the promised continuation of the trend? Let's add support and resistance levels to the chart: We get a picture where three white soldiers have occupied the entire space between two strong levels of support and resistance - the price simply has nowhere to rise, because A lot of bears have entered the market and want to challenge the current price of the asset. The conclusion is that trend continuation models work well between areas of interest for buyers and sellers. The Three Black Crows are a mirror image of the Three White Soldiers model. The model also speaks of a continuation of the trend, but in this example, unlike the previous one, the price fall was not hampered by strong support and resistance levels, so the pattern worked as expected.

Candlestick analysis is not only about memorizing candlestick patterns and patterns. You need to be able to correctly understand what is being said:

- Candle size

- Candle shadow

- Shadow length

- Candle closing level

- Closing a candle near its maximum – the bulls control the market

- Closing a candle near its low – the market belongs to the bears

- A shadow with shadows above and below, and the closing of the candle close to the opening - there is uncertainty in the market

Price Action patterns – Price Action trading systems

Price Action patterns are candlestick patterns and technical analysis figures that should be considered as part of the price chart, and not separately from it. To correctly understand and predict Price Action patterns, a trader must be able to determine levels support and resistanceand correctly plot them on the price chart. The patterns themselves are trading strategies that have their own conditions and rules of application.Of course, there are many Price Action trading patterns, but I will tell you about the most popular strategies that you will often encounter in practice.

Pin bar pattern (Pinocchio) – price action reversal pattern

A pin bar (aka Pinocchio) is a Price Action reversal pattern that looks like a candlestick with a long nose pointing towards the current trend and a Simple Moving Average ll body. The pin bar itself is formed only at the top of upward movements or at the very bottom of downward movements.It is worth paying attention to several components of the correct pin bar:

- The shadow must be 3 or more times larger than the body of the candle

- The body of the candle, preferably, should be the opposite color in relation to the trend (red in upward movements, green in downward movements). If the body of the candle coincides with the current trend, then such a pin bar is less strong, but can still be used to open a trade

- The pin bar should only form on tops or bottoms - there should be empty space to the left of Pinocchio. If candles are located there, then it is considered that the pin bar is in “traffic” and cannot be used

- The pin bar should form at strong support and resistance levels!

- The easiest way (I use it) is to wait for the pin bar to form and open a trade in the direction of the reversal at the beginning of the next candle with an expiration time of one candle (if TF H1 is one hour, then we also open the trade for 1 hour)

- A more complex and, in my opinion, unjustified way is to wait for confirmation of the reversal (wait for another candle). If a reversal occurs, then open a trade for 3-5 candles in the direction of the reversal

- Opening a trade immediately after the formation of a pin bar does not guarantee a 100% price reversal, although in most cases, trades will be closed in profit. Moreover, even if the pin bar has formed at a strong level, there is a chance that a reversal will not occur.

- Opening a trade after the pin bar is confirmed can lead to the fact that the confirming candle is the entire reversal movement after the pin bar, which means the trade will be opened against the current movement. The result is a losing trade.

“Inside bar” pattern in Price Action

The Inside Bar Price Action pattern is a pattern of uncertainty. Depending on where this Price Action pattern was formed, it is worth considering a signal for trend continuation or a signal for a price reversal.The “Inside Bar” pattern, as the name implies, is a candle whose body and shadow are within the boundaries of the body and shadow of the previous candle. So here it is:

- If the inside bar formed during a strong trending price movement (during pullbacks), then it is best to consider only a signal for trend continuation (if there is one)

- If the inside bar was formed at a local maximum and minimum, and is also supported by a strong level of support and resistance, then you should expect a signal for a price reversal

Engulfing pattern or external bar – price action reversal pattern

The engulfing pattern is the same pin bar pattern in Price Action, only it consists of two candles: the body of the left candle fits completely into the body of the right candle. The formation rules are exactly the same as for a pin bar:- The Price Action pattern must be formed at a strong support and resistance level

- The absorption must be formed at the high or low of the price

- There should be empty space to the left of the pattern

- Enter without reversal confirmation – on the next candle after the formation of an engulfing candle

- Entry with confirmation of a reversal - after the formation of an engulfing candle, we wait for another candle directed towards the reversal. On the next candle, open a trade for 3-5 candles

Three-bar reversal – Price Action reversal pattern

The “three-bar reversal” pattern is a formation of four candles (but the countdown is carried out only from the second - the second candle in the formation is numbered “1”): three are directed towards the trend, and the fourth is against it. In fact, a three-bar reversal is another pin bar formation (yes, there are many of them!).The essence of the Price Action pattern is that you need to wait until the low of the second candle in an uptrend or the high of the second candle in a downtrend is broken. Let's look at examples to make it more clear: After breaking through the high or low of the second candle and closing the candle behind this horizontal level, you should open a trade in the direction of a reversal of 3-5 candles. It is worth looking for a three-bar reversal only at strong support and resistance levels. In trend movements, it is better to look for entry points only in the direction of the current price trend.

Reversal pivot - Price Action trading system

A reversal pivot is a price action pattern consisting of three candles. The center candle must have a high (for an uptrend) or a low (for a downtrend) greater than the candle on the left and the candle on the right. In this case, the first candle should be directed towards the current trend, and the third candle should be a reversal and completely absorb the body and shadow directed against the trend of the previous candle.The pattern should be looked for only at strong support and resistance levels and only after sustained price movements. The trade is entered after the formation of the third candle in the direction of the reversal. The expiration time is usually set to three candles.

The upper reversal pivot looks like this: Lower reversal pivot:

False breakout of the trend line

The essence of the Price Action trading system “False breakout of a trend line” is to plot this very trend line on the price chart (for this we need a stable trend - here’s news for you!) along the bodies of the candles. At the moment when the trend line begins to break through, we set the last maximum for a downward trend or the last minimum for an uptrend (we denote it with a horizontal line). At the moment when the price breaks through this local maximum or minimum, we enter a trade in the direction of the breakout.In theory, you can catch a very good trend price movement at the very beginning: This trading method is designed to exclude cases of trend displacement - when, after a breakout of the trend line, the trend continues, but in a more “smooth” form.

Closing Price Reversal pattern - Price Action reversal pattern

Closing Price Reversal is a frequently encountered Price Action pattern. It is best to look for it at strong support and resistance levels, because... between them his performance will drop significantly.The Closing Price Reversal pattern itself is a formation of two candles. There are bearish Closing Price Reversal (downward price reversal) and bullish Closing Price Reversal (upward price reversal):

- Bearish Closing Price Reversal consists of the first bullish candle, the second candle is bearish - it has a shadow that has broken through the high of the first candle

- Bullish Closing Price Reversal - the first candle is bearish, the second candle is bullish - it, with a shadow from below, updated the low of the first candle

Price consolidation

Price consolidation is not a Price Action pattern, but sideways movement can also be used to advantage when trading on a clean chart. For example, there are several interesting features:- After a narrow and prolonged consolidation, we should expect strong trend movements

- Price consolidation can be an area of support and resistance

Pattern 1-2-3 or “False top or bottom” - trend continuation pattern Price Action

The False Top or Bottom pattern (also known as the Price Action 1-2-3 pattern) is a pattern that allows you to find entry points in trending price movements. The essence of the pattern is to “catch” the end of pullbacks during trend movements.If we look at the “1-2-3” pattern in more detail, it consists of three points:

- Point – the beginning of a trend impulse

- Maximum or minimum (start of rollback)

- End rollback

Why Price Action works

One of the main questions of many traders is “Why does Price Action work?” The fact is that Price Action teaches us how to read the chart correctly - this is exactly what we need to predict the price and find the best entry points.The price moves without our participation. Every day, 5 days a week, traders make a huge number of transactions, which leads to certain price movements. But, the price chart is not only a mirror of price movement, but also an extensive source of information. Knowing where to look, you can see a lot.

For example, candles will tell us who is dominant in the market now and what movements to expect, but we only have a few data:

- Candle size

- Shadows (if any)

- Opening and closing levels

- Location on the chart relative to other candles

The point is precisely in the chart itself - it is the same for all traders! If you take any indicator strategy, especially a very exotic one (with unique indicators and special entry rules), then who trades with it? Me, you and a couple of other people?! Yes, of course, indicator strategies can be very profitable, but they work at a certain time, while Price Action works around the clock.

The advantage of Price Action is obvious - there is nothing superfluous in it that could mislead some market participants. We have a candlestick chart and support and resistance levels, and many traders even use only round price levels, so even the levels can be set the same for everyone! If we talk about Price Action patterns, then there can be no disagreement here either - how can you understand otherwise a pattern consisting of three candles?! No way! Accordingly, when trading with Price Action, a trader always moves with the crowd, which means that the effectiveness of his trading will be very high. This is exactly why Price Action works - a set of trading systems that are used by tens of thousands of traders and read the market in the same way!

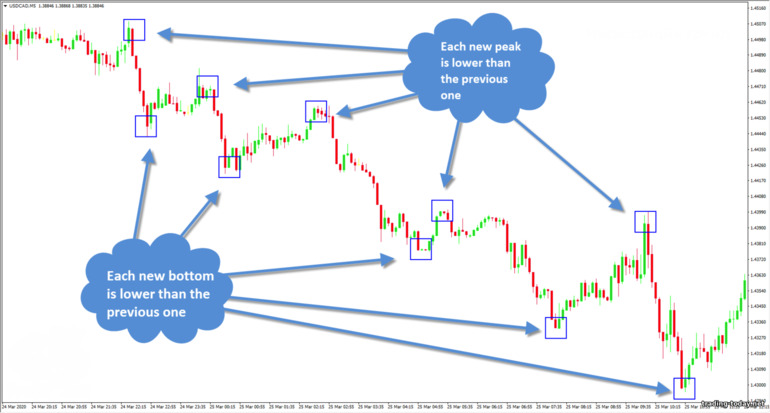

How to trade using Price Action - making money on Price Action trading strategies

First of all, I will tell you what you already know without me - “Trend is our friend!” What does this phrase mean? First of all, you shouldn’t go against your “friends” - it’s better to keep up with them and then the trend will allow you to make money. Price Action “forces” the trader to identify trends. As a rule, the very beginning of a trend can be determined by two peaks and two troughs - if they update each other, then this is a trend: What are peaks or troughs (local minima and maxima)? These are price turning points. The market always moves in waves, so trend impulses are replaced by pullbacks, and pullbacks are replaced by regular trend impulses. Points of change in price direction should be regarded as local highs and local lows (tops and bottoms). By finding them on the chart you can very quickly determine the current trend.Trend retracements can represent price consolidation (sideways movement) that will lead to further continuation of the trend or a reversal. During consolidation, the price gains strength, so at the end you should expect a trend impulse: And so, it’s time to place all significant support and resistance levels on the price chart. Do not forget that strong levels are required to reverse the price earlier (there must be a price reaction to these levels), without this they will be useless: And since the market moves from left to right, we remember all the patterns that we know and predict the price movement, emphasizing that the trend is downward: Please note that not all patterns were used, but only those that are worth using in trend movements. For example, it is foolish to use a bullish Closing Price Reversal in a downtrend, so you should only use a bearish Closing Price Reversal to indicate entry points towards the trend! For the same reason, reversal patterns should only be looked for at strong support and resistance levels.

To trade Price Action, each trading system you intend to use must:

- Have a strict sequence of actions (trading algorithm)

- Be backtested

- Show positive trading results

- Must find repeating formations that occur in the market

Price Action Structural Analysis

All trading comes down to finding the most profitable points for opening transactions - moments when the price is highly likely to move according to the forecast. But how to find such entry points? Structural analysis of Price Action solves this problem - it is a combination of several factors that confirm each other.As an example, take the following confluence of factors pointing to one forecast:

- Price movement in an upward trend - it would be logical to look for entry points upwards

- Candlestick formation - a pin bar during a pullback, indicating further price growth

- Round support and resistance levels where the pin bar formed

- Dynamic levels of support and resistance (moving averages), which also indicate further price growth

Price Action is precisely the analysis of charts as a whole, and not the finding of any individual patterns or candlestick formations, so it is worth taking into account all the information that we can get from price movement. The combination of 3-4 signals may indicate a good entry point, but do not forget that there are no 100% trading systems, so always remember risk management and open transactions for an amount not exceeding the risks.

How to use Price Action in practice

Price action trading is a search for the best signals, which means patience is required from the trader. There are profitable signals, and there are signals that should not be used. For example:- In a trend, it is best to look for only those signals that will indicate the continuation of this trend

- Looking for patterns against the trend if they are not supported by anything is a bad idea

The goal of Price Action is not to “fire from a shotgun,” but to take several accurate “shots from a sniper rifle.” Unlike indicator strategies, where the rule “When a signal appears, I’ll definitely open a deal!” applies, Price Action forces you to be more selective in choosing entry points.

It's funny that Price Action is both simple and complex:

- Simplicity lies in the algorithms of trading systems - they are clear and unambiguous (there can be no mistakes)

- The difficulty will manifest itself precisely in the practical application of your knowledge, when you need to analyze the entire chart to find the right entry point, and not just wait for the “arrow and open a deal”

Another problem that you will definitely encounter in practice is the ability to apply patterns. Yes, you, like me, can memorize all the patterns, their trading algorithms and understand where to look for them, but you won’t be able to do one thing - see these patterns on the price chart. For example, my brain refuses to see the “Inside Bar” (this is always a difficult task for me), although I have no problems identifying patterns such as: Closing Price Reversal, pin bar, engulfing, etc.

Practice will save you! Lots of practice! Of course, it is better to hone your skills on a demo account, and only then move on to real trading. But don't think you'll get it right right away - learning Price Action trading is not an easy task. Be patient. Start by setting support and resistance levels, and then simply watch the price movement - mark the patterns that you find on the chart, or better yet, take screenshots of the forecasts.

At the end of the day (or trading session), your price chart should look like this: And so on every trading session until you learn to identify Price Action patterns instantly. The task is difficult, but doable.

One week with Price Action

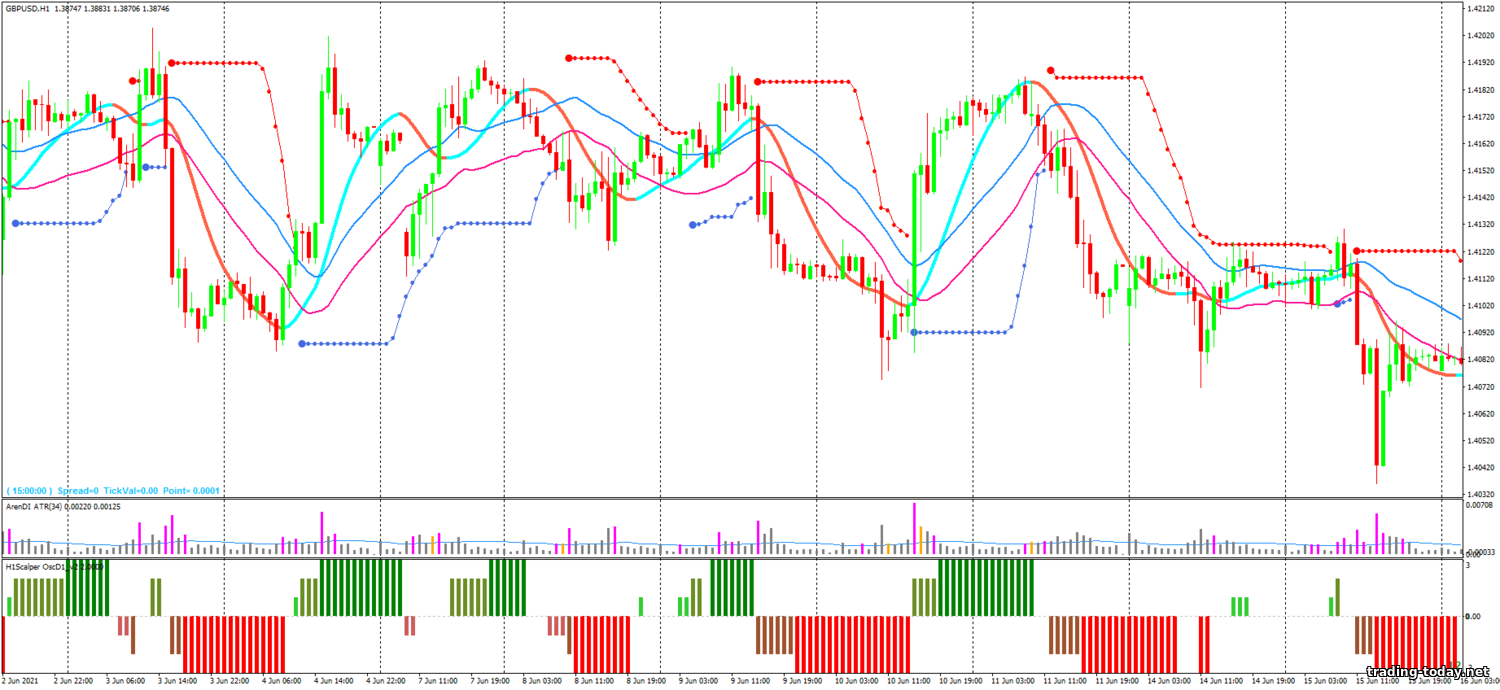

As a practical guide to help you better understand Price Action, let's look at one week and the patterns that I came across. The H1 chart and round support and resistance levels were used. A downward trend was observed, so, according to the logic of Price Action, all patterns were used to enter along the trend (patterns against the trend were not considered!).- Interior bar

- Pin bar

- Bearish Closing Price Reversal

- Upper reversal pivot

- Pin bar

- Interior bar

- Pin bar

- Bearish Closing Price Reversal

- Interior bar

- Bearish Closing Price Reversal

- Interior bar

- Three-bar reversal

- Interior bar

Price Action: results

Price Action should be regarded as a set of trading systems that allow a trader to determine the situation on the market. The constant struggle between bulls and bears forms patterns that should be used to find entry points. Of course, you should trade Price Action wisely - combine levels and patterns, confirm everything with candlestick patterns and technical analysis figures. Only in this case can you achieve maximum results from Price Action.If we talk about time frames of use, they can be anything. Of course, there will be a lot of noise on M1, but there are traders who even make good money on turbo options. So it all depends on your preferences. Also, the disadvantage of TFs is the difficulty in setting support and resistance levels - in addition to round price levels, you will very often have to use the levels that the price indicated to you.

Price Action teaches the main thing - to see price movement as it is. There is nothing superfluous, only information from the price chart. No arrows, indicators, histograms, and much more that prevents you from thinking “creatively” and assessing the full picture of what is happening.

Reviews and comments